Early retirement guide: A few real-life scenarios to consider for Bitcoin HODLers

As we move through life, the importance of insurance as part of one’s long-term plan increases. That’s because insurance is all about providing a financial safety net that helps a person take care of themselves, as well as their loved ones when they need it the most.

That said, a retirement investment portfolio should include a diverse mix of assets.

Should cryptocurrency be one of them?

Diversification traditionally has two benefits. It provides one’s portfolio with ‘non-correlated’ assets so that if some investments tank, others hold steady or even rise in value. It protects one from catastrophic loss if one of the investments implodes.

The real benefit of diversification with cryptocurrencies is to limit extreme outcomes. If one cryptocurrency fails and investment goes all the way to zero, other crypto-investments may still do well.

Consider this – According to a Bloomberg report, cryptocurrency insurance is poised to become a “big opportunity.” A spokesperson from Allianz, one of the world’s biggest insurers, told the news publication that the company is exploring product and coverage options in the space because cryptocurrencies are “becoming more relevant, important, and prevalent in the real economy.”

Anjali Jariwala, a certified financial planner, CPA told CNBC,

“In order to determine how much one can place into a riskier asset class, it is important to first assess your own financial health and make sure you are funding your required buckets first.”

She further added.

“You should only consider investing in a riskier asset class, like cryptocurrency, once there are no other buckets to fund and you still have excess cash flow.”

But, there is something that one should know about before jumping into the pool.

Any ‘crypto-friendly’ retirement accounts?

Adding cryptocurrency directly to a retirement investment portfolio could be tricky.

While you are paying off your high-interest debt, consider contributing to your 401(k) up to any employer match, Jariwala said. “The employer match is ‘free’ money, so it is important to take advantage of this,” she explained.

But, that’s not it. She even recommended diversifying investments for retirement by putting pre-tax money into a 401(k) and post-tax money into a Roth IRA. In a traditional 401(k), contributions are made with pre-tax dollars. Ergo, whatever money one puts in comes straight from the paychecks, thereby reducing the taxable income for the year.

With a Roth IRA, one invests money that’s already been taxed. When he/she withdraws it in retirement, the said person gets the gains tax-free, assuming one follows the withdrawal requirements.

However, neither Roth nor traditional IRAs provide an employer match, as most 401(k)s do. And, there are income limits for those who can take advantage of these accounts that don’t apply to 401(k)s. Although all 401(k) plans that have non-owner employees are subject to very strict and far-reaching rules of the Employee Retirement Income Security Act of 1974 (ERISA).

One of the main purposes behind ERISA was to protect rank-and-file employees participating in employer-sponsored pension plans. Now, be it any kind of investment, risks are bound to be there. One needs to do some due diligence before getting knee-deep into the crypto/Bitcoin pond.

Although it has seen a historic rise over the past year, it is still a relatively new asset and can be quite volatile. At the time of writing, for instance, the crypto was trading above $50k following a 5% surge in 24 hours.

Despite BTC trading in the green zone, volatility has been the top concern.

Source: CoinMarketCap

It’s important to consult with a financial adviser to ensure you know the risks of any investment you make, especially when it comes to cryptocurrencies.

Real-life calculations

One can attain retirement, even early retirement, with Bitcoin, despite the holding value. Be it 0.01 or 0.001 of a Bitcoin.

Here are a few real-life practical situations with conservative and liberal retirement scenarios. Dollar-cost-averaging (DCA) is one of the key aspects for improving the net value of a portfolio. Lark Davis, a renowned investor and analyst, shed light on the importance of it in a series of tweets.

(Here, calculations do not account for inflation, cost of living adjustments, and other variables that traditional financial planners integrate into retirement planning calculations. The beauty of Bitcoin is that its huge rate of return negates having to really consider these variables. The tool used – http://www.moneychimp.com/calculator/compound_interest_calculator.htm)

The next question for retirement planning with Bitcoin is determining the compound interest rate. (The interest earned each year is added to principal. So that the balance doesn’t merely grow, it grows at an increasing rate. It is one of the most useful concepts in finance.)

Assumption: Bitcoin’s compound interest rate will probably be much higher or rather between 25% to 37.5% over a 15-30 year timeframe.

In 2021 alone, estimates show that there are 106 million people who own Bitcoin. So, under 10% of the world’s population HODLs BTC.

Now, let’s imagine that in the coming years, another 10% acquire BTC. Let’s go even further – What about when 50% of the world adopts Bitcoin?

Source: buybitcoinworldwide.com

Now, comes the retirement planning part.

Let’s start off with planning for retirement for a person who has 0.01 bitcoin. He/she wants to retire in 15 or 30 years.

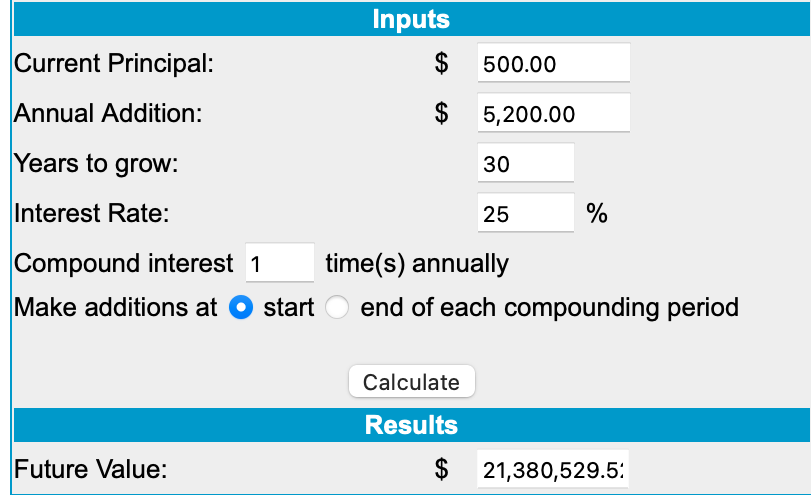

Scenario #1 (CONSERVATIVE)

