ETH liquidations in last 24 hours will make you rethink your trading decision

Holders of the leading altcoin Ethereum [ETH] were the most impressed as the price of the cryptocurrency asset surged by over 15% during the intraday session on 26 October.

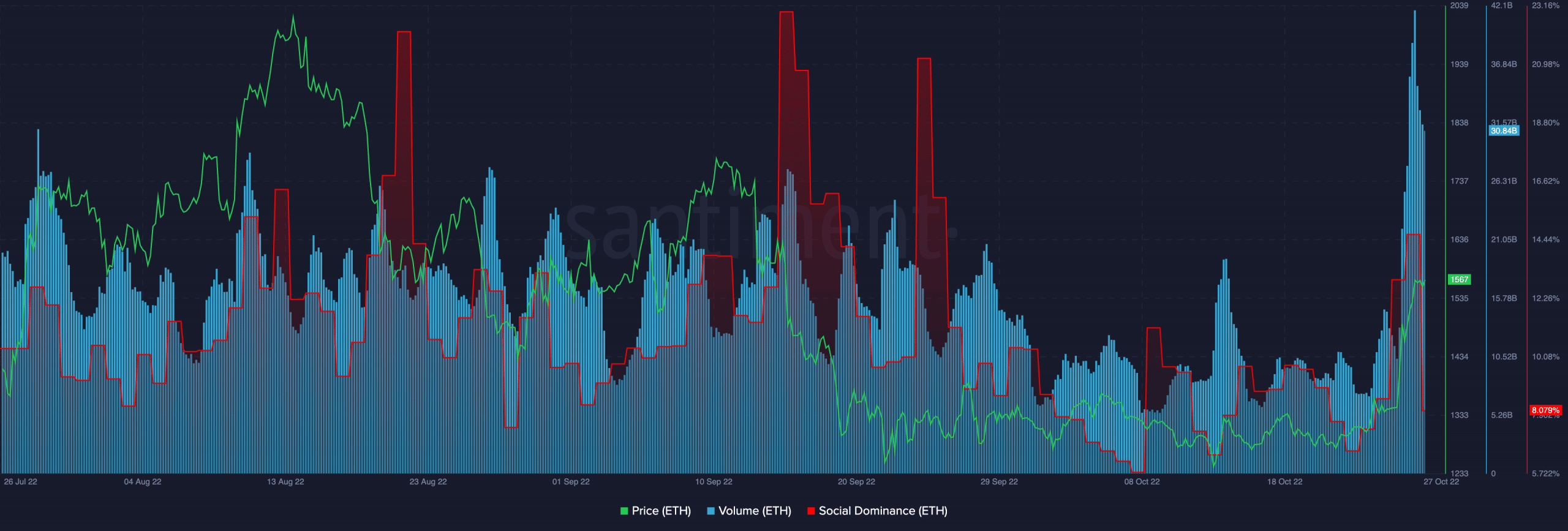

Data from Santiment revealed that ETH traded for as high as $1,589 per coin for the first time since 15 June.

In addition to a jump in its price, its trading volume also touched never-before-seen spots in the past three months. Per data from Santiment, the alt’s trading volume totaled $32.7 billion on 26 October.

With significant trading still ongoing at press time, ETH’s trading volume was $30.8 billion, having dropped by 6% in the last day.

Further, the price and trading activity rally led to increased discussions surrounding ETH on social platforms. This caused its social dominance to hit the highest level since the week after the Ethereum merge.

On 26 October, ETH’s social dominance sat at 14.64%. At 8.24% at press time, it declined by 43% in the last 24 hours.

Do what thou wilt with this

According to CoinMarketCap, the price per ETH was up by 5% in the last 24 hours. On the other hand, its trading volume dropped by 6% within the same period.

This indicates that while the ETH’s price might have rallied in the past 24 hours, investors harbored a low conviction in the continued upward movement of the alt. A price reversal or a consolidation typically follows this until conviction increases.

