GBTC’s discount to its Bitcoin funds narrows in October. What’s next?

- The discount shrunk significantly on a year-to-date basis.

- Legal victories in the Grayscale vs. SEC episode brought positive sentiment.

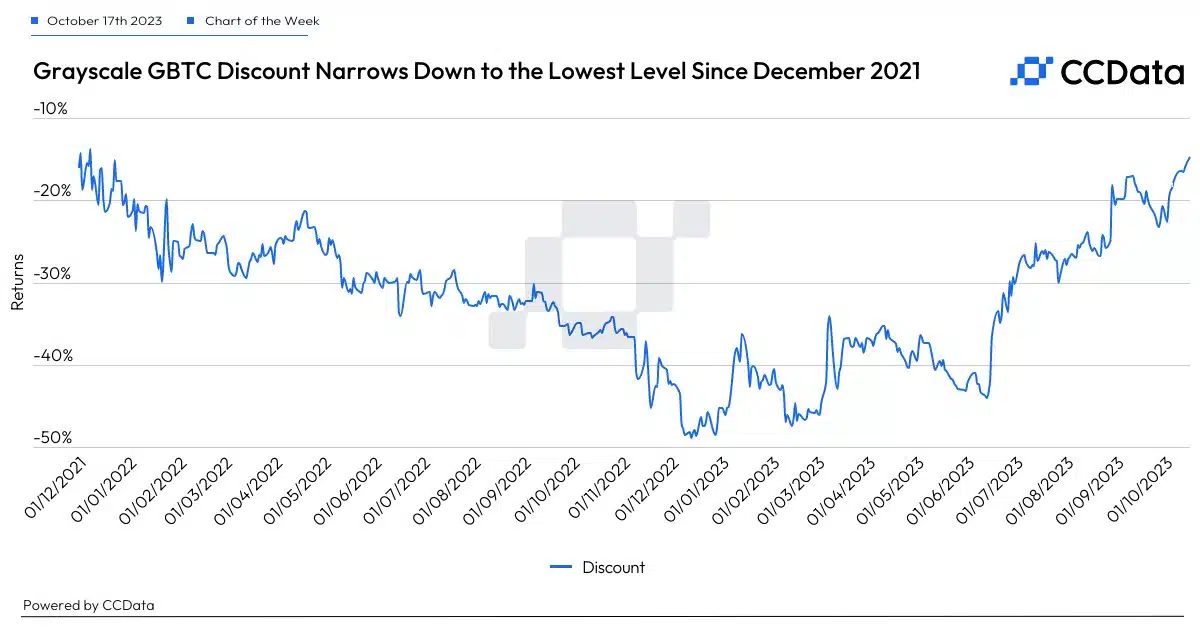

The world’s largest Bitcoin [BTC] fund, Grayscale Bitcoin Trust (GBTC), narrowed the discount to its underlying holdings to its lowest level in nearly two years, according to digital assets data provider CCData.

Is your portfolio green? Check out the BTC Profit Calculator

GBTC gets closer to underlying Bitcoin

Data showed that the $15 billion market cap product’s discount against its net asset value (NAV) dropped to 14.8% in October, the lowest since December 2021. This was a significant improvement on a year-to-date (YTD) basis.

A fund’s discount to NAV essentially means that the market price of the fund’s shares were trading at a lower price than the actual value of the assets held by the fund. Put simply, investors were buying something for less than its worth.

Typically, when the discount narrows, it implies that investors were having a more bullish view on GBTC.

As indicated above, discount to the NAV had surged to about 50% late last year and spent much of H1 2023 in a range around 40%. However, the last quarter marked a noticeable shift in sentiment.

A series of positive developments surrounding Grayscale Investments’ bid to transform the trust into a spot Bitcoin ETF could explain the reversal.

GBTC rides on legal victories

Unlike trust products, which occasionally deviate from the value of their underlying assets, a spot ETF maintains the fund’s value in line with the asset value.

Recall that the U.S. Securities and Exchange Commission (SEC) rejected the application last year, citing non-compliance to investor protection standards. Following this, Grayscale filed an appeal asking for a review of the regulator’s decision.

A court ruling earlier in August agreed with Grayscale’s arguments and directed the SEC to review its decision. The verdict spurred hopes of a conversion in the near future, while also reducing the discount between GBTC and NVA.

Read Bitcoin’s [BTC] Price Prediction 2023-24

The positive sentiment peaked after SEC decided not to appeal against the verdict.

Observing the developments, CCData said,

“The discount is likely to continue diminishing with the ongoing anticipation surrounding Grayscale’s case for the conversion of GBTC Trust into an ETF product.”