DOT moves toward a bearish zone – Will it push forward?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- DOT attempted recovery ahead of US CPI data for May

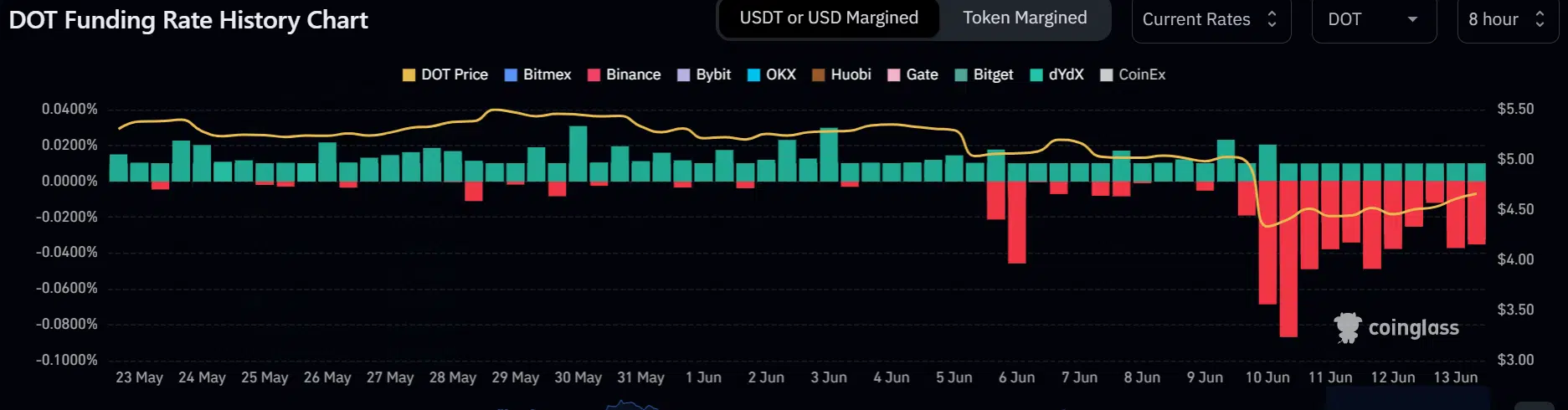

- The funding rate was negative but short positions were discouraged at press time

Polkadot [DOT] is just one of the assets the U.S. SEC mentioned as security during a recent Binance lawsuit. The characterization as a “security” alongside macro headwinds saw DOT tank massively over the past week ( 5-10 June).

Is your portfolio green? Check out the DOT Profit Calculator

But the plunge eased on 10 June, setting DOT to attempt to reverse recent losses. At press time, DOT traded at $4.661, up 3% in the past 24 hours, as per CoinMarketCap. Similarly, Bitcoin [BTC] crossed $26k ahead of May’s US Consumer Price Index (CPI) data.

Who will prevail – bulls or sellers?

After the Binance lawsuit and subsequent characterization of DOT as a security, DOT finally broke below its short-term range formation (white) that began on 8 May. It consolidated between $5.0 and $5.51 before dropping below December 2022 lows and hitting $4.2.

The extended drop on 10 June left behind a Fair Value Gap (FVG) of $4.53 – $4.8 (white). Notably, the FVG zone aligns with a key resistance level in late December 2022/early January 2023 ( $4.689). Hence, it is a key roadblock for bulls to clear.

If the rally falters at the above roadblock, DOT could retrace lower to $4.33 0r $4.2. These levels could act as short-selling targets.

But a session close above the FVG zone at $4.8 will invalidate the above bullish thesis. However, another FVG zone of $4.84 – $4.93 is close to the previous range lows of $5. As such, a move above $4.8 could meet resistance near $5.

Meanwhile, the Relative Strength Index (RSI) hit the median mark and could face little resistance and ease buying pressure before attempting to move up. However, the Chaikin Money Flow (CMF) crossed above zero mark sharply, denoting massive capital inflows into DOT.

Negative funding rate: Shorts discouraged

Most Centralized Exchanges (CEXs) posted negative funding rates for DOT since 10 June, which could delay a strong rally capable of smashing the roadblocks ahead.

How much are 1,10,100 DOTs worth today?

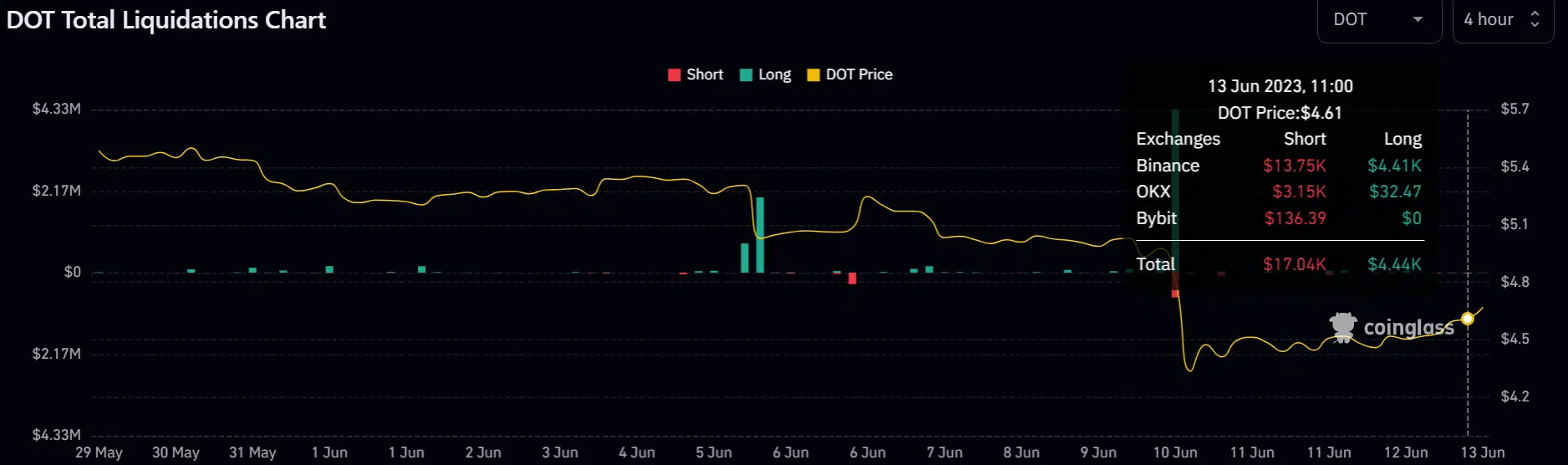

Nevertheless, more short positions were wrecked in the past four hours as compared to long positions. It shows a building bullish momentum ahead of the US CPI data. As such, the mixed signals call for caution and tracking of BTC price action before making moves.