ETC hashrate hits a new ATH- Decoding what it could mean for investors

Ethereum Classic has witnessed immense traction ahead of Ethereum’s upcoming Merge. ETC registered over 150% in the past month and its holders have been enjoying the uphill ride.

But unfortunately, the bears have taken over the ETC market of late. And, the short goers are rejoicing in this opportunity. But investors with high hopes shouldn’t let the celebration end yet as ETC’s hashrate has hit a new all-time high.

Let the party begin

In just over a month’s time, Merge on the Ethereum blockchain would potentially come alive. Ethereum network’s proof-of-work (PoW) miners were forced to find an alternative option to mine.

Ethereum co-founder Vitalik Buterin confirmed that the Merge would likely happen on 15 September. The terminal total difficulty is set to ‘58750000000000000000000’. The Ethereum PoW network had a fixed number of hashes left to mine.

But this didn’t seem to alter ETC’s enthusiasm whatsoever. At press time, Ethereum Classic’s hashrate reached an all-time high as seen in the graph below.

Source: Coinwarz

The current Ethereum Classic hashrate is 37.41 TH/s, representing the global Ethereum Classic network hashrate with a mining difficulty of 561.17 T at block height of 15,786,857.

This marked a 40% jump from 27.56 TH/s to the all-time high at press time. A logical conclusion could be that several Ethereum miners explored Ethereum Classic to see how their earnings would stack up.

Ethermine’s (ETC’s largest mining pool) and Poolin’s (second largest mining pool) combined hashrate of around 16 TH/s is more than 40% of ETC’s global hashrate.

Journey to remember

Now, the hashrate hitting an all-time high (ATH) for Ethereum Classic at this stage is an interesting scenario.

The network went on a steady mining power decline since late April 2022. Even the network hashrate bottomed at just over 1.6 terahash/second in September 2020.

However, at present, the said hike showcased that existing ETH miners jumped ship to Ethereum Classic to reap benefits.

Meanwhile, the network also witnessed or rather garnered some support from renowned institutions.

For instance, JP Morgan market strategists predicted that ETC would likely be one of the main beneficiaries of the Merge. Well, this certainly looks like the case.

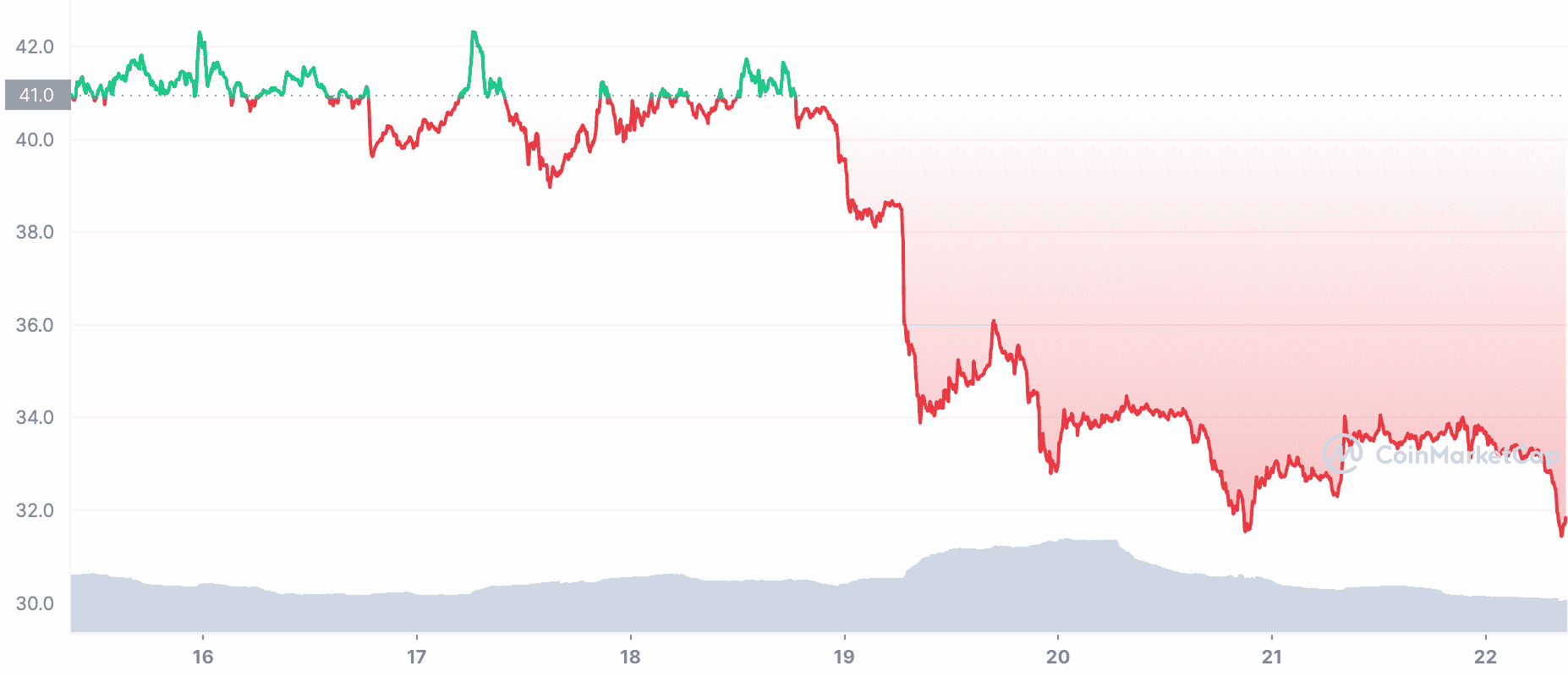

On the price front, unfortunately, the token couldn’t really reiterate the same enthusiasm. At the time of writing, ETC saw a fresh 5% correction as it slid to the $31 mark.