Ethereum actually can become a deflationary asset if it gets this right

Can Ethereum actually become a deflationary and potentially more valuable cryptocurrency than Bitcoin? This is one of the most trending questions today within the crypto space, especially because of the highly anticipated ETH upgrade. Many proponents have shared their opinions about this new transition in protocol: while some remain optimistic, others remain cautiously critical of the same.

It is fair to state that Ethereum went through a roller coaster ride over the months ahead of its tech updates, including delays, updated roadmaps, and various others.

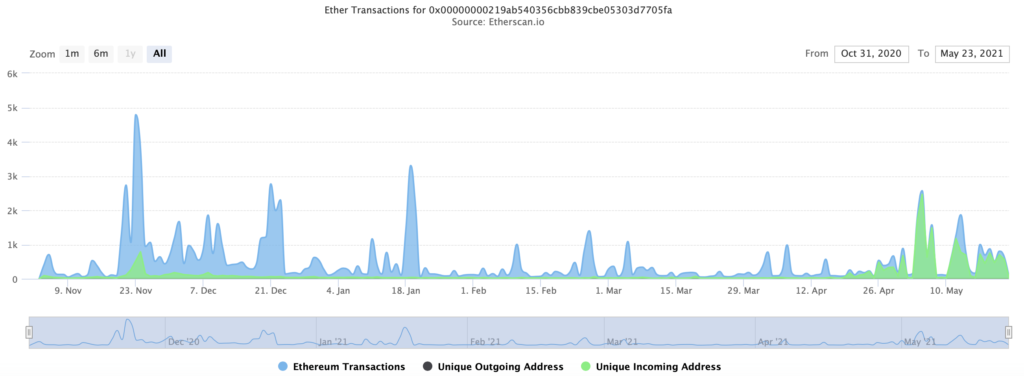

Source: Etherscan

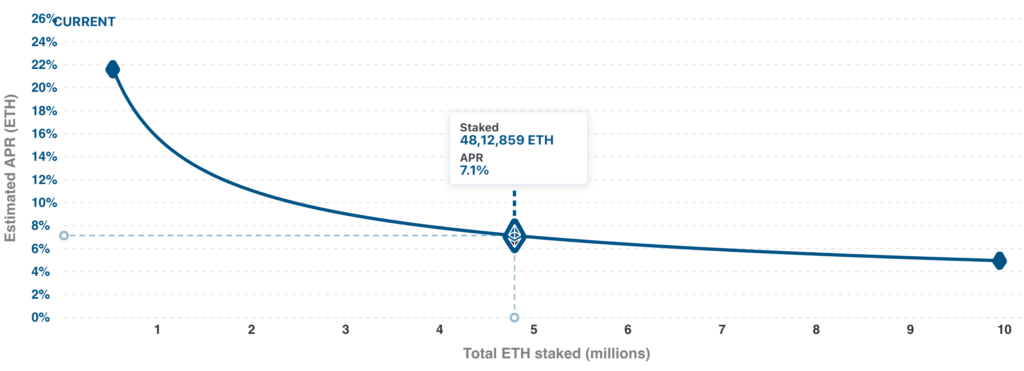

Well, the pessimism seems to have faded as various validators continue to stake ETH on the network. At the time of writing, 4,812,859 ETH were staked on the network.

Source: ETH2 launchpad

In a recent interview hosted by ‘Thinking Crypto’, the interviewee, Michael Arrington, the founder of TechCrunch, Arrington expressed his optimism towards Ether as compared to Bitcoin. He stated: “I really want to publish a lot about Ether thesis in my newsletter for my investors.”

Furthermore, he added:

” A lot of things are happening with ETH this year, way more deflationary of an asset than Bitcoin. So that’s why we’re really excited about ether.”

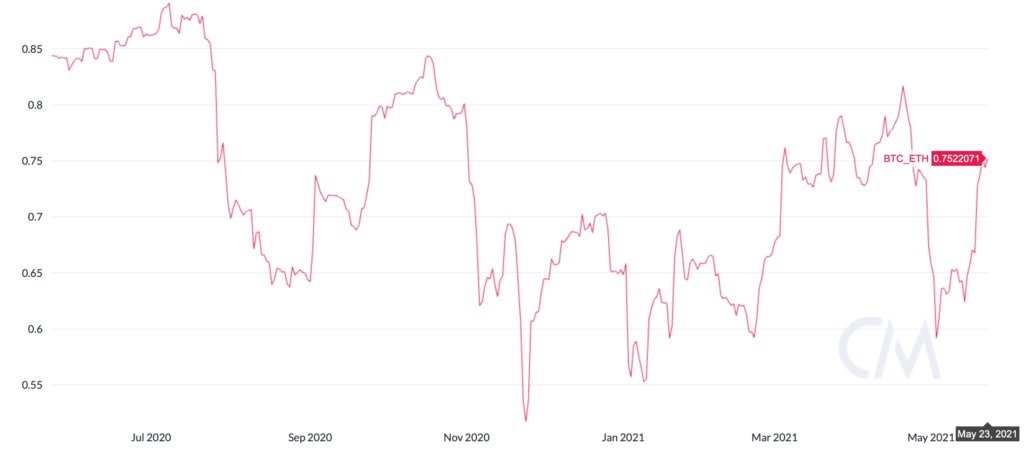

Source: Coinmetrics

Few other enthusiasts saw the same potential in this space.

Panthera’s CEO recently published a blog to highlight the same.

We think this is the beginning of the market re-rating Ethereum for EIP 1559 & Proof of Stake.

A deflationary asset – where each block, negative ethereum are issued.

This means ETH will be a more deflationary asset than bitcoin.

More in our May letter: https://t.co/8JxNsXS04S pic.twitter.com/7WGugxRvWq

— Dan Morehead (@dan_pantera) May 14, 2021

Having said that, the exec was quick to acknowledge another important aspect as well:

“No doubt I’ve been excited about ETH, but again it changes daily depending on the price. Only if Ether could get its monetary policy figured out, that would be a very exciting asset for the long term.”

The aforementioned remark about its monetary policy does however ring a familiar bell. With the new upgrade, EIP-1559 on the horizon, it could make Ethereum a scarcer commodity than Bitcoin.

At press time, Ethereum was trading at the $2,814 mark with an increase of about 8.50% in the past 24 hours.