Despite Bitcoin’s worst Q2 performance in 7 years, here’s the silver lining

Bitcoin’s long-term holders, investors, and institutions that buy and accumulate, (shown by HODLer composition by intotheblock) are a key factor in driving the value of the asset higher. The scarcity narrative has led the price rally since the beginning of 2020.

Bitcoin Price Chart || Source: CoinGecko

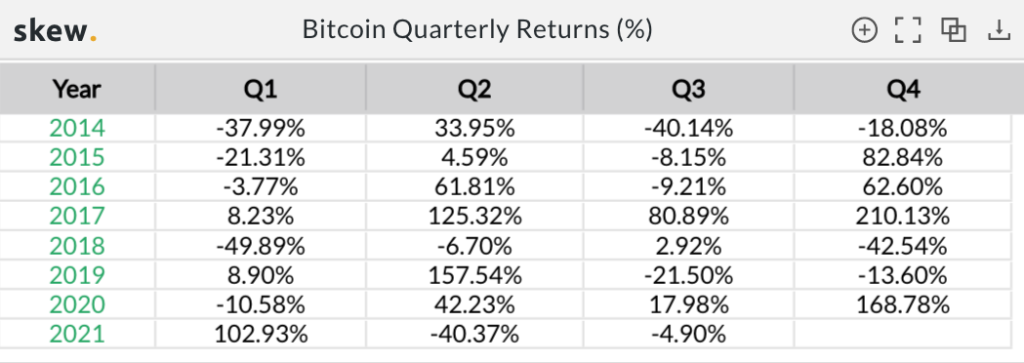

The drop in quarterly returns comes after a 4-month streak where returns hit a peak of 168% in the last quarter of 2020, followed by over 100% in the first quarter of 2021. The last time Bitcoin’s price was on a streak of positive quarterly returns for 4 months in a row was Q4 2017 and the price dropped in Q1 2018, based on data from Skew.

Bitcoin Quarterly Returns || Source: Skew

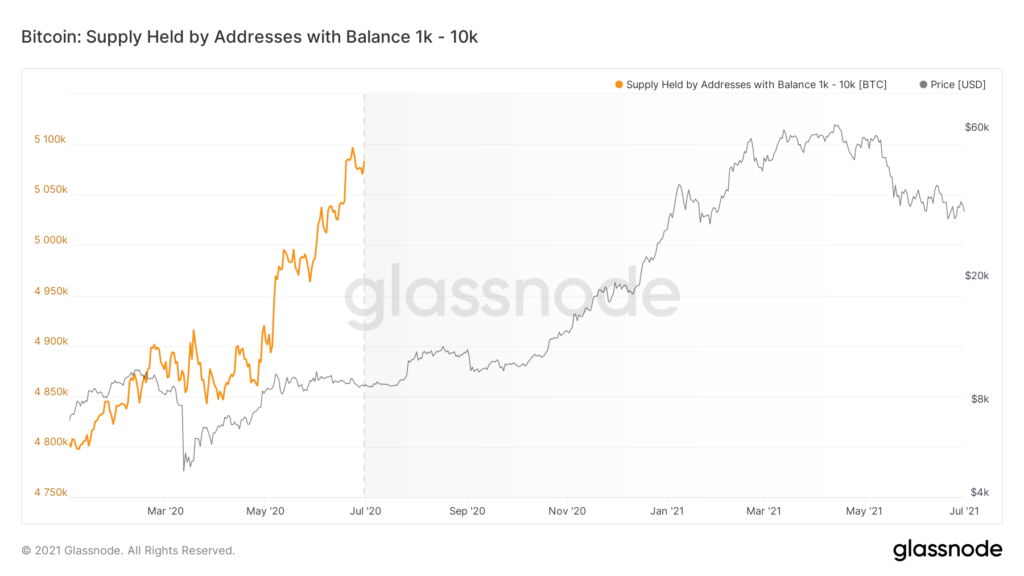

Bitcoin Quarterly Returns are likely to have an impact on the social sentiment of traders across spot exchanges. One important metric to note following changes in the Quarterly Returns is the supply held by Bitcoin Addresses with balance of 1k to 10k. Based on data from Glassnode, this number has increased consistently, despite a drop in the quarterly returns.

Bitcoin Supply Held by Addresses with Balance 1k to 10k || Source: Glassnode

Addresses with balance between 1k to 10k are close to 5 Million; in March 2020 this number was 4.8 Million, which is an increase of 4%. The total Bitcoin Supply held by large wallet investors has an impact on the supply on spot and derivatives exchanges, and an increase in this number supports the Bitcoin supply shortage narrative.

This quarter, there were two significant price crashes, the flash crash of May 19, 2021, and the crash of June 23, 2021. Both these crashes were followed by a recovery in Bitcoin’s price and large wallet investors and institutions continued accumulating Bitcoin based on their wallet balance data from Glassnode.

At the current price level, 68% of Bitcoin’s large wallet investors or HODLers are profitable. Traders who bought Bitcoin during the dip were briefly profitable when the price crossed $35,000 and hit $36,000 level.

Following a negative 40% return, it is likely that in this quarter, there may be a recovery. Since the accumulation has continued and the supply held by large wallet investors has increased, the following quarter is likely to be profitable for traders who bought the asset during the dip.

This can be expected from the trend in the Quarterly Returns and metrics like number of wallet addresses with a balance between 1k to 10k BTC as well. A quarter with positive returns may set the stage for Bitcoin’s price to rally and make a comeback above the $40000 level, yet again, and sustain for the long-term.