Dogecoin’s latest hike and why, perhaps, it’s more of the same

Dogecoin has been the subject of debate for far too long now. While there are those who support its use cases as a future, there are also those who view it as nothing more than a joke.

However, one thing that both of them can agree on is the fact that Dogecoin, in reality, will have its value only as long as it’s in the headlines. Once that stops happening, consider it done and dusted.

Dogecoin is rising… But why?

Yesterday, the well-known Shark, Mavericks owner, and recently-turned Dogecoin enthusiast Mark Cuban had a Twitter quarrel with Preston Pysh, a Bitcoin maximalist. According to some, the altercation may have resulted in DOGE climbing back up on the ‘trending’ charts. Needless to say, DOGEboys were hyped up too, with the result of the same clearly visible on the alt’s price movement.

At the time of writing the altcoin had risen by over 8% already, with the alt trading well in the green.

Dogecoin price action | Source: TradingView – AMBCrypto

Now, there will be some who’d argue something else triggered the rise. But right now, Dogecoin has no particular reason to be climbing up the candles. Sure, its correlation to BTC is strong and close to 0.69, but the king coin itself is in consolidation presently. Ergo, that couldn’t have triggered the hike either.

Additionally, it hasn’t had any major network developments recently, so that’s out of the question too.

Dogecoin’s correlation to Bitcoin | Source: Intotheblock – AMBCrypto

The aforementioned observations only prove that DOGE investors and the market do not take it seriously enough. This altcoin’s only real value is its popularity and once that dies, the crypto might not be as much of a hit as it is today.

A lone factor?

