ECB survey: Crypto’s futures contracts and options trading is bound to be…

The European Central Bank (ECB) recently published a report titled ‘Decrypting financial stability risks in crypto-asset markets.’ The report comes at a time when crypto-assets are at the center of intense policy debates.

The demand for these crypto-assets has radically increased in recent years despite the underlying volatility. The latest issue was at hand during the recent TerraUSD crash which sent shockwaves across the crypto market.

According to the report, there has been a dramatic increase in retail interest in digital assets. A recent survey was conducted as part of the report by ECB’s Consumer Expectation Survey (CES) in the following countries: Belgium, Germany, Spain, France, Italy, and the Netherlands.

The survey showed that around 10% of households may own crypto assets. Interestingly, most crypto-asset owners reported holdings below €5,000 with only 6% claiming to hold crypto assets above €30,000.

Young adult males and educated respondents were deemed more likely to invest in cryptocurrencies. With regard to financial literacy, respondents who scored either at the top level or the bottom level in terms of financial literacy scores were highly likely to hold crypto-assets.

EU deems crypto “risky”

EU financial regulators recently called out crypto assets for posing risks from ‘investor protection’ and ‘market integrity’ perspectives. Despite ascertaining these risks, EU regulation proposals are yet to be agreed into implementation.

One of the proposals included the Markets in Crypto-Assets Regulation (MiCA) to improve market connectivity and check into regulatory uncertainties. The MiCA proposal was published in September 2020 and is yet to be agreed upon. This means it will not be applied before 2024, as it is not expected to be applied until 18 months after it enters into force.

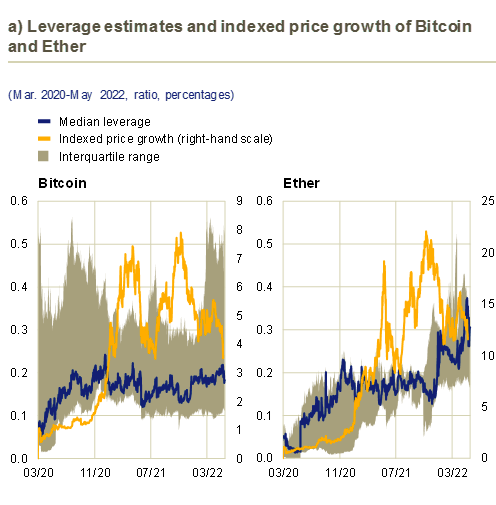

The risk of crypto assets is also apparent in futures contracts and options trading. There has been a significant increase in leverage tokens being used to allow investors exposure to higher crypto yields.

This also increases the risks associated with the leverage tokens. Some exchanges offer ways to increase exposures by as much as 125 times the initial investment. A greater dispersion on individual exchanges for Bitcoin is observed rather than for Ethereum.

Despite no formal regulations being put in motion in the EU, crypto-based companies continue to suffer globally. crypto lending has recently come under intense regulatory scrutiny.

In the United States, the Securities and Exchange Commission (SEC) fined the centralized BlockFi service $100 million for failing to register the offers and sales of its retail crypto lending product as required under U.S. securities law.