Decoding why MATIC is yet to deliver a strong bounce back

MATIC delivered a heavily bearish performance in April but it looks like the bears are running out of momentum. Although the selling pressure seems to be tapering out, the price demonstrated some sideways action in the first three days of May due to a lack of strong buying pressure.

MATIC has been hovering within the $1.07 price level in the last three days. It traded at $1.07 at the time of this press, which is a notable improvement after bouncing back from its latest local low of $1.01.

The last time that MATIC traded at this low price point was in September 2021. That price level also represents a roughly 40% discount from its April high.

MATIC’s RSI indicator reveals that the price briefly entered the oversold zone on 30 April. The slight bounceback puts the RSI back above the oversold zone. Its Money Flow indicator reveals that there have been outflows in the last few days but not enough to push the price to lower price levels.

The DMI indicator confirms that MATIC has been heavily bullish in the last few weeks. Its ADX still suggests that the trend is still strongly bearish but the –DI recently adopted a downward trajectory. This is a sign that the bearish trend is weakening but not a confirmation of trend reversal.

A strong bounce back?

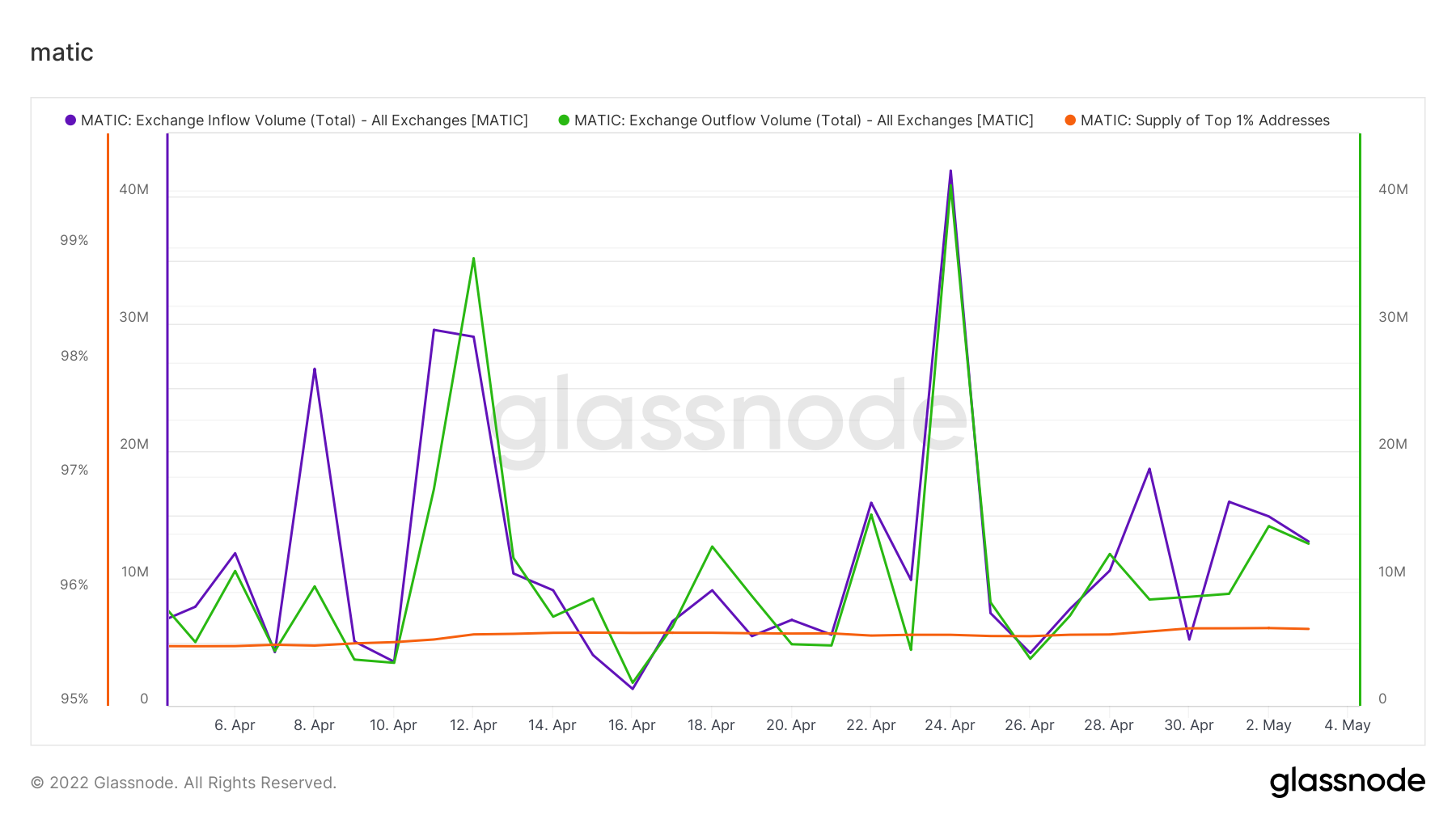

MATIC’s exchange supply on-chain metrics reveal a slight decrease in exchange inflows in the last three days. Meanwhile, exchange outflows registered a slight uptick that is likely responsible for the mild price gain from its end of April low.

The current exchange outflows and inflows figure point towards reduced volumes. This aligns with the current market conditions especially ahead of key financial announcements in the FOMC that will determine investor sentiments.

The lack of strong directional volume and price movement suggests that investors are waiting for clarification before deciding to buy or sell. That clarification is expected to take place in the next few hours. This means that MATIC will break out of its current price range either to the top or bottom depending on the FOMC outcome.