Dogecoin enthusiasts should consider this before buying the dip

Dogecoin’s performance in the last two weeks can be seen as a healthy sign despite its downside.

It is a confirmation of investors’ interest considering the relative inactivity observed in July, and the first week of August.

Let’s explore what this means for Dogecoin fans and investors.

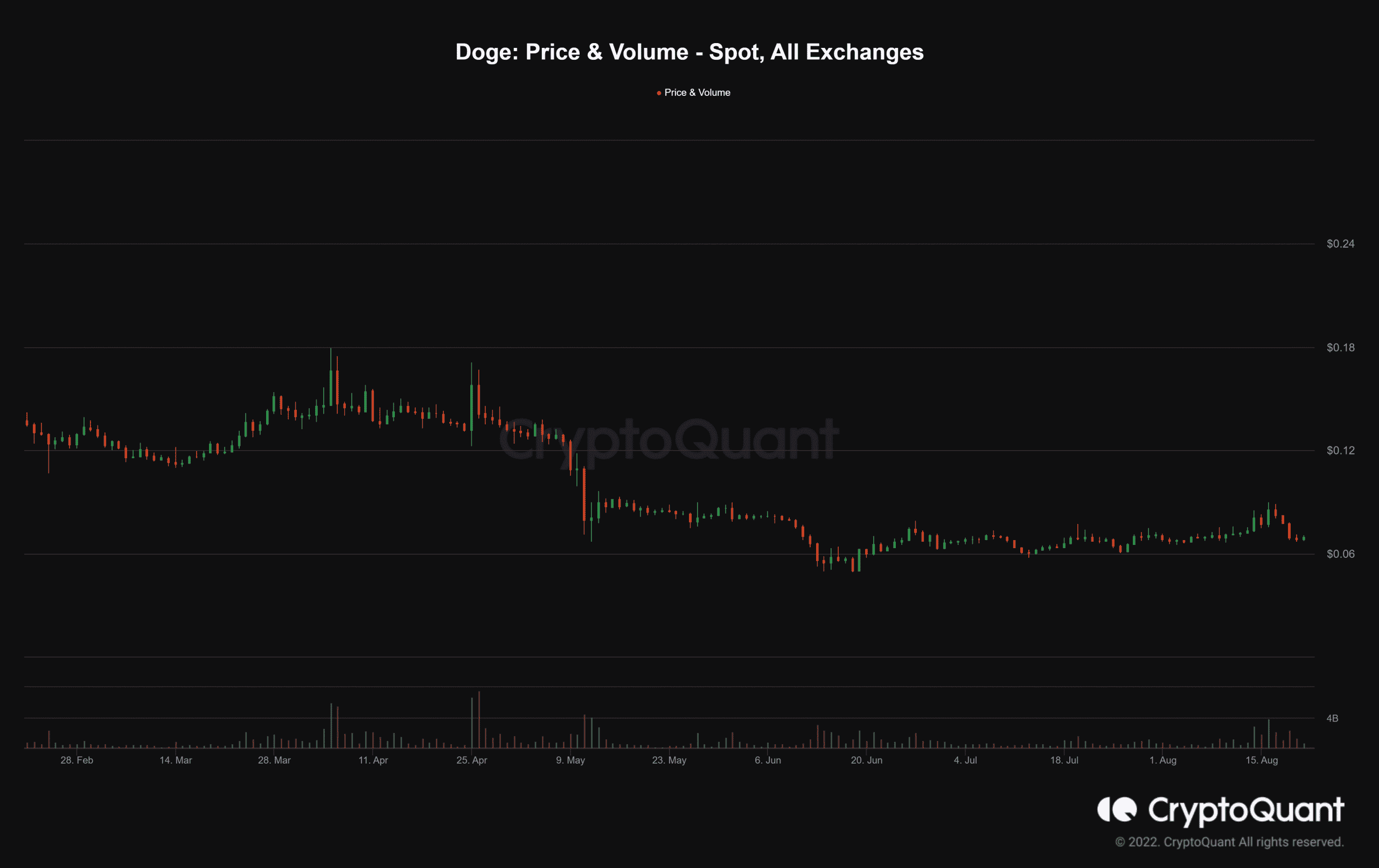

The meme coin embarked on a 26% rally between 12 and 16 August. This was its biggest price movement since its previous bounce in mid-June.

The move confirmed that DOGE could still command significant volumes and that its meme coin status was not a hindrance.

This has been a worry since Dogecoin missed the July rally because investors shifted their attention to cryptos with more utility.

Notably, DOGE bulls were slapped down as the bear took over the market last week, causing a 26% retracement.

This puts Dogecoin within the same price range where it traded in the first week of August. But can it sum up enough volumes to push back up or will it seek more downside?

Well, the following on-chain metrics provide a clearer picture of what is happening with Dogecoin at the blockchain level, and what to expect.

