Dogecoin fails to take off following Musk-induced surge – Why?

- The dog-themed token has reversed all the gains made during the Musk-induced rally.

- DOGE’s social media mentions fell sharply since the event.

World’s largest memecoin Dogecoin [DOGE] retreated sharply since the actions of its most influential endorser, Elon Musk, pumped its price significantly a week ago.

Recall that the “original memecoin” lifted by more than 10% on the 21st of January as social platform X launched its official X Payments handle.

History has shown that Dogecoin invariably reacts positively to payments-related developments at any of Elon Musk-owned companies.

However, pretty much like history, as the hype cooled off, DOGE retraced. The dog-themed token tanked 11% since then, effectively reversing all the gains made during the Musk-induced rally.

DOGE’s roller coaster ride

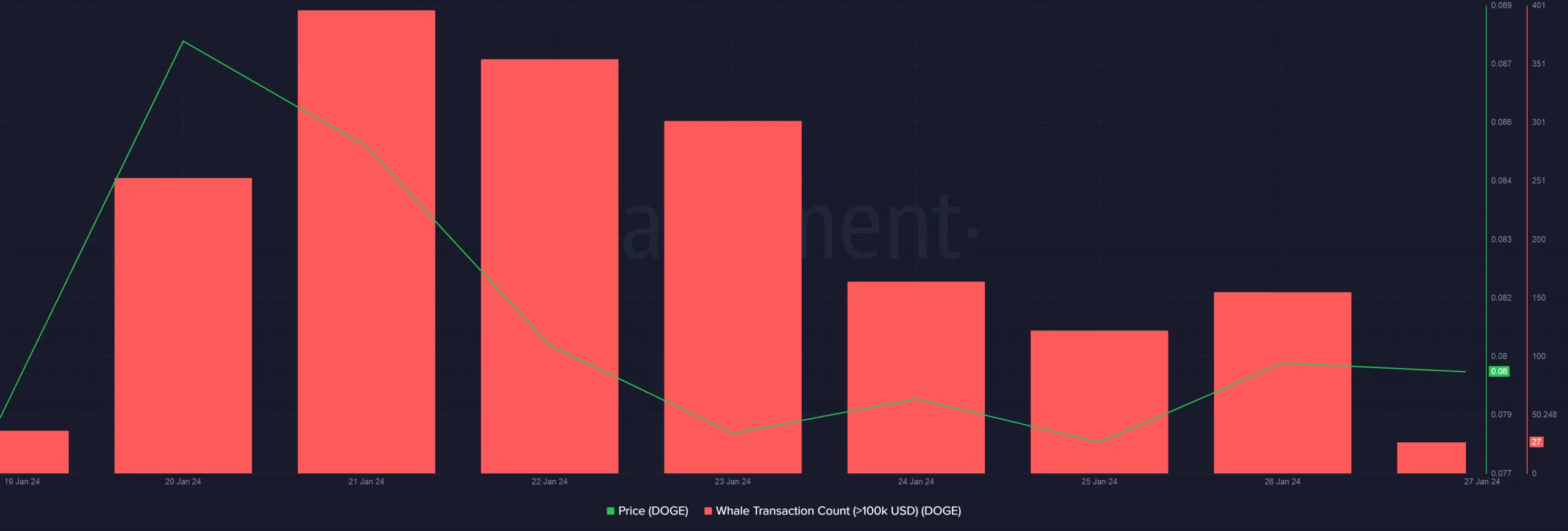

As expected, whale investors, who showed immense interest in DOGE on the day of Musk-induced rally, abandoned it eventually.

According to AMBCrypto’s analysis of Santiment data, large transactions worth more than 100,000 declined 60% since the 21st of January. The trajectory was almost in sync with the price movement of DOGE.

