dogwifhat unable to cross $3.6: Will WIF’s price crash to $2.4?

- dogwifhat climbed past $3.6 but was immediately rejected.

- The bearish sentiment could force further losses.

Meme coin dogwifhat [WIF] had a bright start to the week when it flipped the $3.2 level to support.

However, the past 24 hours of trading were dominated by the bears. Bitcoin [BTC] retested $64k as resistance before falling to $62.2k at press time.

WIF was valued at $2.91 and bulls and bears were battling to control the mid-range mark. An earlier AMBCrypto report highlighting the possibility of a drop to $2.8 was vindicated.

The battle for mid-range rages on

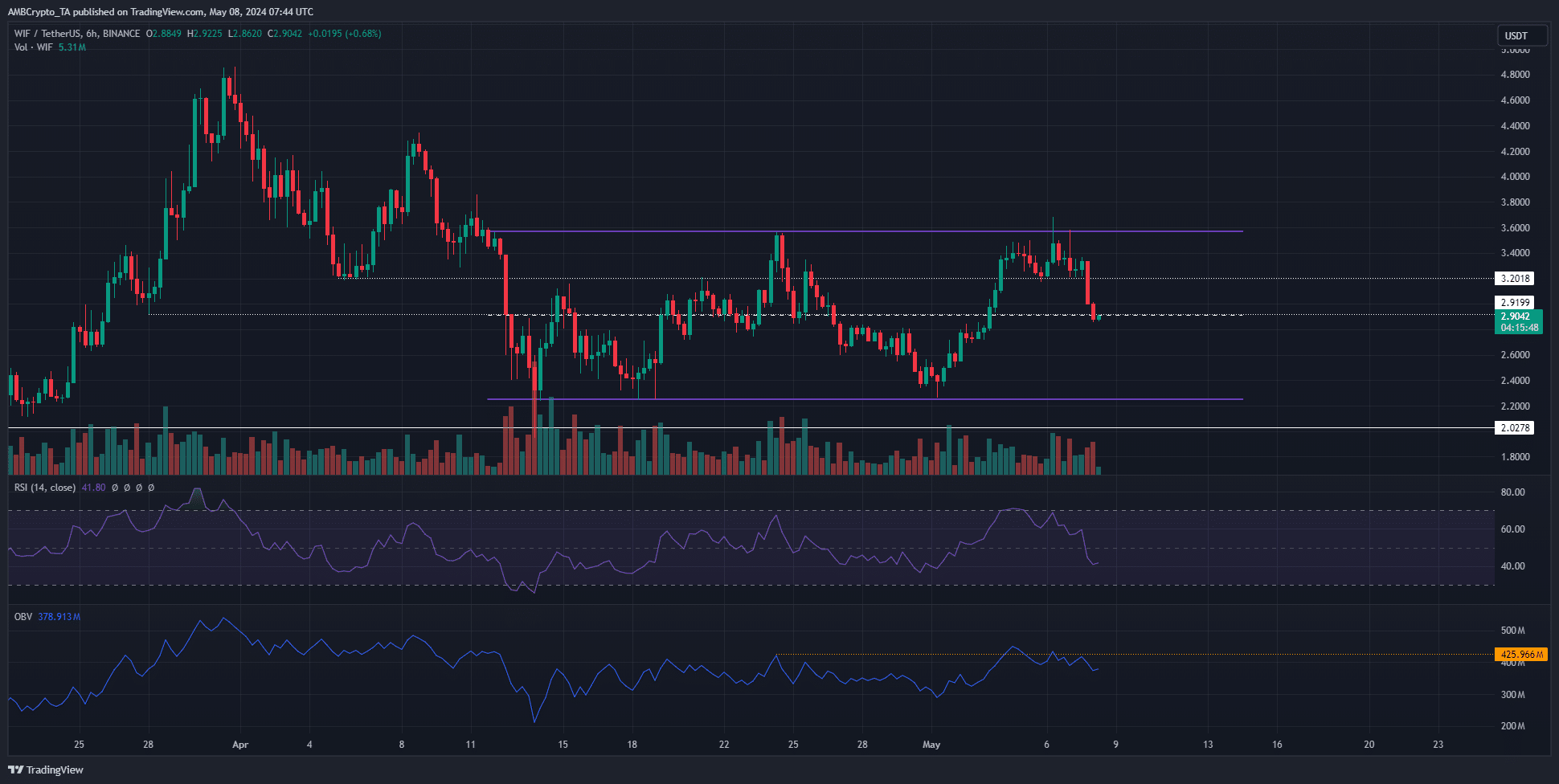

The month-long range (purple) extended from $2.24 to $3.56. The start of the week saw a WIF rejection at the range highs. The OBV was also unable to breach the local highs and trend higher.

This was a strong sign of a lack of buying pressure. This saw the meme coin stumble to the mid-range level at $2.9.