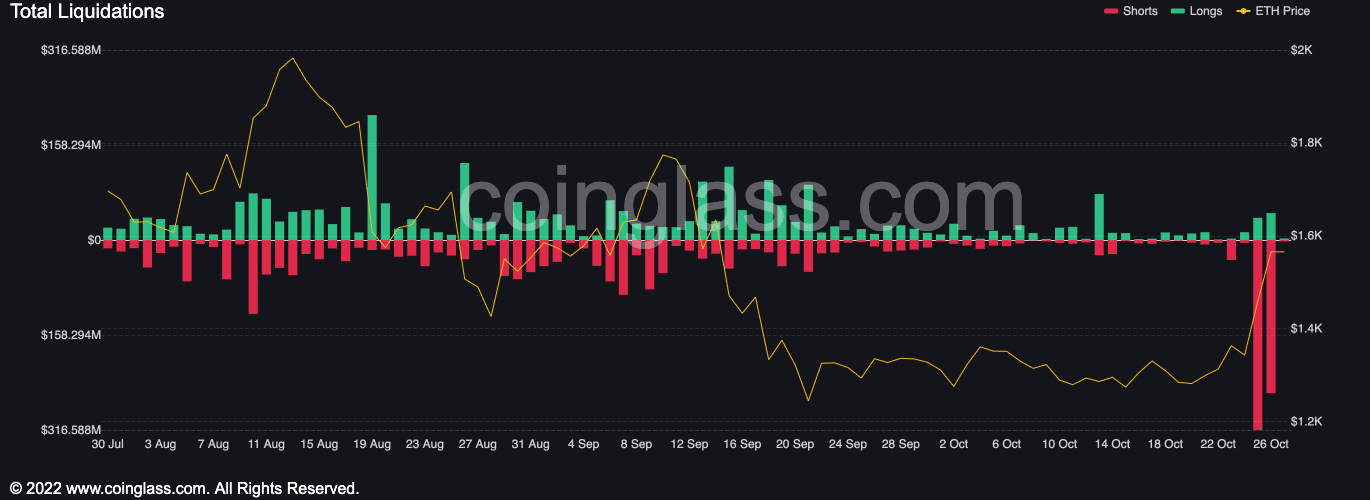

This low conviction led to significant ETH liquidations in the last 24 hours. According to data from Coinglass, 108,990 traders have been liquidated in the general cryptocurrency market, with $759.66 million removed in the last 24 hours.

The amount of ETH liquidations within the same period totaled $302.12 million. This represented 40% of the total liquidations in the market.

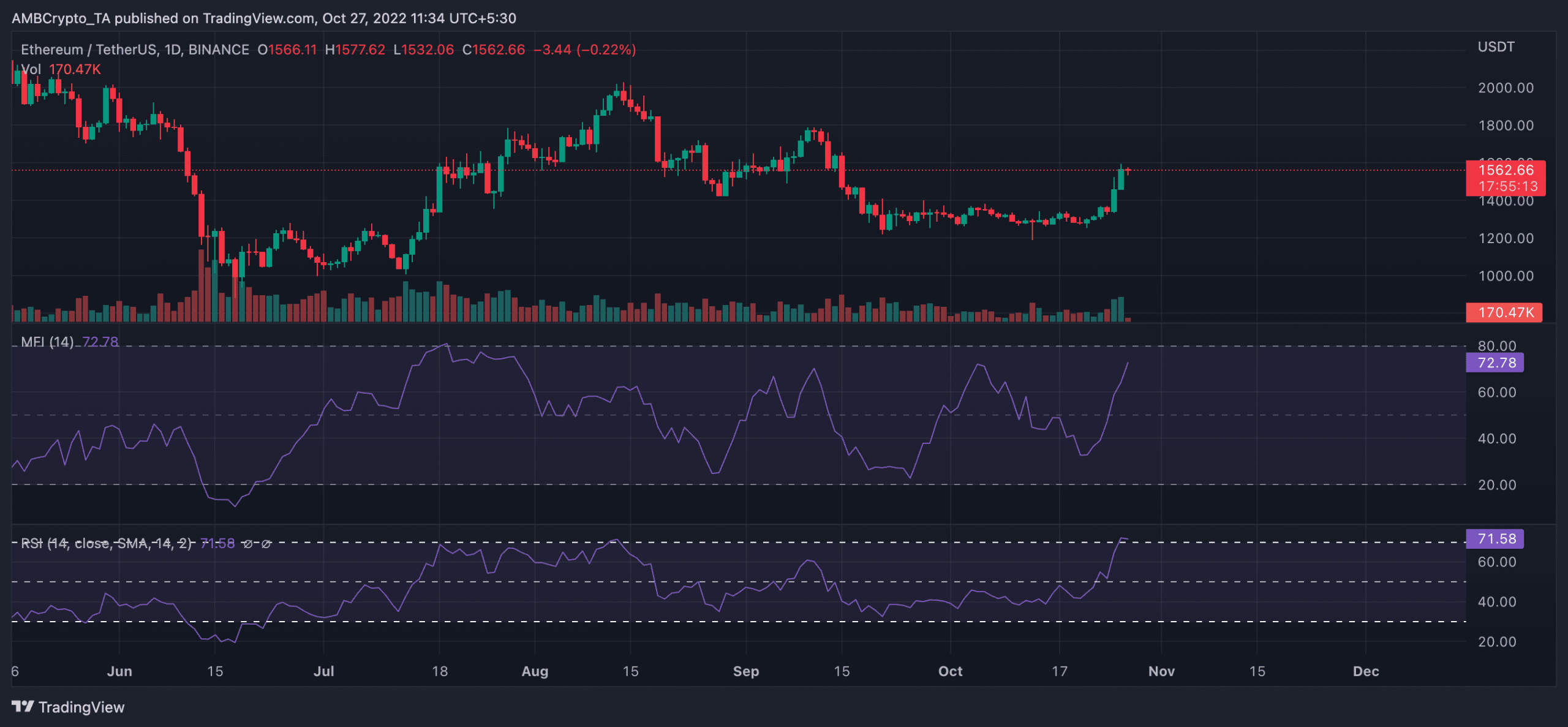

The asset’s movements on the daily chart also revealed that sellers might be gearing up to return to the market. At press time, ETH was overbought, and the highs touched by key indicators are usually followed by a reversal, meaning a price dump might be imminent.

At press time, the Relative Strength Index (RSI) lay in the overbought spot at 71. The Money Flow Index (MFI) was also spotted at 72. These are overbought positions that are usually followed by a reversal; hence caution is advised.