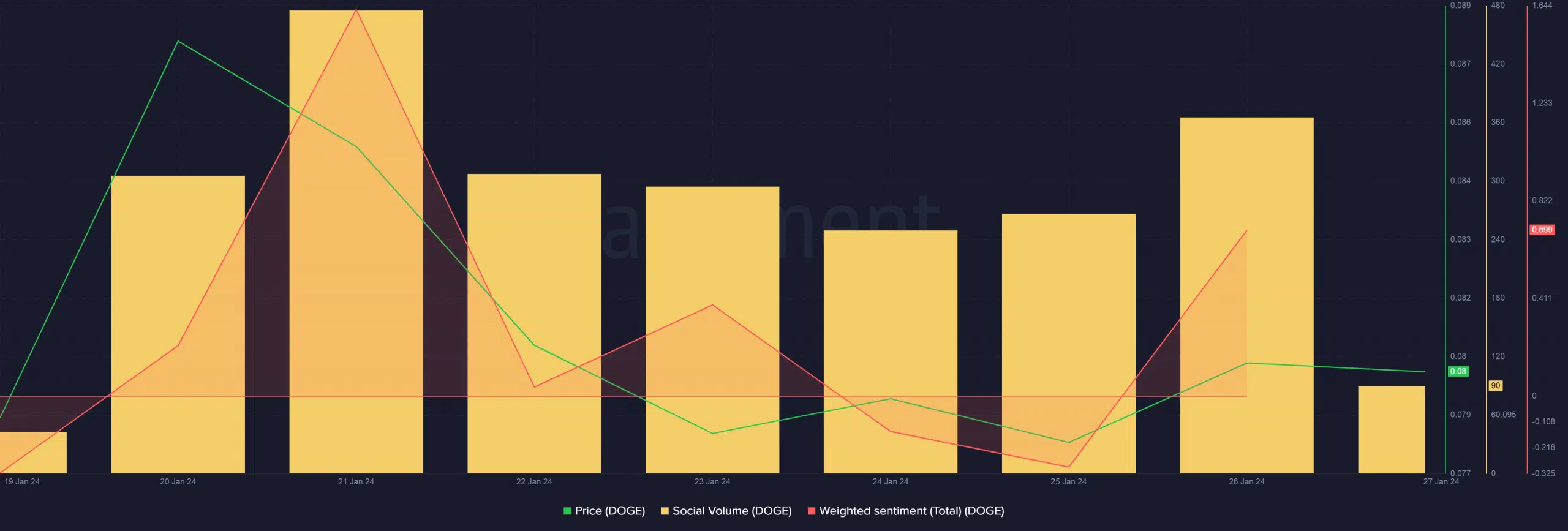

Moreover, DOGE’s mentions on popular crypto-focused social media channels fell sharply since the double-digit rally.

The weighted sentiment too, fell into the negative territory, indicating depleting investors’ confidence.

Over reliance on Elon Musk?

These metrics reiterated what has been the story for DOGE throughout much of its recent history.

Social media posts and payments-related news linked to Elon Musk would get the community excited, only for nothing significant to come out for the memecoin eventually.

This over dependence on the tech Czar has not only limited DOGE’s potential but also made it as a highly volatile asset. In contrast, other memecoins like Shiba Inu [SHIB] and Floki [FLOKI] have diversified towards real-world use cases.

A peek into DOGE’s futures market

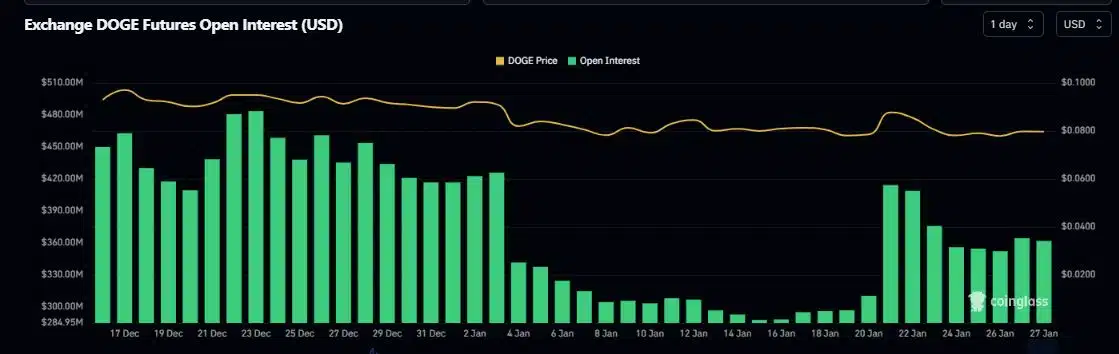

Meanwhile, the tenth-largest crypto by market cap was witnessing better demand in the derivatives market when compared to earlier in the month.

Realistic or not, here’s DOGE’s market cap in BTC terms

According to AMBCrypto’s analysis of Coinglass data, the Open Interest (OI) in DOGE futures was $361.9 million as of this writing. For the period between the 4 January – 20 January, it failed to cross $350 million.

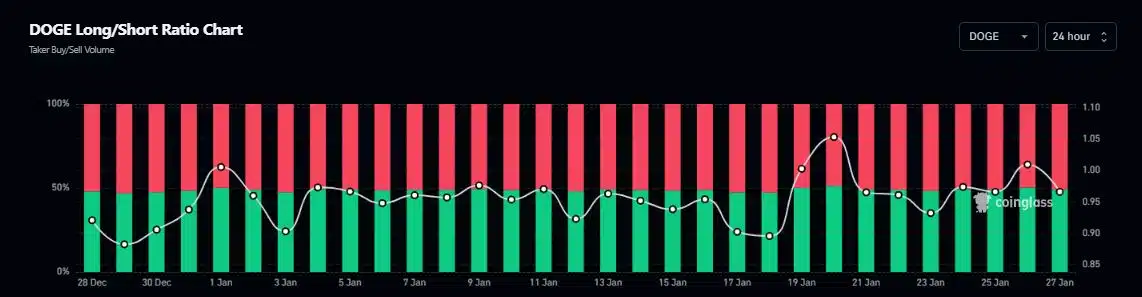

Furthermore, the number of shorts taken for DOGE surpassed longs for much of last week, the reading of the Longs/Shorts Ratio chart showed.