ETH whales decreased their holdings prior to Merge- Here’s why

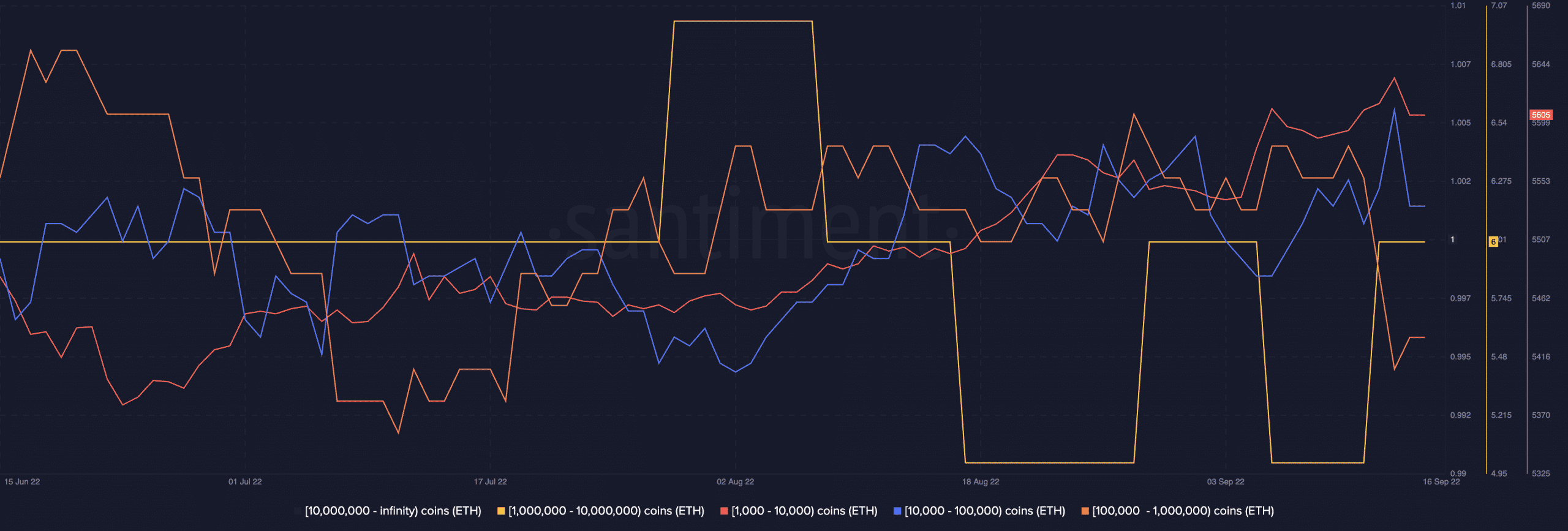

In the last three months leading up to the final transition of the Ethereum mainnet network into a proof-of-stake consensus mechanism, data from Santiment revealed a disparity in the ETH holding behavior of whales on the network.

According to the on-chain analytics platform, the count of ETH whales that hold between 1000 to 10,000 ETH coins increased by 2% in the last 90 days. For wallet addresses with 10,000 to 100,000 ETH coins, this category of whales rose by 1% within the same period.

Interestingly, the larger whales on the network gradually let go of their ETH holdings within the 90-day period under review.

According to Santiment, the index of ETH addresses holding between 100,000 to 1,000,000 fell by 4% in the last three months.

After rising to a high of seven wallet addresses in July, the count of addresses that hold between 1,000,000 to 10,000,000 ETH coins fell by 14% at press time.

