Ethereum addresses hit ATH, upswing coming?

- Ethereum’s non-zero addresses hit an all-time high as it surpassed 100.2 million.

- Ethereum saw a positive funding rate as bullish sentiment dominated.

Ethereum’s [ETH] quest for the $2,000 price realm wound up after encountering numerous obstacles. Nevertheless, two crucial indicators consistently pointed towards a steady upward trajectory, signaling a growing fascination with accumulating and trading ETH.

Ethereum non-zero addresses hit ATH

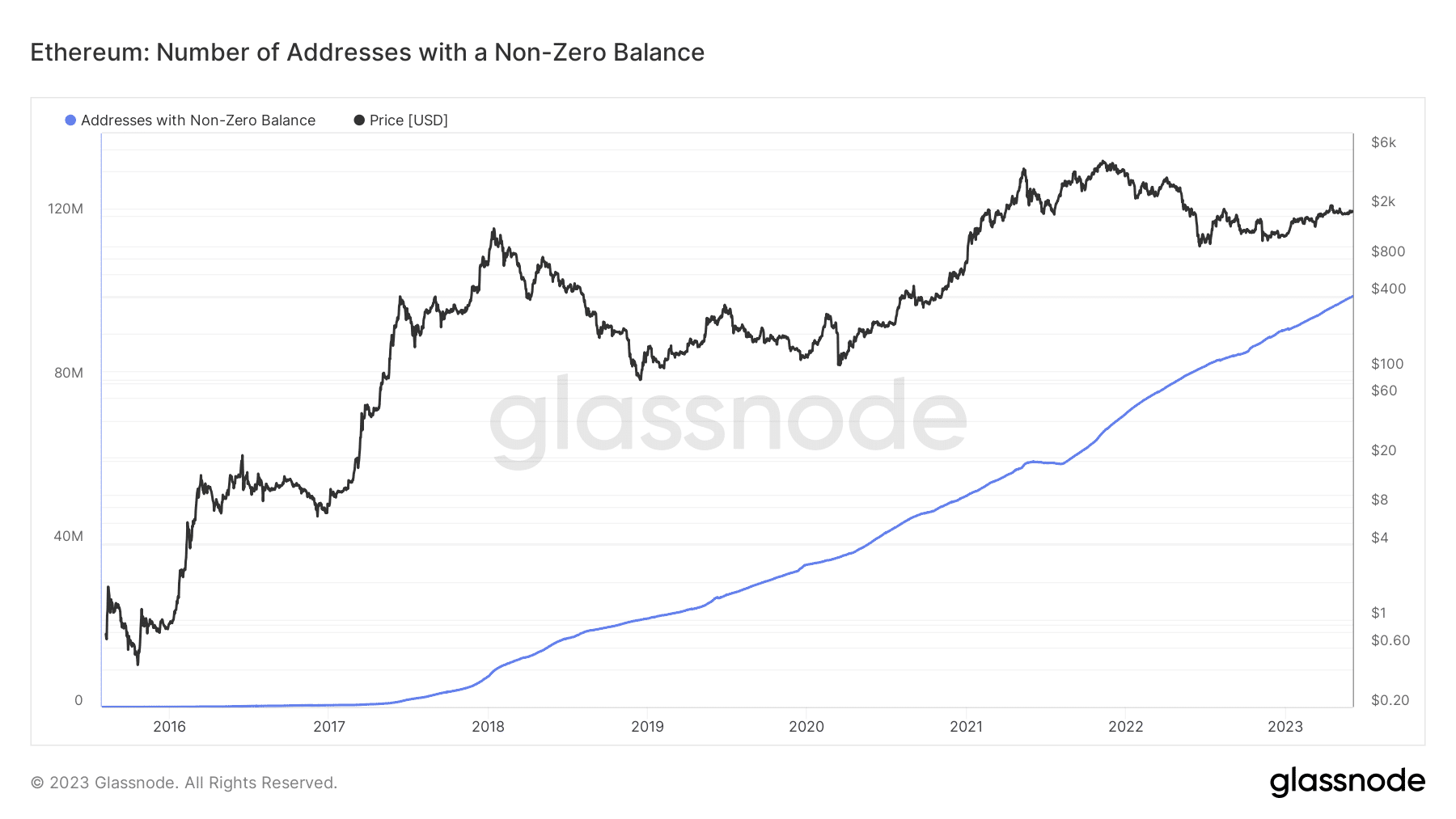

A recent post from Glassnode brought attention to the emergence of a greater number of Ethereum addresses on the network. A glance at the Glassnode chart revealed that these addresses were associated with ETH balances.

As of this writing, the count of non-zero addresses stood at a remarkable 100,242,187, representing an unprecedented peak in their existence.

The chart also revealed a consistent upward trend in the daily increase of these addresses, reflecting substantial growth. To put things into perspective, the number of addresses was 98.3 million at the beginning of May and 92.1 million in January.