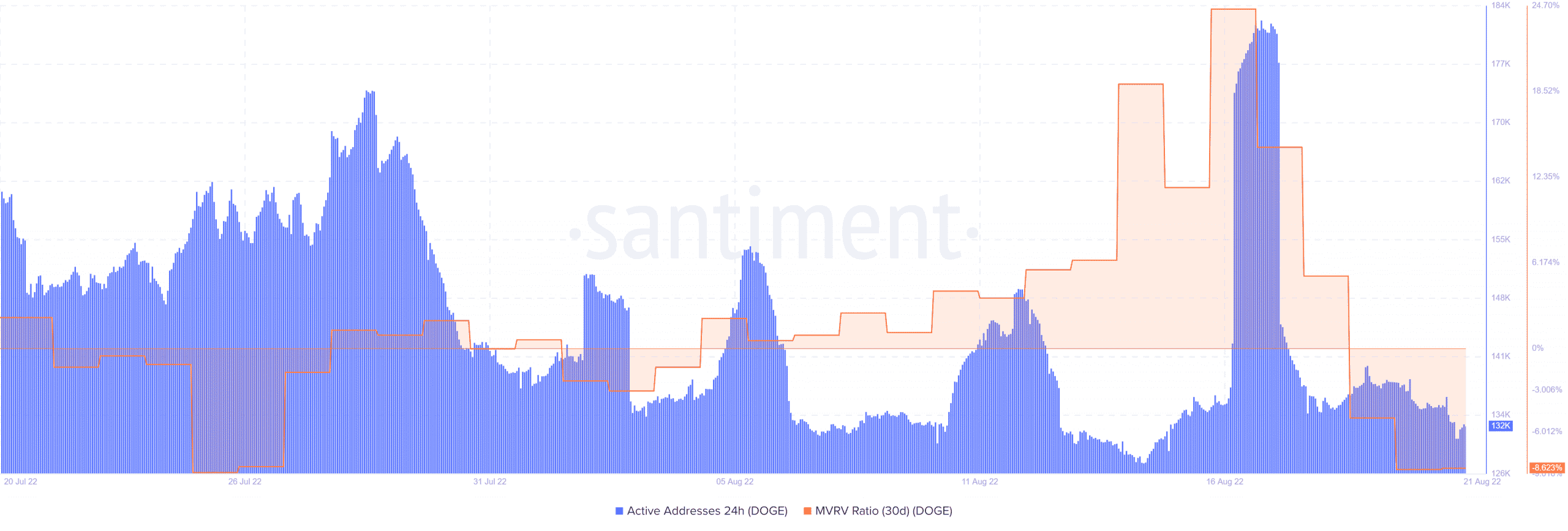

The number of active addresses at press time was 132,760. This was close to the lowest number of active addresses in the last 30 days.

Traders can take it as a confirmation that there are not a lot of new addresses or new demands coming in.

DOGE’s 30-day MVRV ratio, at press time, was down to its monthly lows, confirming that almost all of the positions entered in the last four weeks are out of the money.

It also confirmed that there has been very little accumulation at the current lows.

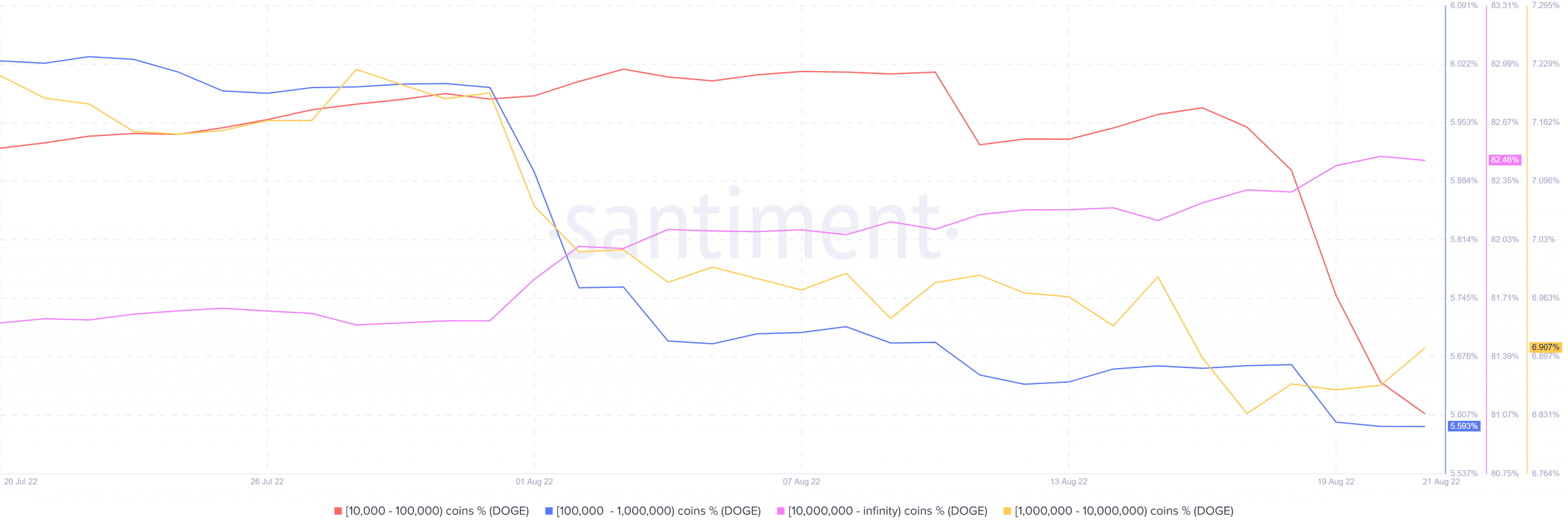

Furthermore, the supply distribution metric underlined a staggered outlook at the current discounted levels.

Some addresses holding between one million and 10 million coins have been buying the dip.

However, the buying pressure has been canceled out by selling pressure from addresses holding between 10,000 and 100,000 coins.

Addresses holding more than 10 million currently control most of the circulating supply at 82.46% at press time.

This whale category has the biggest impact on price. There were sizable inflows from the said category in the last four weeks.

DOGE addresses holding more than 10 million increased their balances substantially in the last 10 days, which means they have been buying the dip.

Conclusion

Accumulation from some of the largest whales was clearly not enough to offset last week’s selling pressure.

But this is a healthy sign that some of the largest accounts still have faith in Dogecoin. It should also come in handy during the next bullish phase.