EOS aborts liftoff a week after rebranding- what’s next

The EOS cryptocurrency has been one of the more interesting performers in August. It enjoyed a strong rally ahead of its rebranding but has since then let go of most of the gains in the last 10 days.

Understanding its latest price action may help formulate a decent short-term outlook. At the time of writing, EOS was down by roughly 5.2% in the last 24 hours and 23.5% in the last seven days. It had previously rallied by about 130% from its current 2022 bottom to the recent top.

The latest retracement thus reflects the selling pressure from those cashing out after the rally.

EOS’s strong upside was backed by excitement about the rebranding to Antelope. A strong uptick occurred prior to the rebrand date, thus forming a “buy the rumor, sell the news” type of price characteristic.

Furthermore, the price as of 31 August, was moving within Fibonacci zones, and this provides an advantage as far as predicting the next outcome is concerned. EOS’ downward trajectory was facing friction at the 0.236 Fibonacci level.

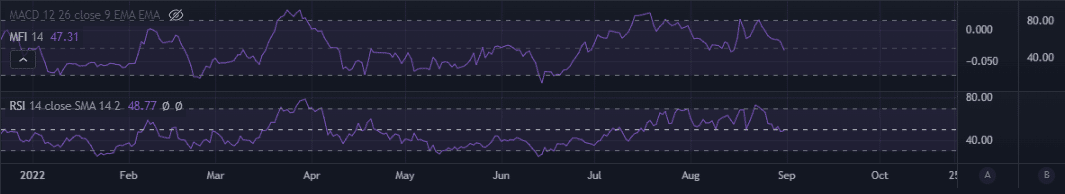

Both the Relative Strength Index (RSI) and the Money Flow Index (MFI) stood around the 50% level, hence an increased probability of a bullish pivot.

Ripe for the upside?

