Did BTC’s decoupling from Gold and SPX impact its rise to $30k? Decoding…

– Decoupling from real-world assets like gold and stocks was a factor in Bitcoin’s rise to $30,000.

– The MVRV suggests that Bitcoin’s upward trend may continue despite being overbought, making it an attractive investment option for diversification.

Bitcoin’s [BTC] ascent to the $30,000 price mark can be attributed to a myriad of complex and multifaceted factors. However, it’s important to note that one factor played a reverse motivating role in the process. Specifically, the king coin has decoupled from the movement of some key real-world assets, which has undoubtedly impacted it.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Bitcoin’s correlation with gold and SPX weakens

The crypto-SPX correlation is a term used to describe the connection between the value of digital currencies like Bitcoin and stocks. The correlation with gold and stocks has significantly affected Bitcoin’s price in the past.

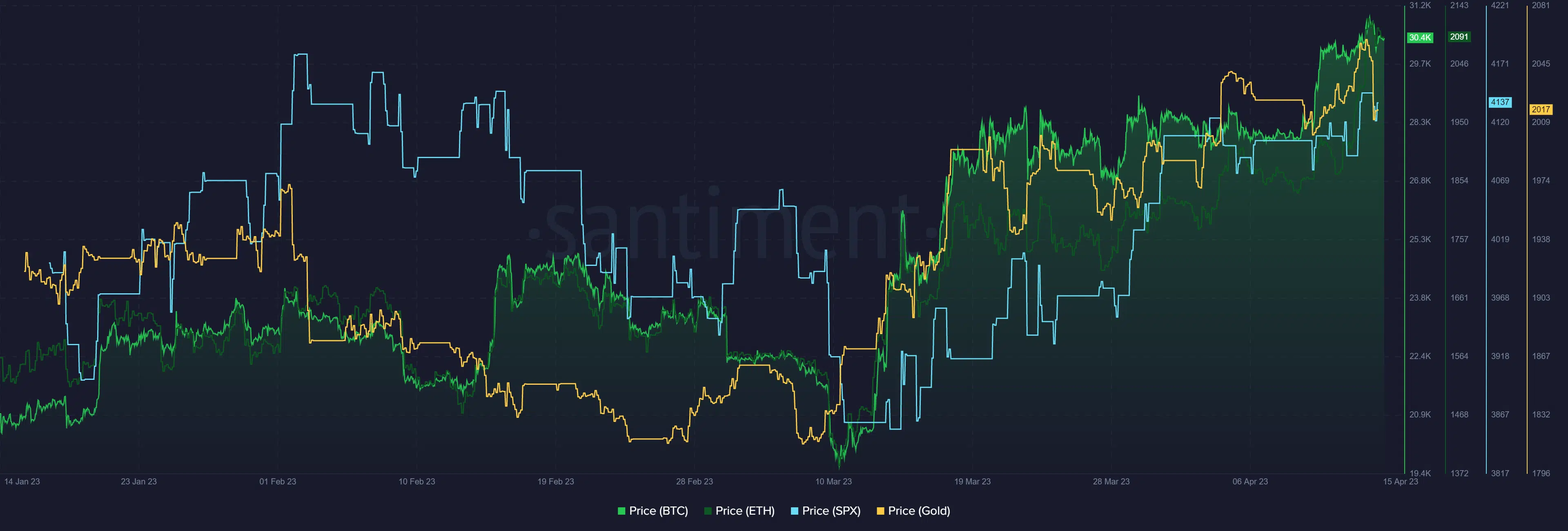

Per Santiment, the S&P 500 index showed a higher upward trend than gold and Bitcoin earlier in the year. However, there has been a noticeable decline in the correlation between Bitcoin and equities lately. BTC also showed a weakened correlation with gold following the banking crisis.

This reduced dependence on external factors was one of the driving forces behind Bitcoin’s surge to a 10-month high.

Bitcoin on a daily timeframe

Analyzing BTC on a daily timeframe chart revealed that its ascent toward the $30,000 price threshold began on 8 April. The correlation chart confirmed this observation, suggesting that the decoupling of BTC from external assets coincided with this trend.

Currently, BTC was trading at roughly $30,460, showing a slight drop of less than 1% at the time of writing.

The Relative Strength Index (RSI) also suggested that BTC was currently in the overbought zone, which typically showed that the asset was trading at a higher price than its intrinsic value. Based on the current position of the RSI, BTC may experience some price corrections soon.

Is your portfolio green? Check out the Bitcoin Profit Calculator

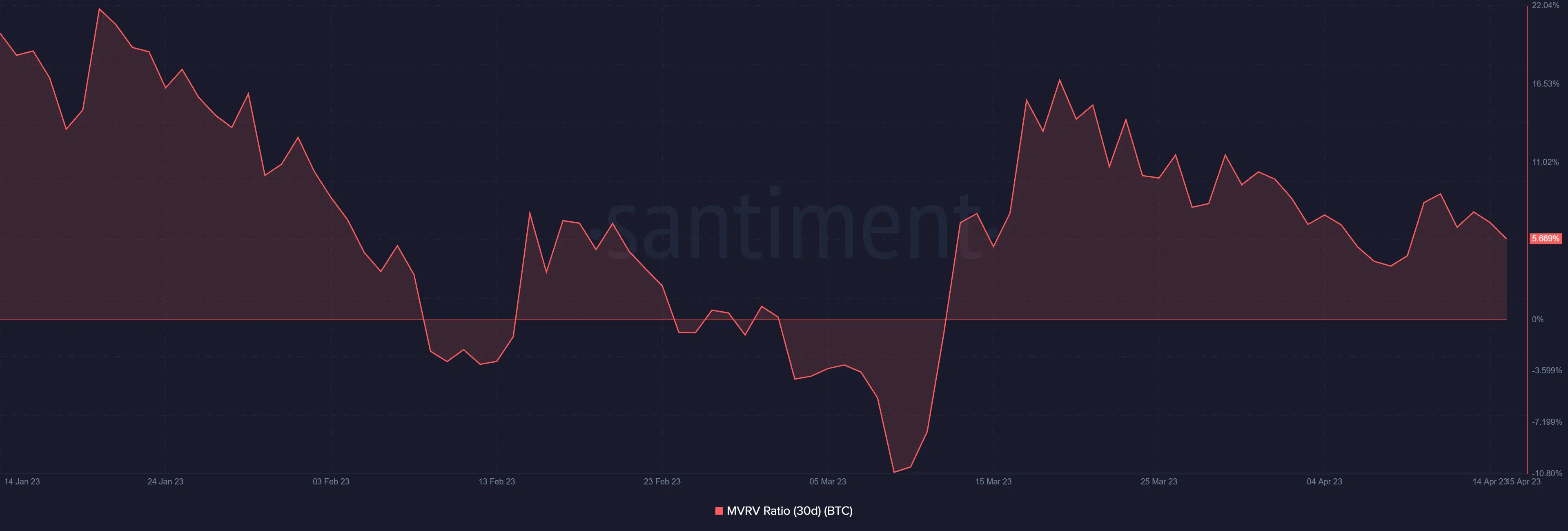

MVRV predicts a possible rise

The 30-day Market Value to Realized Value ratio (MVRV) suggested that its upward trend may not have reached its peak yet. As of this writing, the MVRV was approximately 5.6%, indicating that BTC was slightly overvalued, but it also suggested the possibility of further price increases.

As Bitcoin’s price continues to move separately from other assets, it becomes an attractive option for investors seeking diversification in their investment portfolio, which may further contribute to its price increase.