The 6-hour session close below this level in recent hours meant that the bears will likely win this battle and force a move toward the $2.4 support region.

The RSI also slipped below the neutral 50 mark to highlight bearish momentum was stronger.

In the short term, we may see a bounce to the $3.1-$3.2 region to fill the imbalance left during the swift losses of the past 24 hours.

Sentiment begins to falter amidst losses

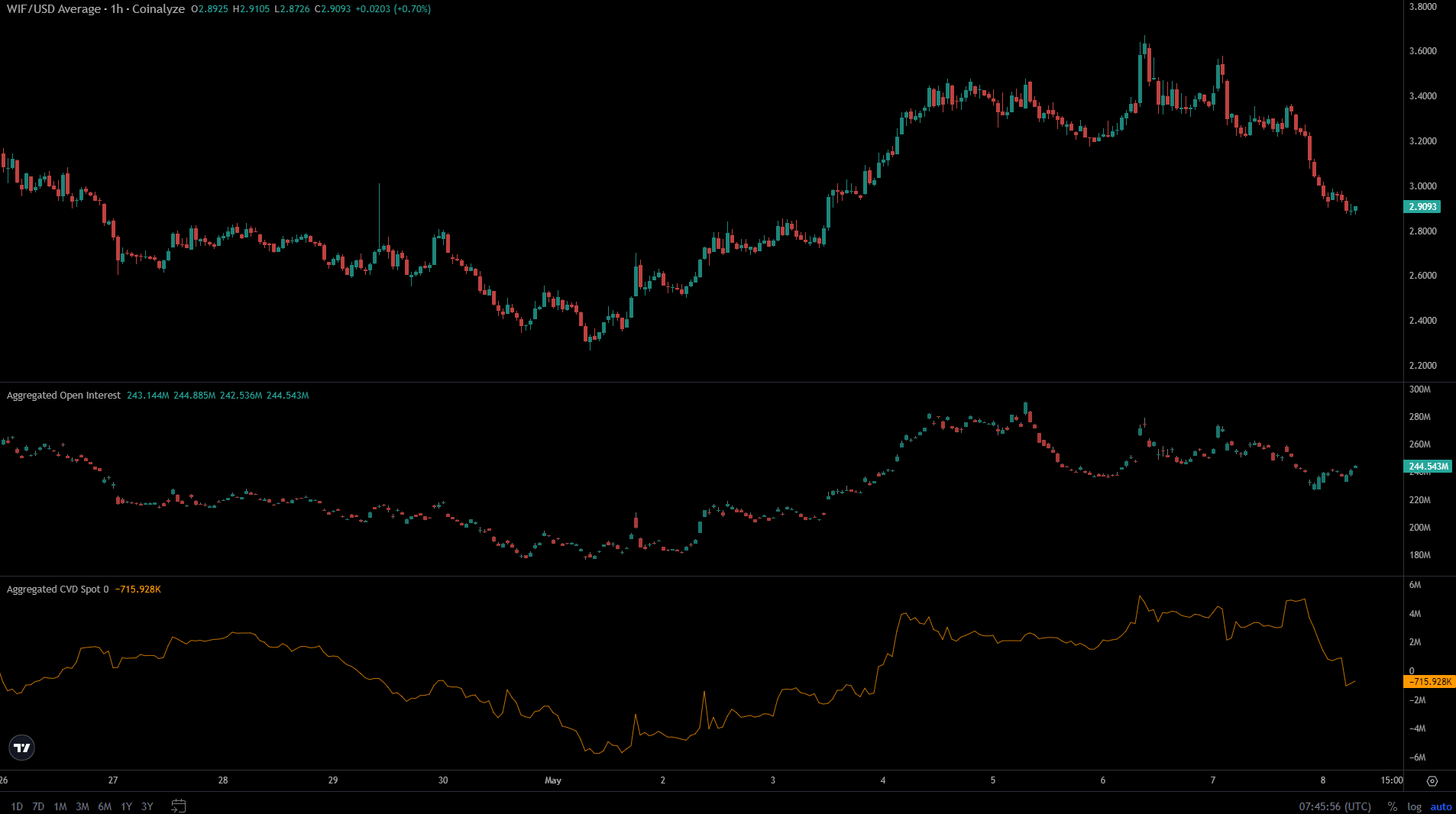

Source: Coinalyze

AMBCrypto reviewed the data from Coinalyze and found that the move to $3.68 on Monday the 6th of May lacked bullish conviction.

Realistic or not, here’s WIF’s market cap in BTC’s terms

The Open Interest chart had already been falling lower over the weekend and didn’t recover sufficiently during Monday’s rally.

The spot CVD also slumped in recent hours to underline increased selling pressure. The technical factors indicate that the next few days would likely see WIF losses on the chart.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.