Dogecoin critics will be appalled to know that DOGE rallied 46.48% because…

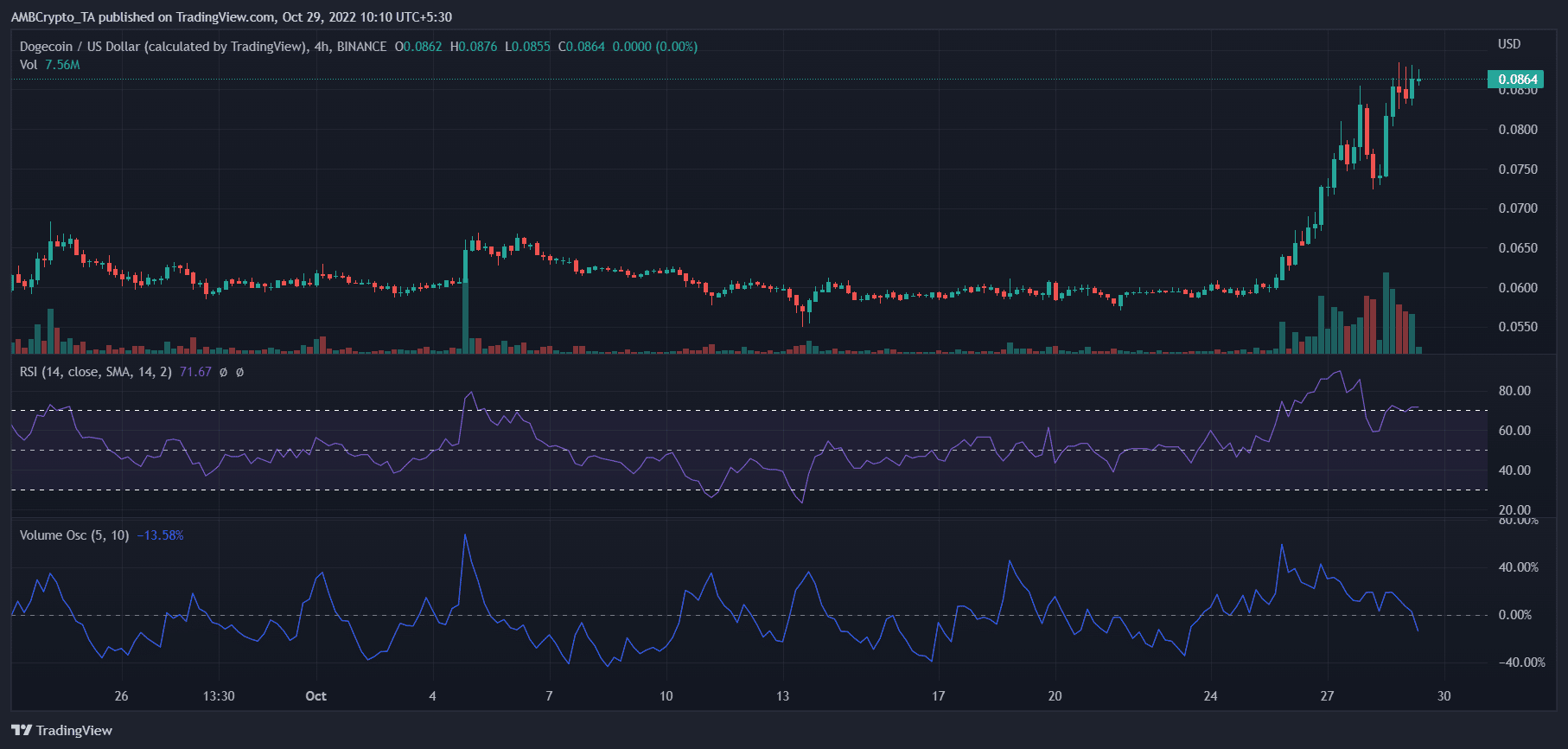

Dogecoin [DOGE] saw an impressive rally over the past week, as its price rose from $0.059 on 25 October to $0.086, at the time of writing. Markedly, the meme coin’s price crossed $0.085 for the first time since 17 August. Much to the surprise of investors, it rallied by 46.48% in the past seven days.

Now, DOGE’s unexpected price increase is, indeed, great news for investors. Interestingly, according to what the market perceives, there are two major reasons behind its spike. Both of these are seemingly unrelated- Elon Musk’s Twitter acquisition and Dogecoin’s great burn.

Timing is everything

Elon Musk has been affecting Dogecoin’s price since 2019, when he simply tweeted, “Dogecoin rulz.”

Dogecoin rulz pic.twitter.com/flWWUgAgLU

— Elon Musk (@elonmusk) April 2, 2019

As it is well documented, with time, the meme coin became synonymous with Musk. This time was no different as the price of DOGE increased by 10% when Musk changed his Twitter bio to “Chief Twit.”

Since Musk’s official tweet confirming the acquisition of Twitter, the price of DOGE has seen volatile action. On the 4-hour chart, DOGE rallied with a 16.18% increase over the last day.

However, its leading indicator RSI rested at the neutral mark. Thus, implying that the rally was losing strength. Even the volume oscillator was registering new lows, empowering bears to take control of the market soon.

Surprisingly, the news of Musk buying Twitter coincided with the news of DOGE’s great burn. On 23 October, the Dogechain governance platform announced a proposal that would burn 80% of the existing Dogecoin, alongside feedback on whether the vesting period of the remaining airdrops should be reduced from 46 to six months. There was overwhelming support for both proposals, with 99.9% votes in favor of the great burn.

?Threshold reached – Voting continues until Oct 28 ?

Exciting update frens! ?

✅ The vote threshold to burn 80% of the total supply of $DC tokens has been reached.

? Users have already locked 550 million votes in favor of the burn (99.9% YES)! pic.twitter.com/2ZK0T3YKmw

— Dogechain? (Giving away a Tesla) (@DogechainFamily) October 25, 2022

What about the metrics?

Well, its transaction volume in USD saw a steep rise to $653.6M, at the time of writing. There was an increase in the number of whales making transactions in the network. This clearly showed that investors’ sentiment was reviving.

Whether DOGE will continue its climb or succumb to the market pressure, remains to be seen. However, investors should exercise caution before making any sort of trading moves.