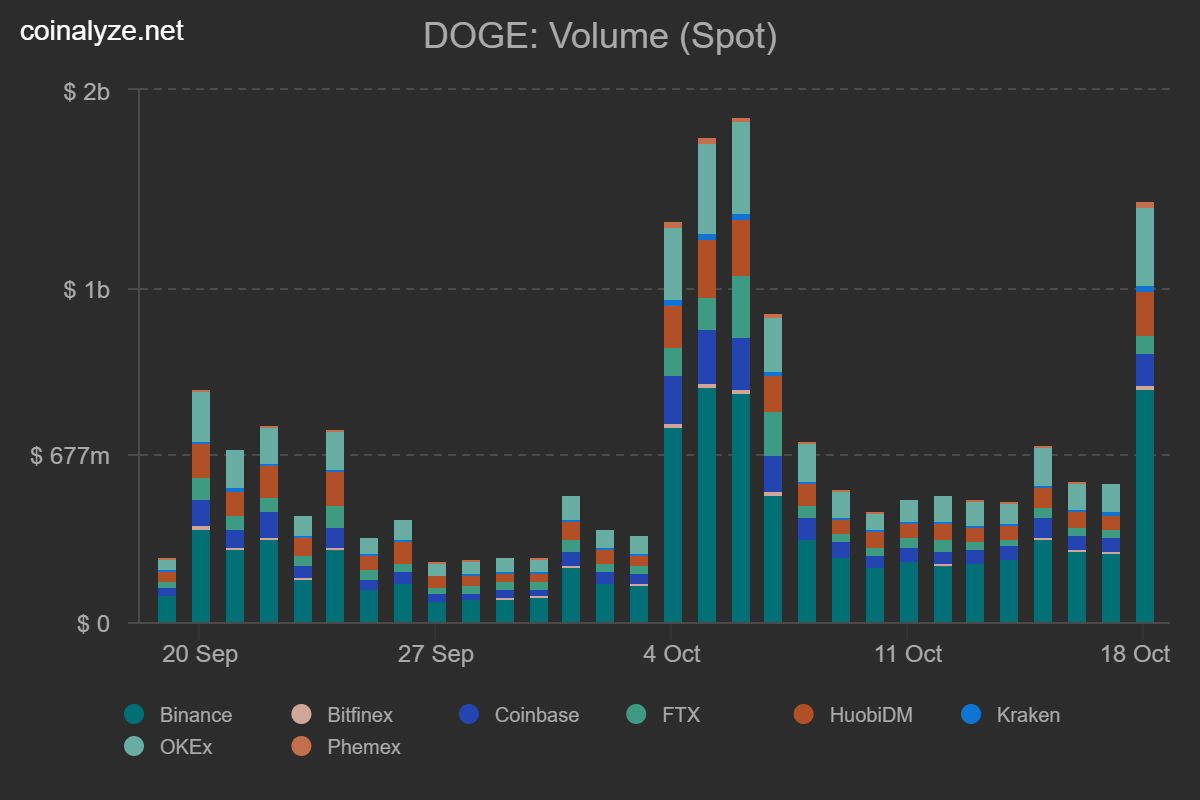

At the moment, there is no other reason than Mark’s DOGE defense that could explain why trading volume has tripled in 24 hours. In fact, at press time, the same had figures of over $1.5 billion.

Dogecoin volumes | Source: Coinalyze – AMBCrypto

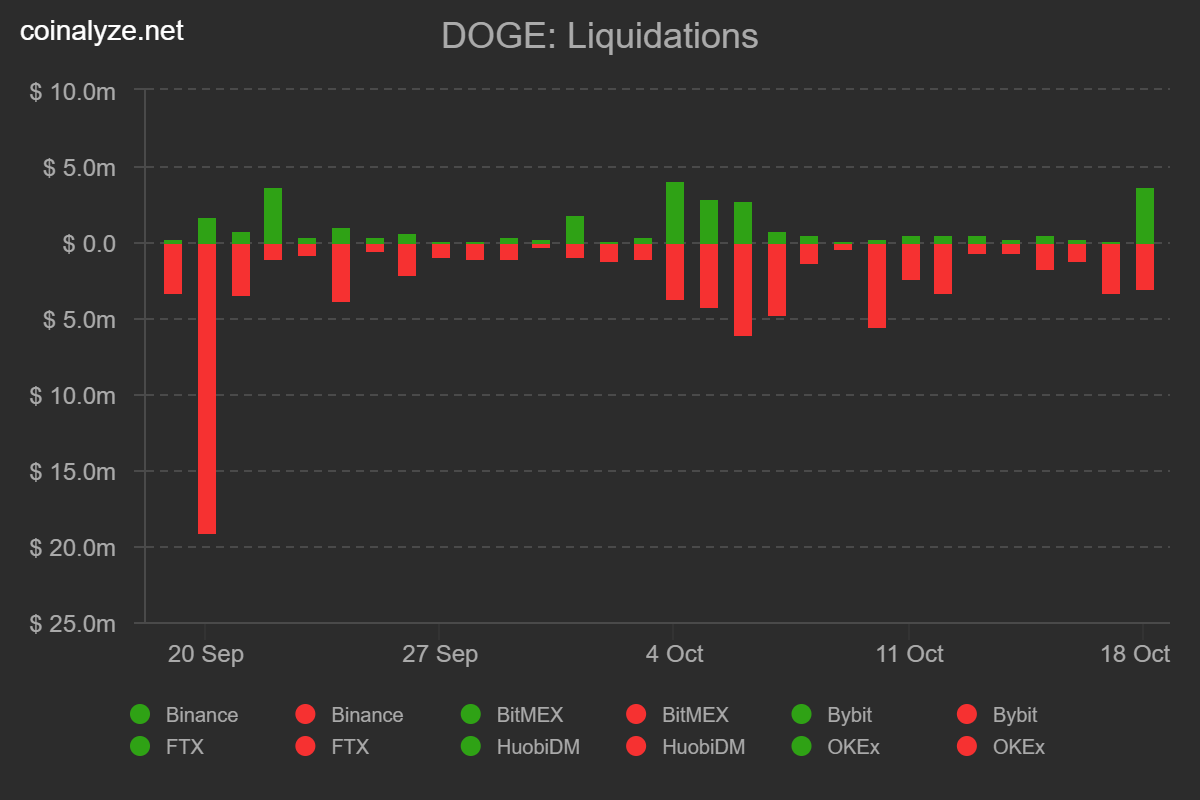

Curiously, it might also explain why suddenly, after 10 days, people began shorting DOGE and liquidations hit $3.45 million.

