Despite Algorand’s promising TVL, is ALGO wavering? Decoding…

- Algorand’s TVL increased, but revenue and fees declined slightly.

- ALGO’s price plummeted drastically, and negative sentiment spiked last week.

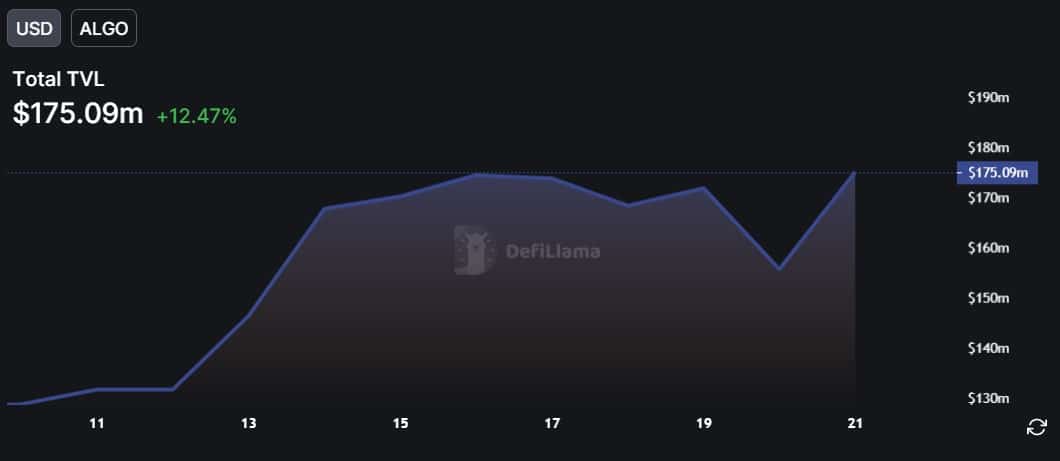

Algorand [ALGO] registered a double-digit uptick in its network value in the last 24 hours alone. According to DeFiLlama, Algorand’s TVL increased by over 12%, which was surprising, considering the press-time bearish market.

Read Algorand’s [ALGO] Price Prediction 2023-24

This caused the surge!

A reason behind this sudden surge could be attributed to Alogrand’s latest announcement. As per a 20 April tweet, the Algorand Foundation has deployed 36 million ALGO to Algorand’s native lending markets, options vaults, and algo/galgo liquidity.

?1/7

Community Update: The Foundation has deployed 36MM $Algo to Algorand native Lending Markets, Options Vaults, and Algo / gAlgo liquidity via @FolksFinance, @AlgoRai_finance, and @pact_fi.

— Algorand Foundation (@AlgoFoundation) April 20, 2023

Algorand mentioned that the goal of this allocation is to contribute to ecosystem liquidity and support TVL growth. Its effects were quite quickly reflected on the chart, as evident from Algorand’s TVL growth in the last 24 hours.

Can it impact other key stats?

