Dogecoin: Down 92% from its all-time-highs, is DOGE gone for good

Dogecoin has always been an iffy cryptocurrency considering its fundamentals and uses cases. However, it managed to amass an audience of seasoned and amateur traders alike.

But with the recent crash, that spell may break soon.

Dogecoin fails to be a good boy

The last week was one of the most devastating, if not the worst, weeks this year. Dogecoin, which never recovered from the crash in May, only continued depreciating over the next 13 months bringing DOGE to where it stands today at $0.0541.

Dogecoin price action | Source: TradingView – AMBCrypto

After falling by 32.03% in the last seven days, Dogecoin has declined by 92.19% from its all-time high of May 2021, when it hit $0.7559. Although a lot of cryptocurrencies faced such crashes, a downfall, this high has been noted by only a few, including Terra.

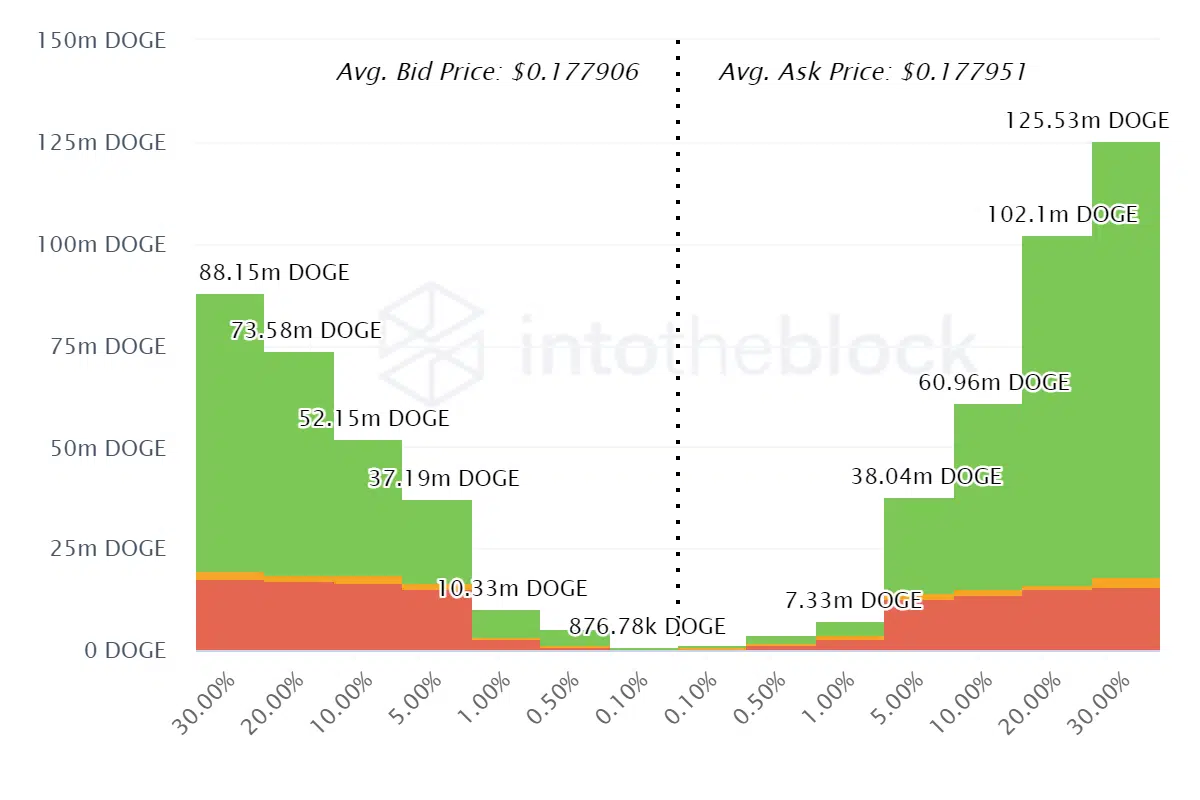

For investors, this will is nothing short of heartbreaking who have officially resorted to exiting the space. Not only has the arrival of new investors been slow, but the present DOGE holders prefer to sell more than buy, even though one could consider this as an opportunity to “buy the dip.”

Sell orders exceed the buy orders by almost 43% or 40 million DOGE across exchanges.

Dogecoin buy and sell orders | Source: Intotheblock – AMBCrypto

But the biggest hint of this pessimism comes not from retail investors but from Dogecoin whales that occupy 46.85% of the supply. Their presence and activity in the market subsided long ago, back in January, and it has still not returned almost six months later.

On average, this cohort only conducts transactions worth $200 million to $400 million presently, while right before January, these figures stood at more than $5 billion.

Dogecoin whale transactions | Source: Intotheblock – AMBCrypto

However, most of these sellers happen to be either short-term or mid-term traders since their disappearance has been making room for long-term holders that have been loyal to Dogecoin for more than a year now.

Commanding 28% of the supply, these LTHs’ concentration has grown significantly since January as they stand to be the only supporters of Dogecoin regardless of the state of the market.

Dogecoin supply distribution | Source: Intotheblock – AMBCrypto

Thus, going forward, recovering from these lows is a very questionable course for Dogecoin. However, if it manages to, it might be able to retain its place among the top 10 cryptocurrencies.