Dogecoin liquidations | Source: Coinalyze – AMBCrypto

At this point, even non-DOGE maximalist traders know that these incidents are the best times to jump in and cash out. And, they’re probably taking full advantage of the same.

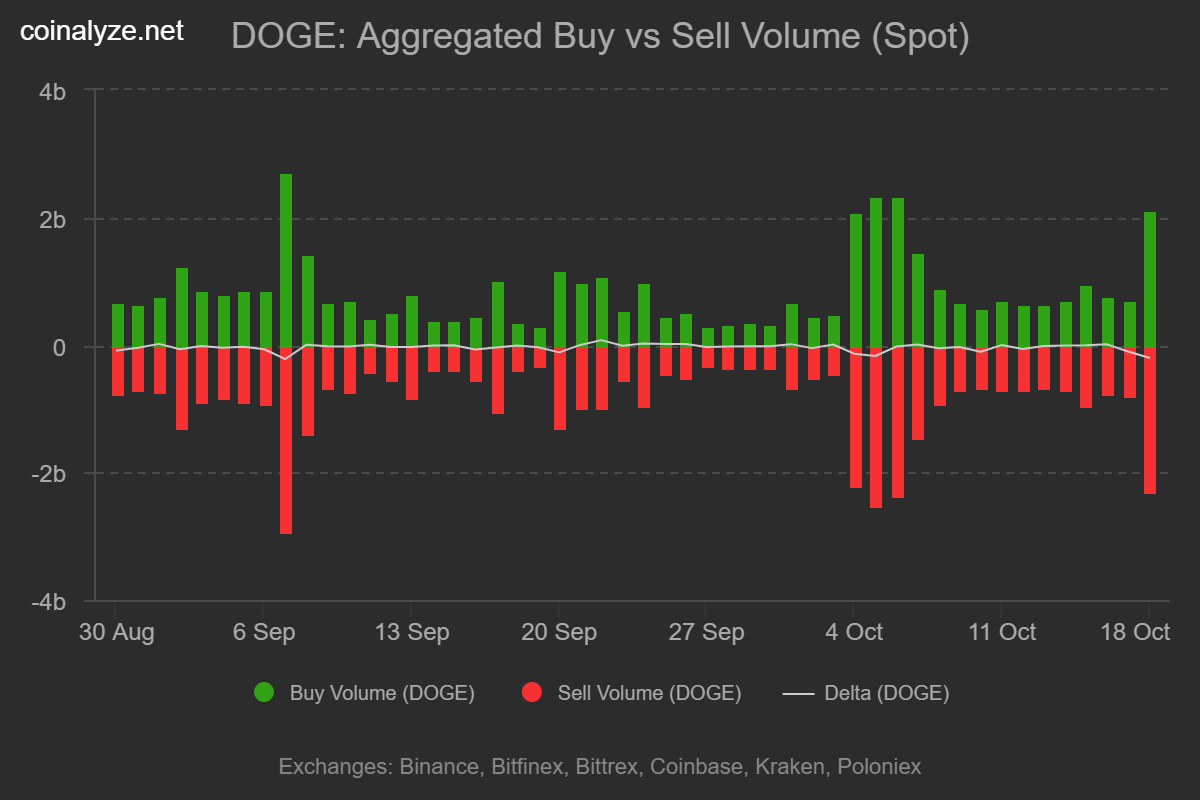

Dogecoin buy-sell volumes | Source: Coinalyze – AMBCrypto