Dogecoin’s short-term price targets – Rally to $0.13 or a fall to $0.09?

- Market sentiment around Dogecoin turned bullish, despite a price decline

- If the bulls fail to take over, then DOGE might fall to $0.09

Like in the case of most cryptos, Dogecoin [DOGE] bears have been dominating lately, with its weekly chart red at press time. However, the world’s largest memecoin was trading at a crucial level too. And, this could possibly trigger a trend reversal soon on the price charts.

Dogecoin’s critical support level

Dogecoin’s value dropped by over 3% last week. So was the case over the last 24 hours too as at the time of writing, DOGE was trading at $0.1012 with a market capitalization of over $14.7 billion.

According to IntoTheBlock’s data, more than 4.4 million DOGE addresses were in profit at press time, accounting for over 70% of total DOGE investors.

On the contrary, while the memecoin’s price dropped, its weighted sentiment rose significantly.

This indicated that bullish sentiment around the memecoin has been rising. Its social volume also spiked, reflecting its popularity in the crypto space.

A possible reason behind this hike could be because Dogecoin was testing its crucial support at $0.10. If the memecoin manages to successfully remain above this level, then investors might soon witness a bull rally.

The rally could allow DOGE to reclaim $0.13 this upcoming week. Nonetheless, a slip under the support might push DOGE down to $0.094.

Will DOGE turn bullish this week?

Finally, AMBCrypto’s analysis of Hyblock Capital’s data revealed a bullish indicator. As per our analysis, DOGE’s whale vs retail delta increased from 0 on 16 August to over 43 on 17 August.

A value closer to 100 indicates that whales are having longer exposure in the market. This can be inferred to be a positive signal.

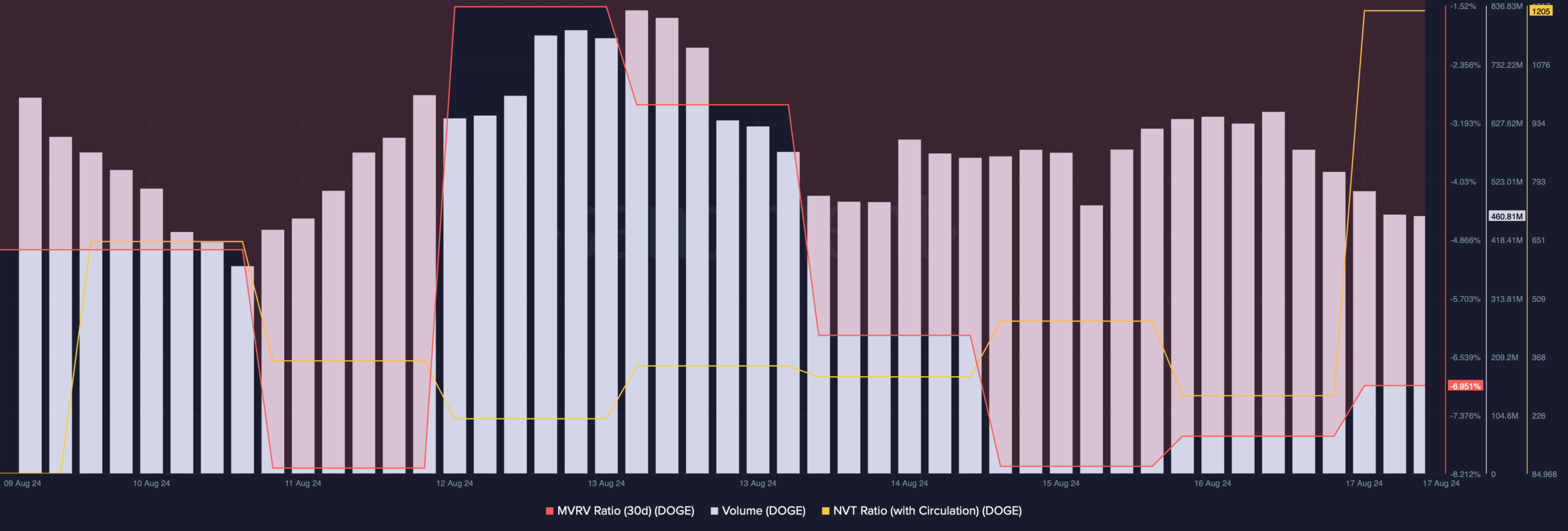

We then checked Santiment’s data to better understand whether metrics hinted at a successful test of the $0.10 support level. We found that Dogecoin’s trading volume remained stable last week.

The NVT ratio registered a sharp uptick too, which meant that the memecoin was overvalued. Another bearish metric was the MVRV ratio, which remained low.

Read Dogecoin Price Prediction 2024-2025

As AMBCrypto previously mentioned, if DOGE fails to test the support, then its price might drop to $0.09.

The liquidation heatmap also revealed a similar possibility. However, in case of a bullish breakout, DOGE might as well touch $0.15 soon before noting a price correction.