Digital asset investment products make a fantastic comeback in October

- The total AUM for institutional crypto products increased by 6.74% to $31.7 million.

- GBTC’s discount to underlying Bitcoin dropped to its lowest level in nearly two years.

Optimism was truly back in the digital assets market in October. Analysts and traders construed the recent fake news-induced market rally as a “dress rehearsal” before the eventual approval of spot Bitcoin [BTC] exchange-traded funds (ETF).

In response to the false alarm, the king coin ascended to $35,000, the highest level since May 2022, per data from CoinMarketCap. By and large, BTC has held on to its gains since the event. As of press time, BTC exchanged hands at $34,000, with gains of 26% since the start of the month.

Crypto market attracts institutional investors

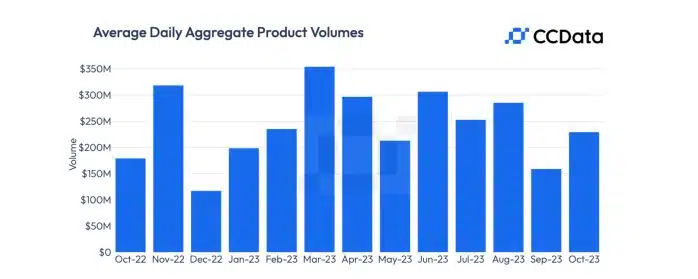

The positive sentiment started to reflect on the trading activity. According to crypto market data provider CCData, the average daily volume of digital asset investment products surged by a whopping 44.3% to $230 million. This was the third-highest monthly jump in volumes in 2023.

Moreover, the total assets under management (AUM) for institutional crypto products increased by 6.74% to $31.7 million, snapping a two-month long losing streak.

The AUM is a measure of the flow of investor money in and out of a fund and the market value of the underlying asset. The size of the AUM gives investors an idea about the investment company’s operations.

Most investors are drawn to funds with big AUM simply because they have sufficient liquidity to meet any redemption pressures.

BTC-based products grow, Ether sees decline in investments

The jump in Bitcoin-based investment products witnessed an AUM increase of 11.1% to $23.2 billion. The jump expanded their market dominance to 73.3%, up from 70.5% last month.

To the contrary, Ethereum [ETH]-based crypto products recorded a decline of 5.45% in their AUM to $6.35 billion. The negative growth squeezed its market share to 20% from 22.6% in September.

Surprisingly, the subpar performance occurred during the month that saw half-a-dozen Ether futures ETFs, including those by VanEck and ProShares, hitting the market.

While ETH disappointed, other altcoin-linked products witnessed a sharp jump in market worth. Solana [SOL]- based products were the biggest winners in October, witnessing a massive 74% increase in AUM.

Positive improvements in its ecosystem, which resulted in price gains, aided in increasing the market worth of SOL-linked products. Indeed, SOL was the second-highest gainer in the last 30 days, increasing its market value by a whopping 72%.

U.S., Canada experience rise in AUM

The dominant North American institutional crypto market reaped the fruits of the bullish outlook. The U.S., home to some of the biggest crypto asset managers, witnessed a 3.22% increase in AUM to $24.5 billion. With this, its market share increased to an astounding 77.3%.

Canada, another important market, saw a $2.03 billion growth in AUM in October. Notably, Canada accounted for 6.39% share of the market, the second-highest after the U.S.

Key European markets like Germany recorded a 16% growth in AUM to nearly $700 million.

GBTC narrows discount to underlying asset

Grayscale Investments, the world’s largest crypto asset manager, observed a 3.24% increase in AUM to $23.1 billion in October.

Moreover, its most popular product, Grayscale Bitcoin Trust (GBTC), narrowed the discount to the underlying holdings to its lowest level in nearly two years.

Typically, a reducing discount between a trust’s shares and the net asset value (NAV) of its holdings—in this example, Bitcoin—indicates that investors are bullish on the outlook.

As indicated above, the discount to the NAV was nearly 45% in June. However, growing optimism over conversion to a spot Bitcoin ETF, helped by recent court verdicts, led to a sharp decline. The discount fell to 12.6% on 18 October, the lowest since November 2021.

Note that GBTC is the world’s largest Bitcoin fund with a market cap of over $17.8 billion. Grayscale wants to transform the trust into a spot Bitcoin ETF owing to the relative advantages that the latter provides.

Will the party continue?

As things stood, the market appeared to be ready for a launch. The general sentiment was upbeat regarding the approvals of spot ETFs. Although there was clearly a shift in sentiment in October, it will be interesting to watch if the optimism lasts into November.

The total market cap of all circulating cryptos increased to $1.26 trillion at press time, marking a 20% increase from last month.