Current value of 1 bitcoin = $50,000 (approx)

Person has 0.01 bitcoin

Person saves $100/week ($5200/year) for 30 years

Estimated compound interest rate of Bitcoin in 30 years = 25%

The table looks like this –

Source: Moneychimp

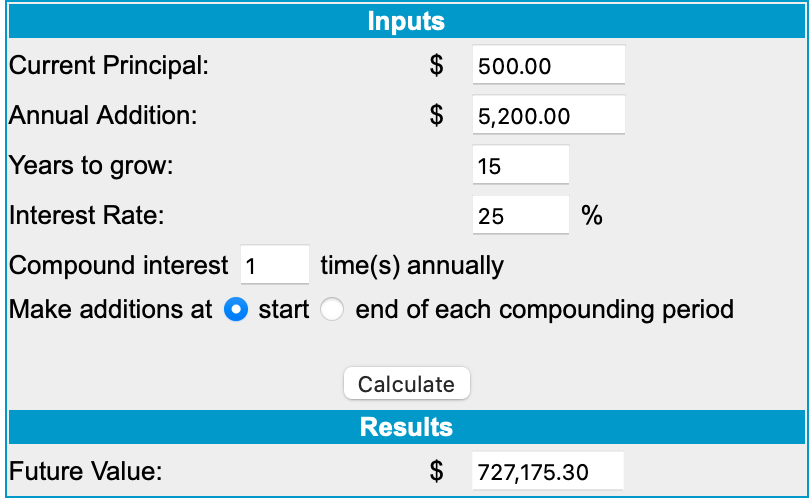

Scenario #2 (CONSERVATIVE): Let’s redo scenario #1 except over a 15-year time frame –

Source:Moneychimp

Observation: The sheer power of compounding is at display here. That is, Compound Interest is magnified in a 30-year period versus a 15-year period. What does this signify?

Well, to quote something Warren Buffett said a while back,

“Someone is sitting in the shade today because someone planted a tree a long time ago.”

This is why people need to start retirement planning as early as possible.

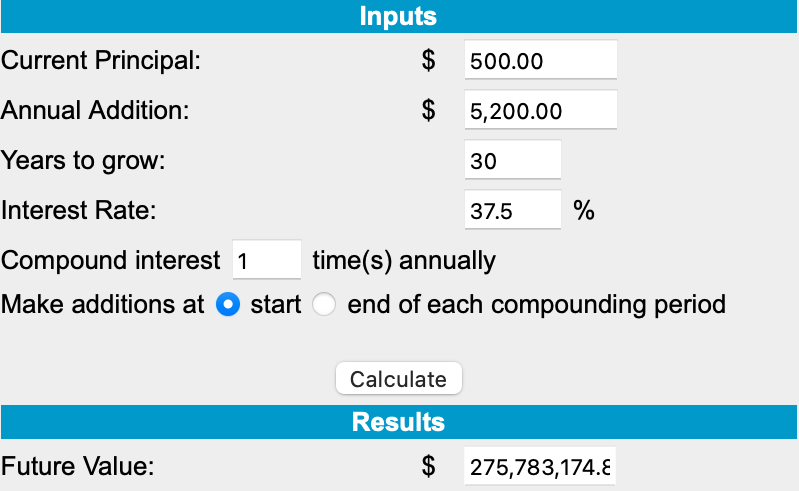

Scenario #3 (SEMI-CONSERVATIVE):

Current value of 1 bitcoin = $50,000

Person has 0.01 bitcoin

Person saves $100/week ($5200/year) for 30 years

Estimated compound interest rate of bitcoin in 30 years = 37.5%

Source:Moneychimp

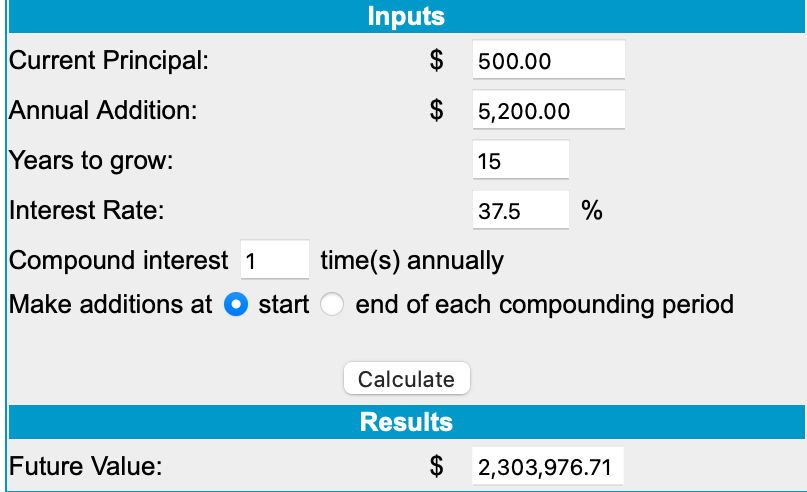

Scenario #4 (SEMI-CONSERVATIVE): Let’s do scenario #3 except over a 15-year period –

Source:Moneychimp

The aforementioned 4 real-life plans could lead the way for anyone to actually consider going down this route. But consider this, be it 0.001 BTC 0r 0.1 BTC or even >1 BTC, holdings will surge in value down the line.

Conclusion

Ultimately, Bitcoin is a volatile asset with more inherent risks than the assets one would typically invest in for retirement. But, investing in it for the long term is a great way to diversify your portfolio, and with more upside than other alternative assets.

Happy retirement, fellow HODLers!