Ethereum traders bulk up on the derivative side

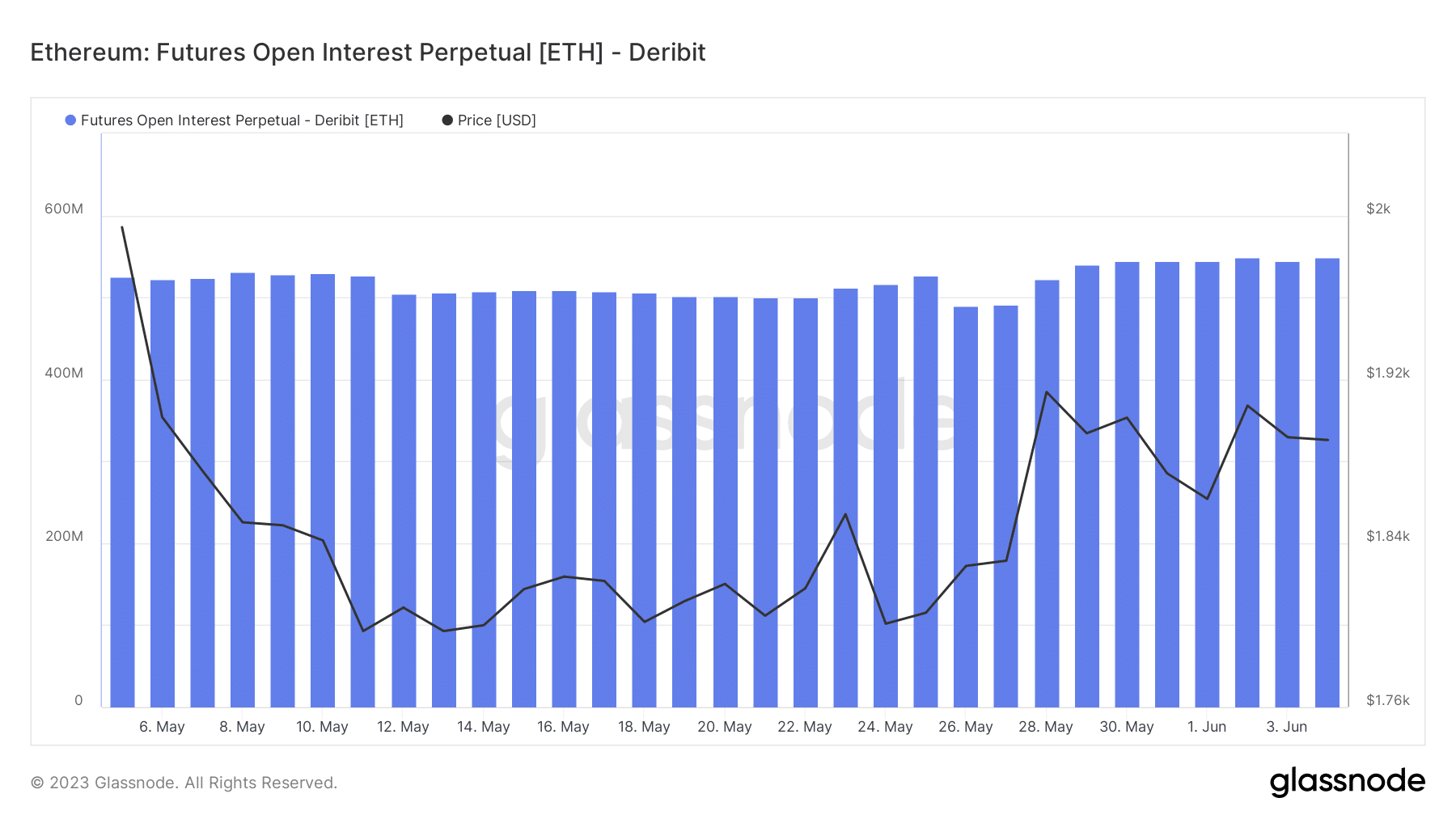

As the number of Ethereum addresses holding ETH balances continued to rise, the derivative aspect of Ethereum has also experienced notable expansion.

The Glassnode metric for Open Interest in Perpetual Futures Contracts reached an all-time high as well. According to the observed chart, the Open Interest in Perpetual Futures Contracts on Deribit stood at approximately 550 million ETH at press time.

This marked the highest level recorded in the past three years. Open interest is a significant indicator in the derivatives market, providing valuable insights into market participation and liquidity.

Increased open interest suggests heightened trading activity and market interest. It indicates that more traders are actively entering new positions or rolling over existing ones in perpetual futures contracts.

Traders remain bullish

Despite the less-than-ideal performance of Ethereum, traders were displaying a positive outlook regarding its future movement. The ETH funding rate metric on CoinGlass revealed a consistent positive funding rate for the asset over the past few weeks.

How much are 1,10,100 ETHs worth today?

ETH maintained a positive funding rate across multiple exchanges as of this writing. This showed a bullish sentiment surrounding its price trajectory.

As of this writing, ETH was trading at a slight loss. The spot price was approximately $1,870, reflecting a modest decline of almost 1% in value. Nevertheless, the Relative Strength Index (RSI) suggested that Ethereum was still within a bullish trend.