ETH hits 100 million addresses with balance; can this event stop the bears?

- ETH retail demand soars to new historic level as addresses with non-zero balances soar.

- ETH whales were on-board with accumulation but demand remained weak.

The Ethereum network continues to grow especially with the help of layer 2 networks despite the lengthy crypto winter. So much so that it has now achieved a new milestone in address growth.

Is your portfolio green? Check out the Ethereum Profit Calculator

A recent IntoTheBlock analysis revealed that Ethereum, at press time, had over 100 million addresses with balance. This means Ethereum had more addresses than it did at the peak of the last bull run.

This underscores the fact that more people have been embracing ETH. But does this mean that ETH can secure enough demand to raise its floor price?

Ethereum crosses 100M addresses with balance! A milestone moment in crypto adoption. #ETH100M

?https://t.co/kfjHd1gZAJ pic.twitter.com/qDJzOO1vy7— IntoTheBlock (@intotheblock) October 18, 2023

The growing number of addresses could indicate more demand for ETH on paper. However, reality is much more complicated. Let’s take a look at demand indicators that may help offer some insights into what is happening.

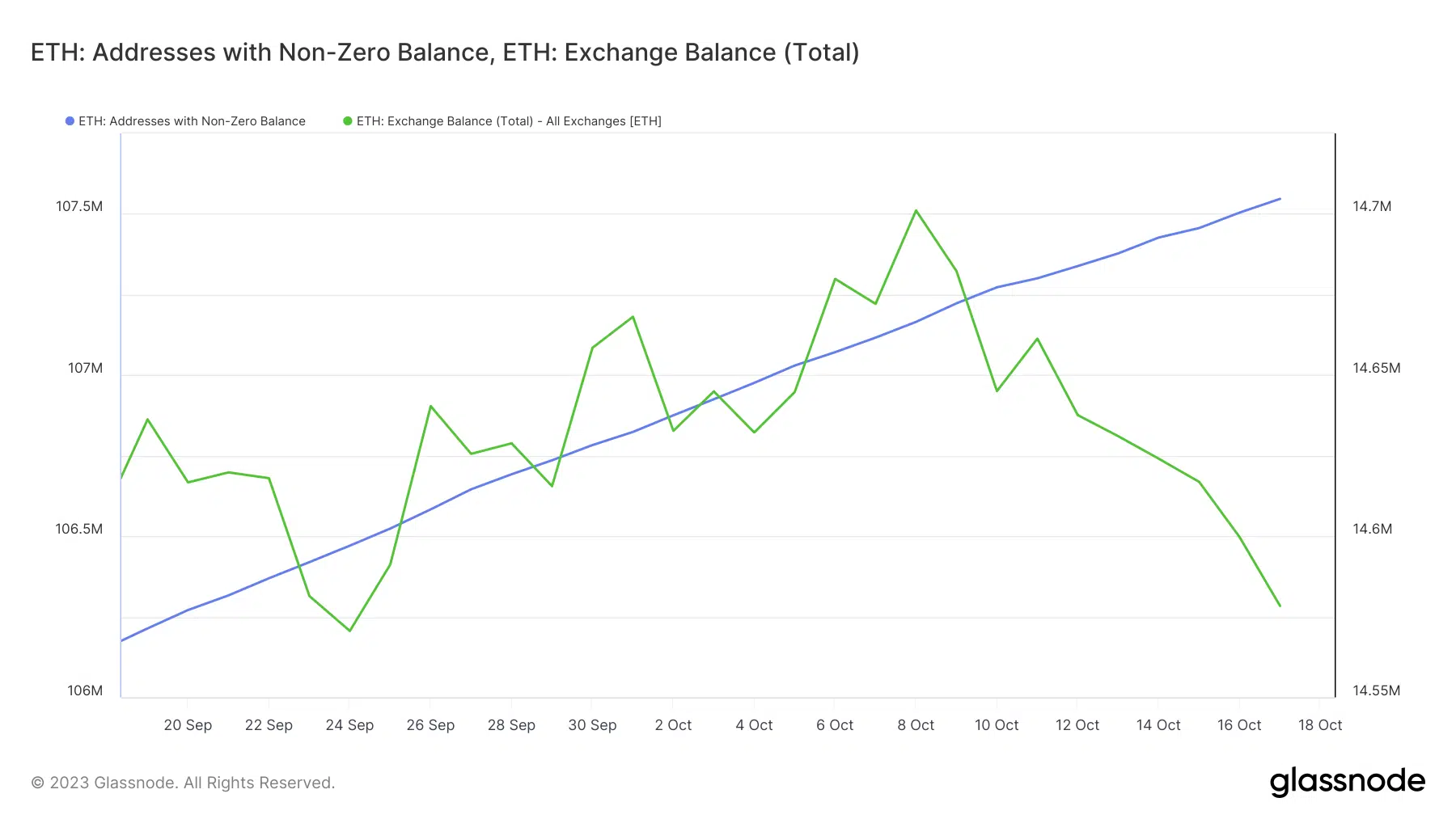

For context, IntoTheBlock highlighted the same thing observed with the addresses holding non-zero balances which, at press time, stood at over 107 million.