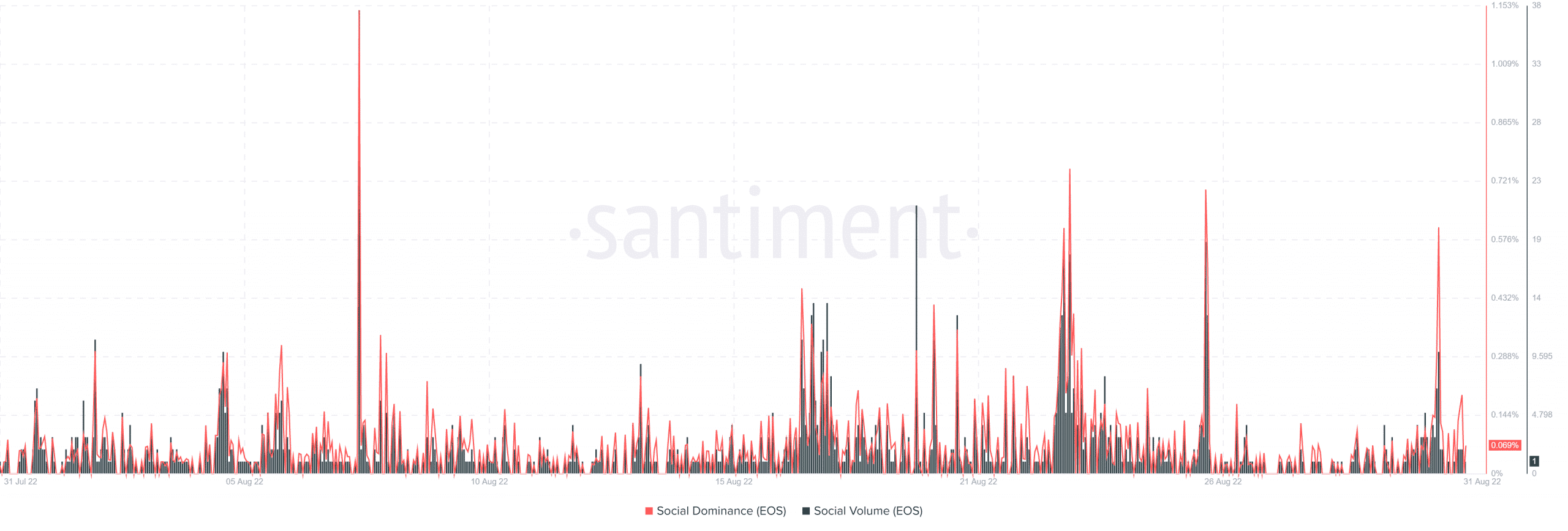

The alignment of multiple indicators may suggest that EOS might be ready to regain its bullish trajectory. It will have to secure a lot of buying pressure but its social metrics suggest, that should not be much of a problem.

In fact, EOS’ social dominance and social volume metrics registered a notable spike in activity between 30 and 31 August. This outcome further strengthens the case for a potential pivot.

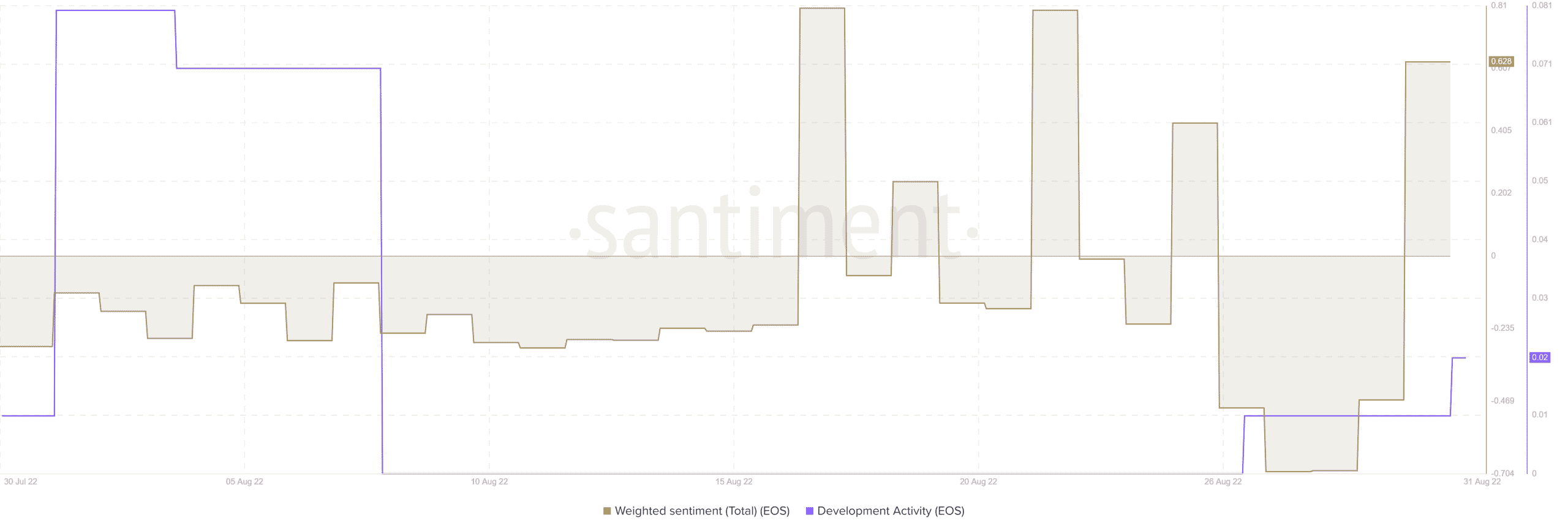

EOS’ weighted sentiment also highlighted a strong shift in the market sentiment since 29 August.

Meanwhile, its developer activity metric demonstrated an increase in activity in the last five days. A positive development considering its trajectory before mid-August.

Investors watch-out

The increased development activity may further cement the current short-term outlook. However, investors should also consider the overall market scenario.

Notably, some liquidity returned to the market between 30 and 31 August but the global crypto market still lingers somewhere below $1 trillion.

This means most investors are still on the fence about buying back in. On the flip side, the improving sentiment after the latest downside might be a sign of what to expect in the first week of September.