Wait, there is more

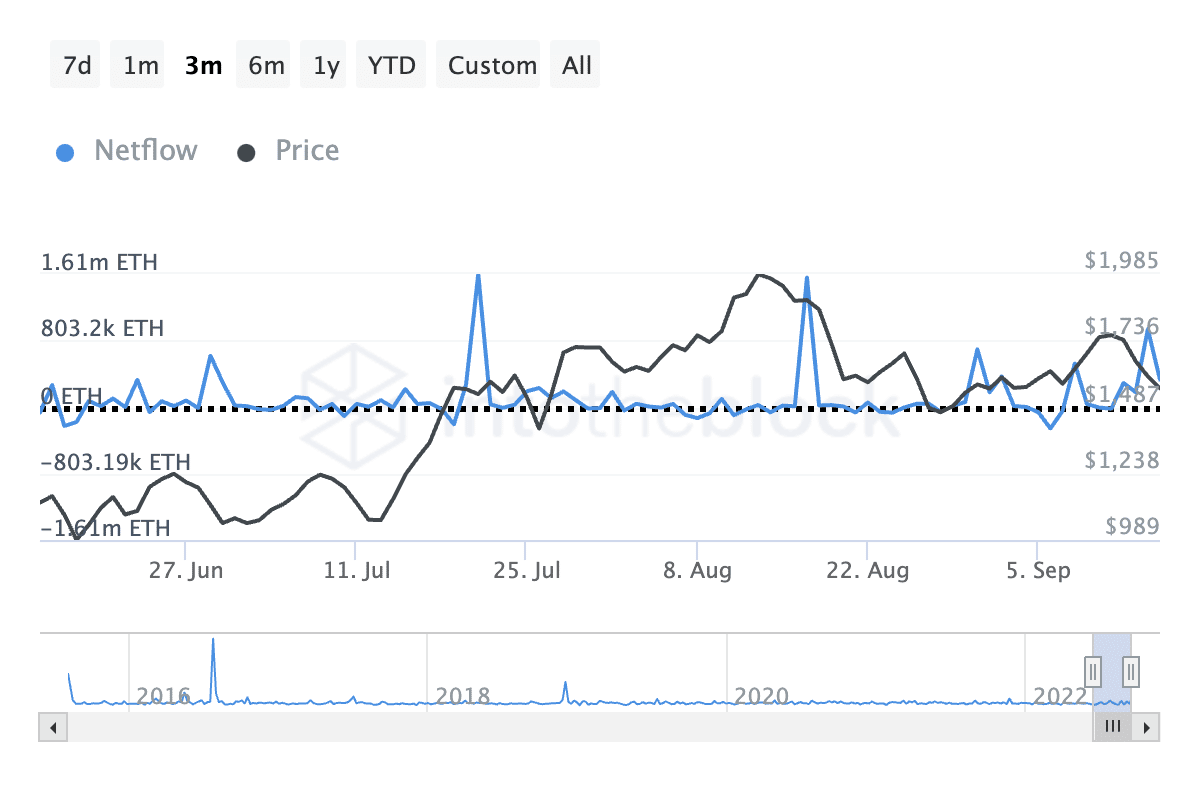

According to data from IntoTheBlock, ETH large holders slowed asset accumulation in the last three months. Large holders are holders of at least 0.1% of the circulating supply of a crypto asset.

Large holders netflow of a crypto asset is a metric that describes the change in the positions of whales and investors holding over 0.1% of the asset’s supply.

When this metric sees a spike, it means that this category of holders has taken to accumulation. Conversely, a decline is an indication of “reduced positions and selling.”

In the last 90 days, data from IntoTheBlock revealed a 281.60% decline in ETH large holders netflow. However, due to the Merge, this category of investors significantly accumulated ETH in the last seven days as this metric went by 819.58% within that period.

ETH looks the other way

While a few Ethereum-linked assets logged significant gains post-Merge, the price of the leading altcoin only rallied by 2% moments after the Merge.

Following the rally, the price of ETH plummeted by 10%, 24 hours later, data from CoinMarketCap revealed.

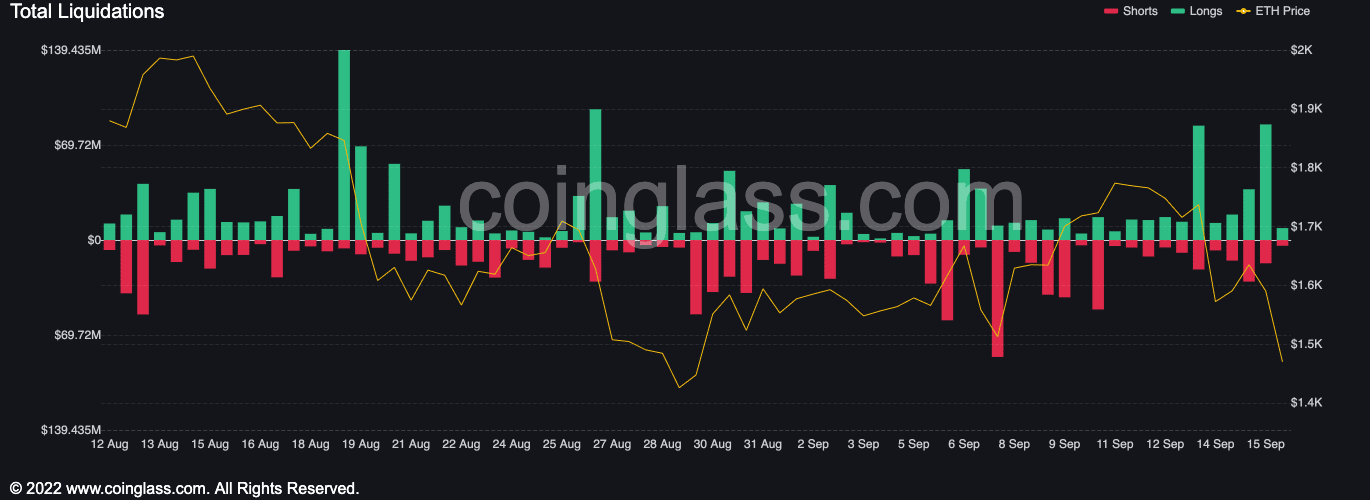

Moreover, in the last day, the total liquidations across the general cryptocurrency market were pegged at $215.22 million, according to data from Coinglass.

With $128.80 million taken out of the ETH market within the same period, ETH liquidations accounted for 67% of the total funds taken out of the entire market in the last 24 hours.