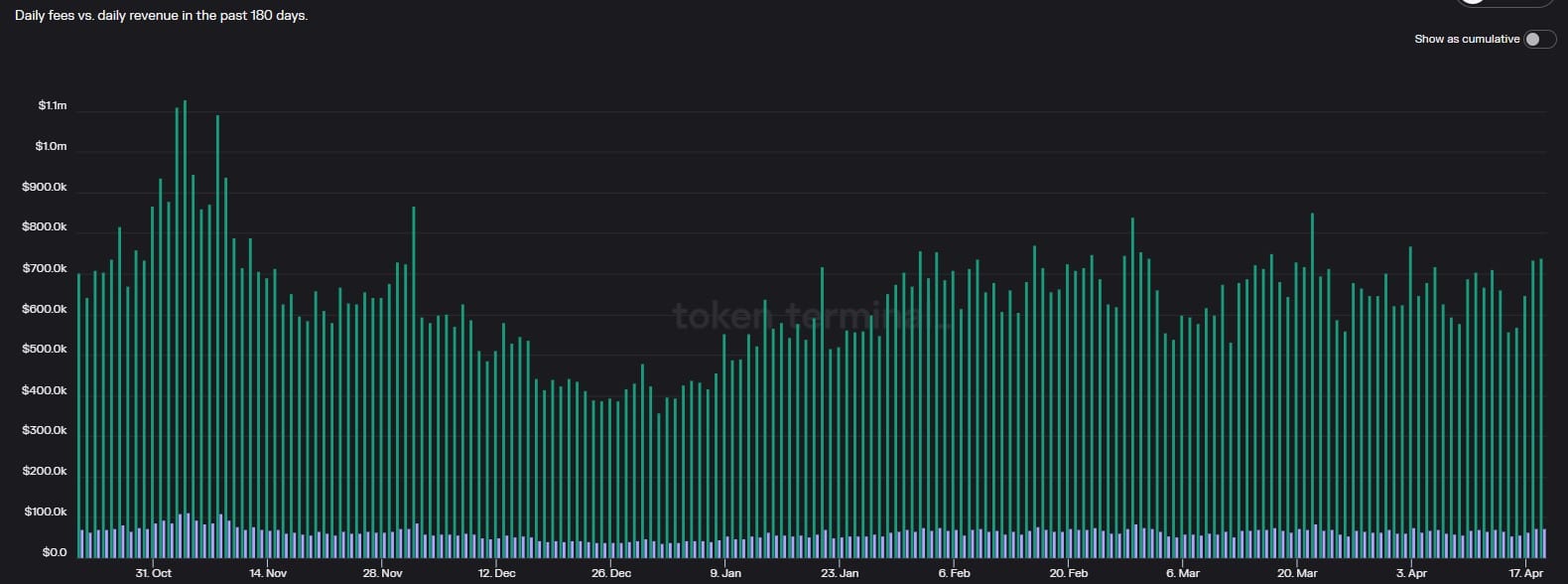

Though Algorand’s TVL increased substantially, the same can’t be said for the network’s fees, which fell over the past few weeks, according to Token Terminal. This remained true for the network’s revenue as well.

However, looking at the impact the Algorand Foundation’s announcement had on the network’s value, it will be interesting to see whether it could also help increase network usage and, in turn, increase its revenue.