The growing number of addresses holding non-zero balances aligned with the latest dip in exchange balances. The amount of ETH on exchanges has been declining since the second week of October and was almost at its lowest level in the last four weeks. This was interesting because it initially surged between the last week of September and the end of the first week of October.

ETH short-term sell pressure is fading but can demand take over?

Declining ETH exchange balances confirmed that there was a healthy demand for ETH. However, whales have the biggest impact on the market and have the power to determine if the cryptocurrency will enjoy more upside or face more short-term sell pressure.

How many are 1,10,100 ETHs worth today

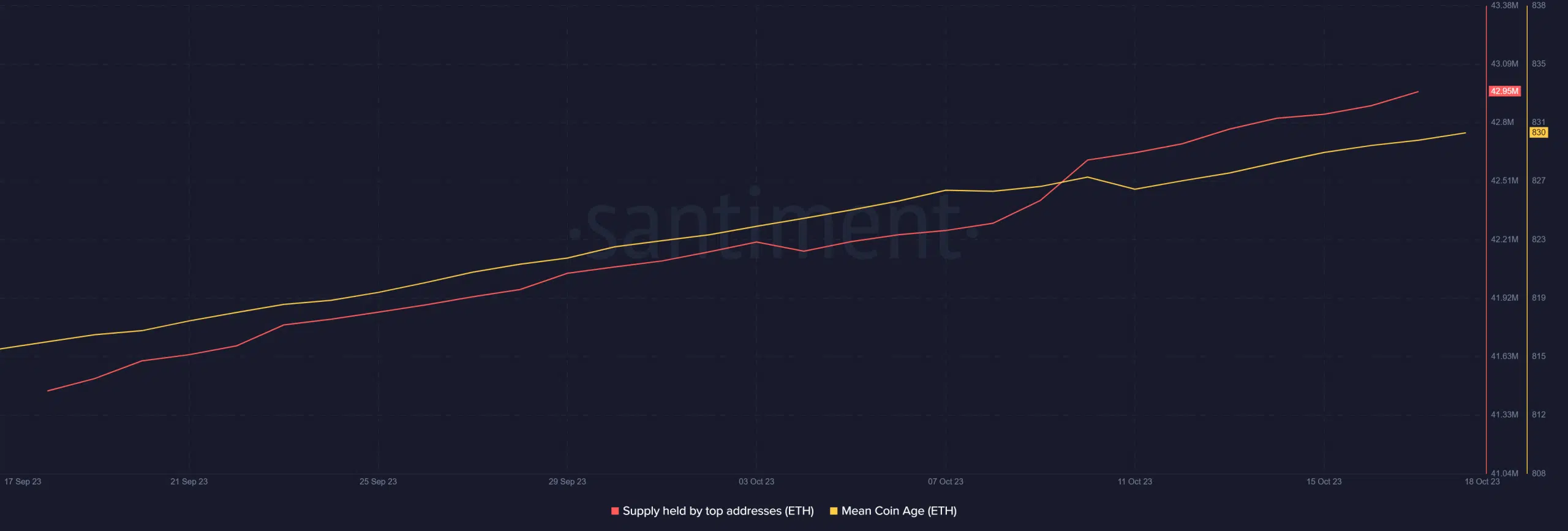

The supply of ETH held by top addresses has been rising in the last four weeks and was at a monthly high at the time of writing. A sign that whales have been accumulating at recent lows. Similarly, ETH’s Mean Coin Age was also at a monthly high, hence signaling that the current level of demand could have a longer-term focus.

Despite the above findings, ETH bulls were still struggling to secure dominance against the bears. Granted, there was an attempt to push higher after the support retest that we observed last week. ETH exchanged hands at $1563 at the time of writing, which was still close to its current short-term support level.

The above findings suggested that ETH was still at the mercy of short-term market conditions. However, those market conditions currently looked like they were— growing in favor of the bulls.