Despite Solana’s recent outage, root cause still unknown as SOL…

- Solana updated the crypto community that the reason for the previous week’s outage was still unknown.

- Transactions have resumed as SOL consolidates.

Days after Solana [SOL] experienced another outage, the blockchain’s engineers have yet to ascertain the cause. In the early hours of 27 February, Solana put the word out that the problem that surfaced was still under investigation.

The root cause of the 2-25-23 outage is still unknown and under active investigation. The following document will be updated as new information becomes available https://t.co/kKYaTuizu0

— Solana Status (@SolanaStatus) February 27, 2023

Is your portfolio green? Check out the Solana Profit Calculator

Another “SOL” down, when does it end?

On 25 February, Solana users were unable to perform transactions on the network. The problem lingered such that initial attempts to restart transactions were unsuccessful.

While validators had to cease their strive, Solana users bore the brunt and had to wait until the next day before engineers got headway.

However, the cause of the downtime was still not identified at press time. According to the Solana communique,

“The cause of this is still unknown and under active investigation. Due to the performance degradation, validator nodes automatically entered vote-only mode, a ‘safe mode’ designed to help the network recover in the event of data unavailability.”

While the Solana mainnet is now functional, it is important to note that the blockchain had several outages in 2022. Now that another has happened in the new year, it suggests that Solana might need to work on securing its network against breaches and also polish where faults remain.

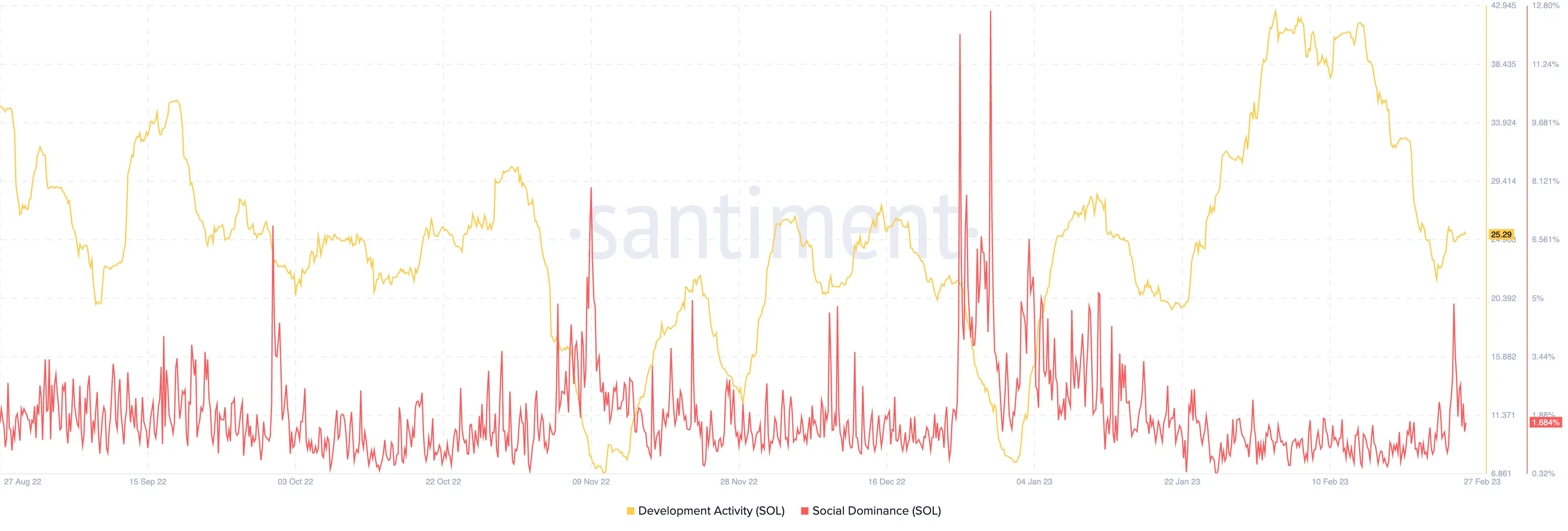

Following the intermission, the Solana development activity shrunk significantly to 22.23. The metric describes how dedicated a team is to pushing out a working product.

At the time of writing, the development had revived to 25.29, confirming that the blockchain was committed to reviving activities on the network.

However, the social dominance which spiked on 25 February had taken the opposite turn at the time of writing. This implies that the measure of discussions around Solana, and SOL was no more overhyped.

The SOL price: What next?

Meanwhile, the SOL price was rarely impacted by the network tumble. According to CoinMarketCap, SOL exchanged hands at $22.74, even as the volume dropped 21.62% to $398.83 million.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Per the daily chart, the SOL momentum remained bearish. This was due to the revelations of the Moving Average Convergence Divergence (MACD).

At press time, the blue dynamic line was slightly below the orange line. This status indicated that buying control was not better than selling pressure.

With respect to the direction, SOL could most likely end in consolidation. On assessing the Directional Movement Index (DMI), there was no significant strength for either the upward or downward turn since the Average Directional Index (ADX) was 18.50.

Also, the positive DMI (green) was 20.42 while the negative DMI (red) was close by at 19.66.