Digital asset products find September unfavorable – Why?

- The AUM dropped for the second straight month in September.

- Bitcoin, Ethereum-based asset products registered significant decline.

Delays in making a decision on the numerous applications for a spot Bitcoin [BTC] exchange-traded fund (ETF) continued to keep the digital asset market on the tenterhooks in September.

Read Bitcoin’s [BTC] Price Prediction 2023-24

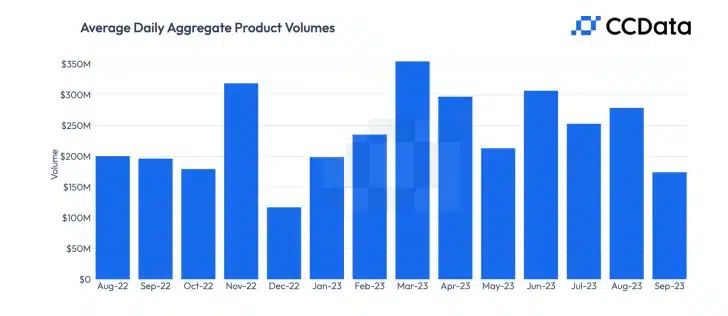

According to digital assets data provider CCData, the average daily volume of digital asset investment products plunged to $175 million in September, the lowest level recorded in 2023.

In fact, the monthly decline of 37.6%, was the worst since December 2023, arguably the zenith of the bear market.

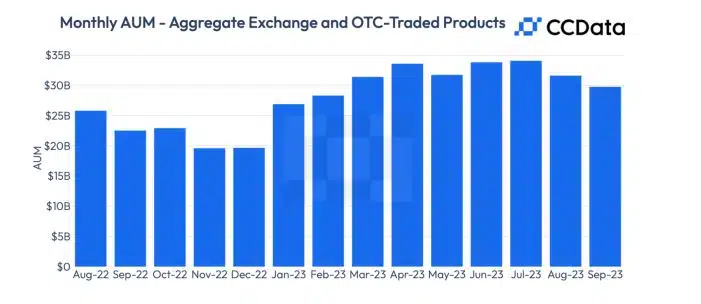

Apart from this, the total assets under management (AUM) dropped for the second straight month in September, with a decline of 5.86% to $29.8 billion.

Low volatility proving to be a pain point

The AUM is a measure of the flow of investor money in and out of a fund and the price performance of the underlying asset. The size of the AUM gives investors an idea about the investment company’s operations.

Most investors are drawn to funds with big AUM simply because they have sufficient liquidity to meet any redemption pressures.

The decline observed in AUM and trading volumes was tightly tied to the range bound price action of market bellwethers like Bitcoin. Barring bouts of volatility, the king coin was largely stuck in compact trading ranges of $25,800-$27,000 over the last month, data from CoinMarketCap revealed.

Indeed, the report revealed that the fluctuations in AUM followed a similar pattern when it came to BTC liquidity on centralized trading platforms.

Leading investment products see decline

Bitcoin-based investment products witnessed an AUM decline of 5.21% to $21.2 billion. Interestingly, despite the marked decrease, BTC products retained their dominance in the market. The market shares marginally increased from 71.2% in August to 71.7% in September.

Ethereum [ETH]-based crypto products registered a steeper AUM drop of 7.65% during the month. Moreover, unlike Bitcoin, ETH products lost their market share to an extent, coming down from 22.3% to 21.9%.

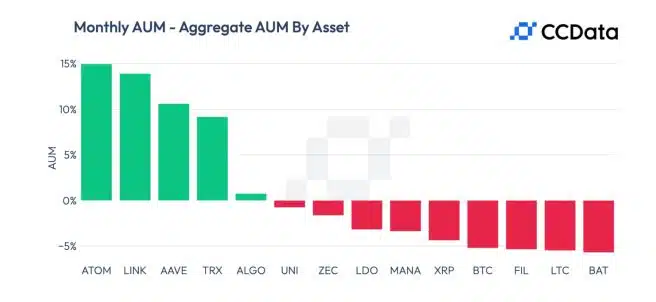

While the leading products faltered, some with significantly lower market values rose to the occasion. As can be seen above, investment products related to Chainlink [LINK], Aave [AAVE], and Tron [TRX] recorded a noticeable increase in market share.

Positive improvements in their particular ecosystems, which resulted in price gains, aided in increasing the market worth of their investments. According to CoinMarketCap, most of these assets were among the top gainers in the market over the last month.

While LINK jumped by a whopping 28.84%, TRX rose by more than 10%.

North American market faces headwinds

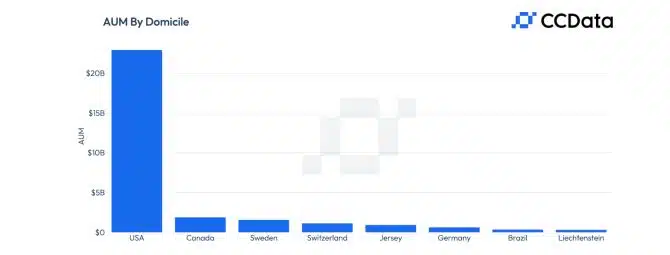

The United States retained its dominant position in the digital asset space, commanding a robust 78% share of the market. Although, it witnessed a notable decrease in the AUM, by 5.81%, in September.

The country was home to the largest and most influential crypto asset manager in the world – Grayscale Investments.

The worst decline in AUM was observed in Canada, another major player in the field of institutional crypto products. The North American nation saw the market value of its investments plummeting 14.8% to $1.69 billion.

The report highlighted “cautious investor sentiment” in both the U.S. and Canada as the main factor behind the decline in AUM.

Where does Grayscale stand?

As mentioned earlier, Grayscale was the dominant firm in terms of AUM. While the asset manager witnessed a 5.56% decline in AUM in September, it continued to account for the lion’s share of the market, at more than 73%.

Grayscale Bitcoin Trust (GBTC), the world’s largest Bitcoin fund, contributed to the decline. The AUM for GBTC dropped 4.6% to $16.6 billion in September.

Moreover, the second-largest traded crypto trust product, Grayscale Ethereum Trust (ETHE), fell by an even steeper 8.55% during the month.

Overall, trust products recorded a decrease of 5.56% in AUM in September. However, they increased their market share marginally to 74%.

ETF products, which have recently grown popular, saw their assets under management fall by 12%. The market pie narrowed to 11.7% from 12.6% last month.

Is your portfolio green? Check the BTC Profit Calculator

Unlike trust products, which occasionally deviate from the value of their underlying assets, a spot ETF maintains the fund’s value in line with the asset value.

Grayscale has attempted to convert its trust into a spot Bitcoin ETF, but has been rejected by the U.S. Securities and Exchange Commission (SEC). However, a recent court verdict directed the SEC to review its decision, spurring hopes of an approval in the near future.