Cardano – Assessing how likely a recovery is

- Cardano exchanged hands almost 22% lower over the last seven days

- Furthermore, its development activity, volume, and weighted sentiment also painted a bearish picture

Most cryptocurrencies have been the victim of some bearish price action over the last few days. However, the last seven days have been particularly difficult for Cardano [ADA]. As per data from CoinMarketCap, ADA was exchanging hands at $0.2738 at the time of writing.

What stood as an extreme concern was that ADA was trading 22.54% lower over the last seven days. To add to the bad news, a tweet from IntoTheBlock stated that as of 13 June, 90% of cryptocurrency holders held their tokens at a loss. Furthermore, 91.52% of ADA holders were Out of The Money.

The recent crypto market dip sent several assets tumbling. Some are even surpassing 90% of holders holding at a loss.

Not all is gloomy though! several assets seem to weather the storm pretty well. Curious about how they compare? ?Check out our latest infographic?#BTC #ETH… pic.twitter.com/jfLUarvx4F

— IntoTheBlock (@intotheblock) June 13, 2023

An Out of the Money asset is one that would generate a loss if exercised. Furthermore, traders are less likely to exercise such a sale as it would fail to generate any value.

Realistic or not, here’s ADA market cap in BTC’s terms

Cause(s) for concern

To add to the list of sad news, data from the intelligence platform Santiment added to the list of concerning factors. ADA’s development activity witnessed some improvement at the beginning of June. However, the metric witnessed a decline post 9 June and stood at 17.84 at press time.

This indicated that developers weren’t actively contributing to the Cardano network. Furthermore, a look at the weighted sentiment also painted a gloomy picture for the altcoin. At the time of writing, ADA’s weighted sentiment stood at -2.493.

Adding to the bearish sentiment, ADA’s volume also witnessed a steep decline over the past few days. A price drop coupled with a drop in volume indicated that traders weren’t actively engaged in trading the altcoin.

Furthermore, a look at ADA’s indicators on the price chart didn’t show any indication of a change anytime soon. ADA’s Relative Strength Index (RSI) stood at 21.50. This was an indication of the ongoing selling pressure in the market. Furthermore, the Awesome Oscillator (AO) was also flashing red bars below the zero line.

Additionally, ADA’s Moving Average Convergence Divergence (MACD) also saw the MACD line (blue) moving below the signal line (red). The MACD indicator also showed no signs of a crossover which indicated that the bearish sentiment could last for the next few days.

A tiny ray of hope

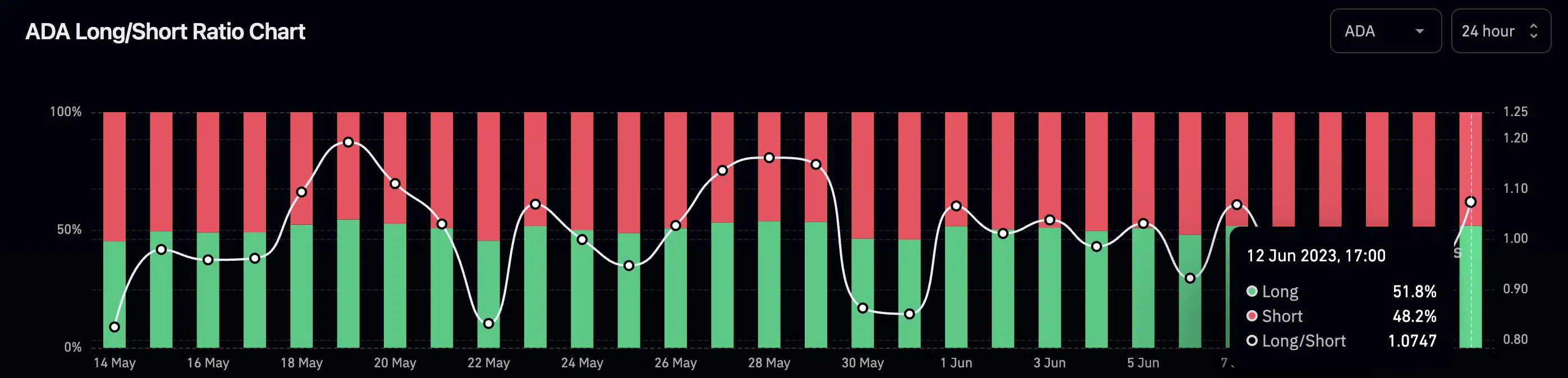

Despite the bears blocking ADA’s way to the bulls, there was a tiny ray of hope. As per data from coinglass, at press time, ADA’s long/short ratio stood at 1.07. Additionally, 51.8% of holders held long positions whereas 48.2% held short positions.

How much are 1,10,100 ADAs worth today?

This indicated that a higher number of investors believed that ADA would bounce back to its bullish price action.

Furthermore, data from LunarCrush also stated that ADA ranked #1 in the top 10 trending searches on LunarCrush.

Top ten current trending searches on https://t.co/Ye6Yvoh7kQ

Tuesday, 13 June 2023 07:05 UTC$ada $btc $vra $eth $lina $lunc $ftm $imx $matic $lunr pic.twitter.com/gDHemmDiqj

— LunarCrush (@LunarCrush) June 13, 2023