ETH and SOL NFTs in trouble after market shutdown? Analyzing…

- Both NFTZ and the Rally sidechain announced plans to close the projects.

- Ethereum and Solana NFTs increased sales in the last 30 days.

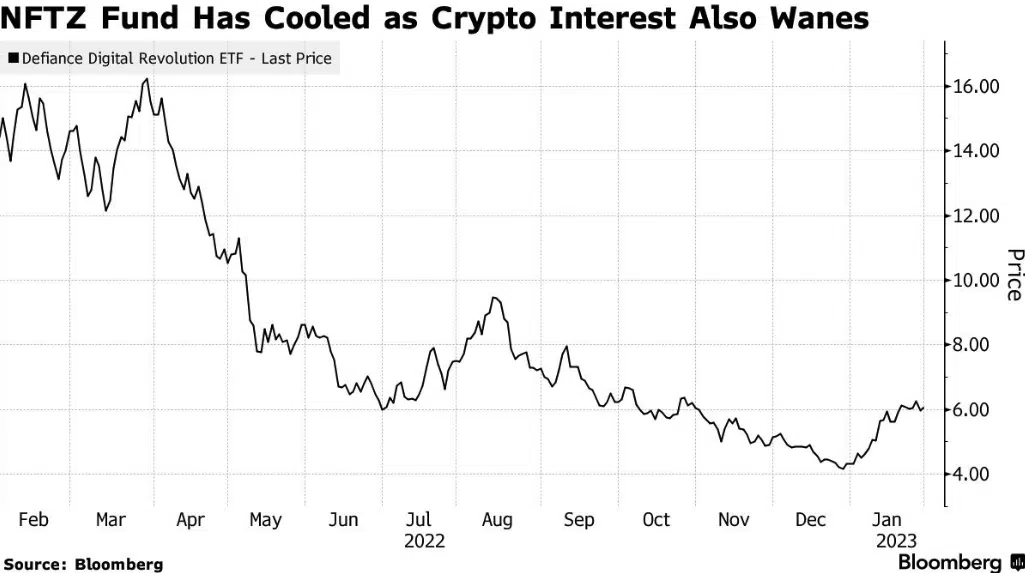

Despite some resurgence in NFT prices and transactions, the ecosystem might still be plagued with some downsides. Bloomberg, in its 31 January update, reported that the DeFiance Digital Revolution EFT, also known as ticketNFTZ, was shutting down.

Realistic or not, here’s SOL’s market cap in ETH’s terms

The fund, which focused on NFT Exchange Traded Funds (ETFs), announced that it would close business on 28 February. According to the press release, the firm would begin official liquidation of all its portfolio assets by 16 February. The company’s CEO, Slyvia Jablonski, responding to reasons for the decision, said that the fund failed to attract assets like it projected.

Partners in exit

Details from the information provided revealed that NFTZ closed January with $5.3 million in assets. This was a significant decline from its worth as of March 2022, when interest in the NFT market was incredibly high. During this period, NFTZ assets were worth $14 million.

Recall that the NFT market raked in billions of dollars across several chains for the second half of 2021 and early 2022. However, the market turned hawkish in the last two quarters of 2022. But, in 2023, there has been some sort of revival in floor prices, interest, and volume.

Ethereum [ETH] blue-chip collections have been able to exit the lowest points of the previous years. Similarly, collections under the Solana [SOL] chain have mildly recovered, thanks to the cryptocurrency’s price jump and re-dedicated developmental strides.

In a related development, the Rally social platform also disclosed that it was closing down its NFT sidechain.

Rally just rugged all their creator's NFTs. Lol pic.twitter.com/t3ILwOOUo1

— kydo? (reposting vitalik arc) (@0xkydo) January 31, 2023

Like NFTZ, Rally pointed to the 2022 unfavorable market condition as its reason. Additionally, Rally’s CEO, Rob Collier, noted that the NFT side chain was expensive to maintain. In an email obtained from Reddit, the development team communicated,

“The team has worked relentlessly to try to find a path forward, however the challenges and macro headwinds are too overwhelming to overcome in the current environment.”

Up in thirty; down in seven

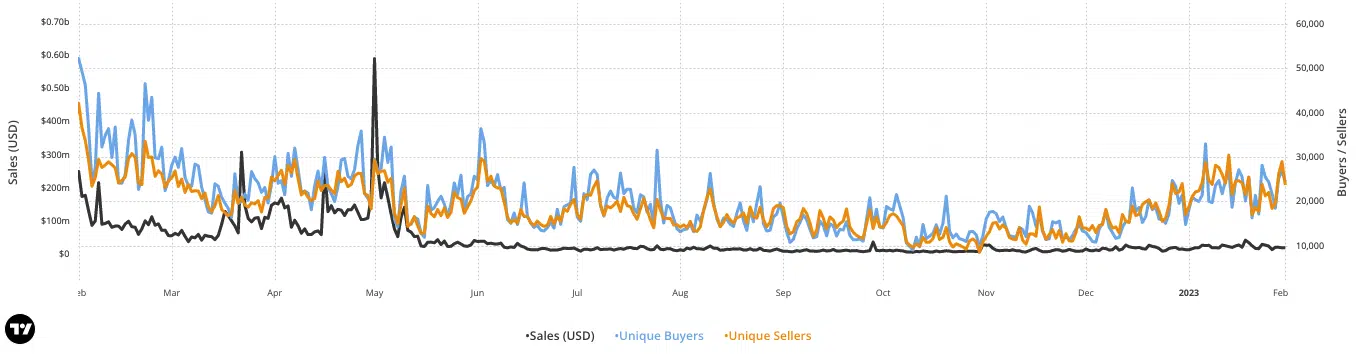

Meanwhile, data from CryptoSlam showed that both ETH and SOL NFTs recorded notable upticks in sales in January. The blockchain collectibles aggregator revealed that Ethereum NFTs sales spiked 42.49%. In the same time, Solana went up 70.92%.

Is your portfolio green? Check out the Ethereum Profit Calculator

Although collections like Bored Ape Yacht Club [BAYC] and DeGods maintained the greens in the last seven days, the wider Ethereum and Solana collectibles sales declined.

In the last 24 hours, transactions have been low as sellers’ and buyers’ involvement reduced. However, despite the shutdown, NFT traders remain optimistic about the future of the market.