ALGO did not benefit

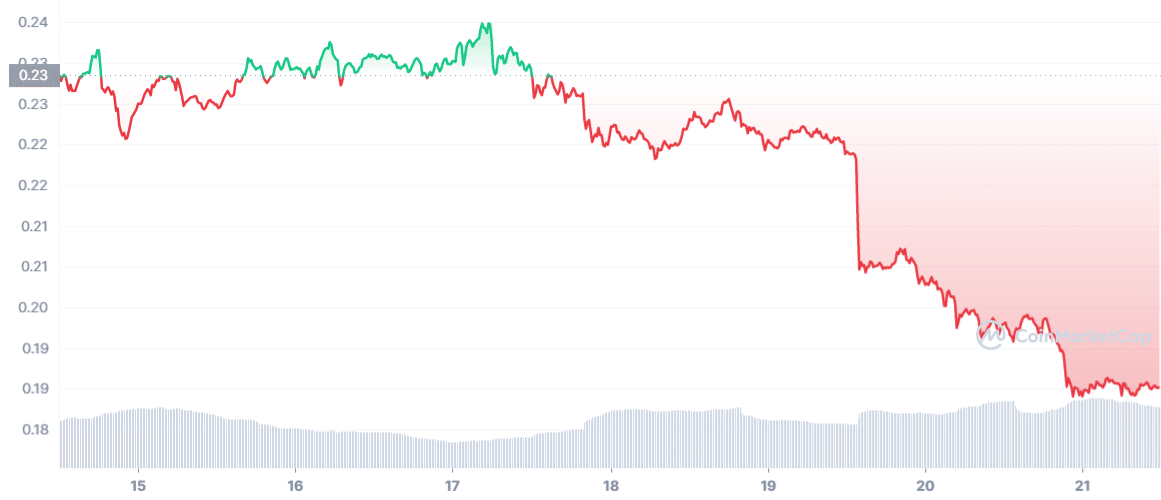

While the blockchain’s TVL rose, its price followed the opposite route by registering a double-digit decline in the last week. According to CoinMarketCap, ALGO’s price went down by over 16% and 4% in the last week and 24 hours, respectively. At the time of writing, ALGO was trading at $0.1902, with a market capitalization of $1.37 billion.

Confidence in Algorand is low

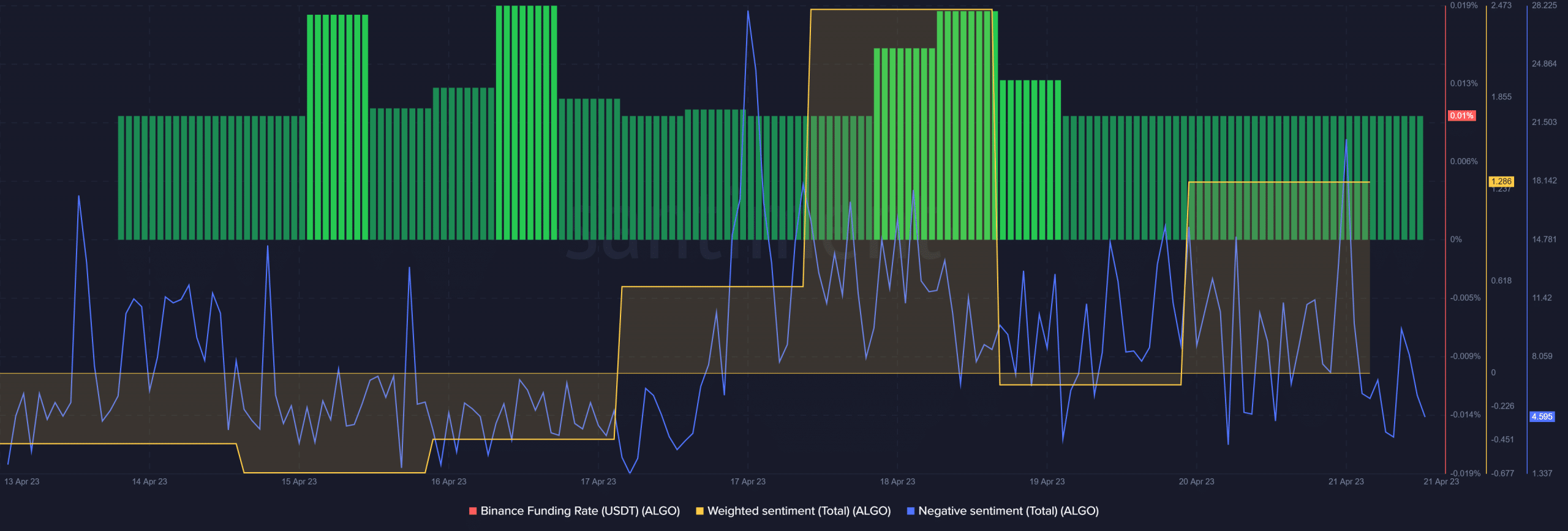

Thanks to the price decline, investors’ confidence in ALGO seemed to have dwindled over the last week, which was evident from its weighted and negative sentiment. LunarCrush’s data revealed that ALGO’s Altrank increased, which is typically a bearish signal.

How much are 1,10,100 ALGOs worth today?

As per CryptoQuant, ALGO’s Relative Strength Index (RSI) and stochastic were still neutral, suggesting that the ongoing market trend can continue further.

However, it was interesting to see that despite the price plummet, ALGO’s demand in the derivatives market remained pretty stable, as indicated by ALGO’s green Binance funding rate.