How Ethereum on exchanges dropped to a 5-year low

- Ethereum on exchanges hits a five-year low.

- The number of ETH holders grows steadily as the price hovers around $1,900.

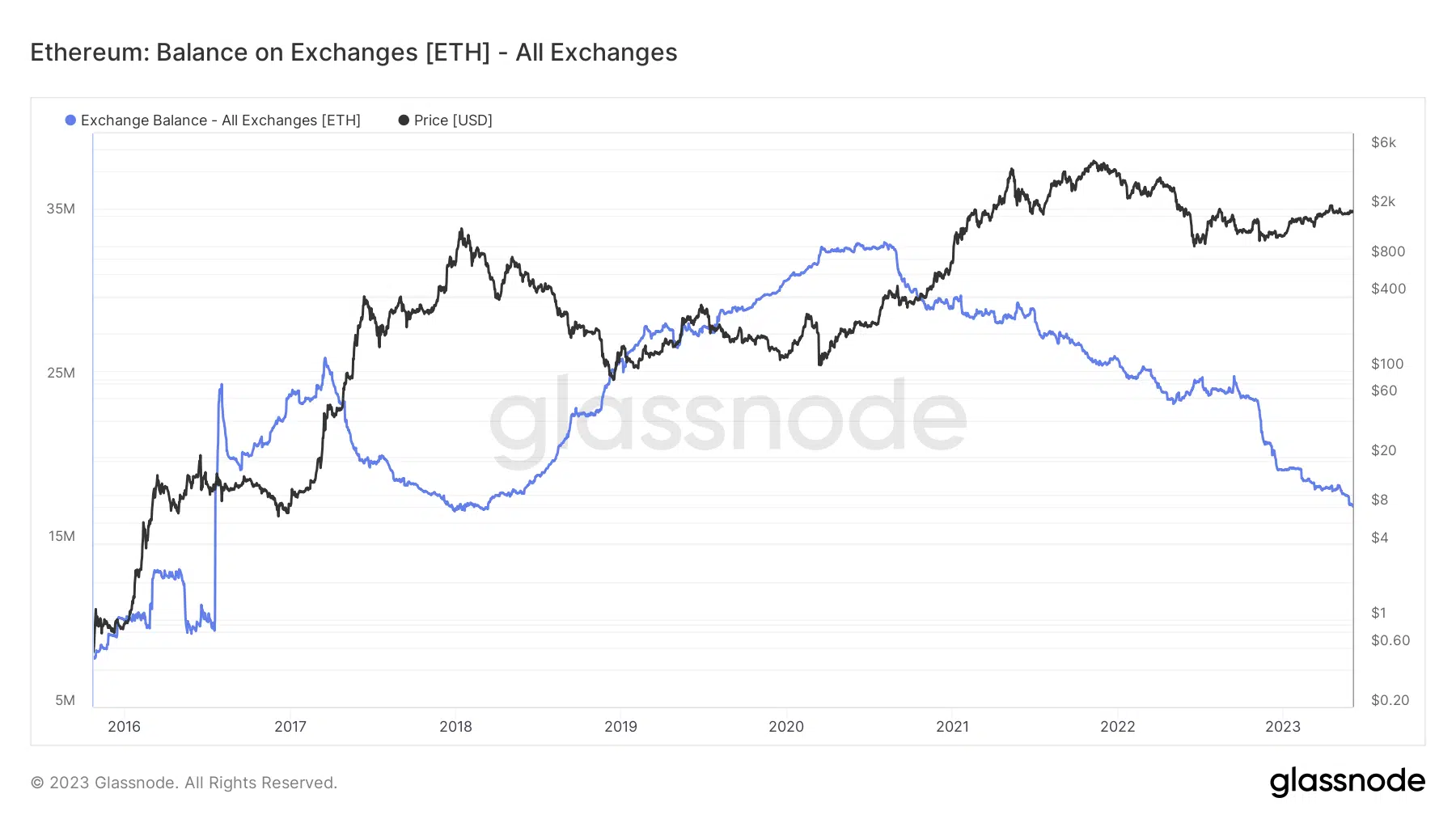

New data indicated a dwindling influx of Ethereum onto exchanges in the past few weeks. The most recent chart analysis revealed that the current balance of Ethereum on exchanges reached a new nadir, indicating a decline in overall liquidity on these platforms.

Ethereum on exchanges decline

Glassnode Alerts recently unveiled a chart showcasing the ongoing decline of Ethereum on exchanges. It also showed that each passing day marked a new record low.

The latest data from Glassnode indicated that the current balance of ETH on exchanges stood at approximately 17.2 million, marking the lowest point witnessed in the past five years.

Comparatively, back in January, the balance on exchanges exceeded 19 million; at the start of May, it surpassed 18 million.

This downward trend implied a reduction in available liquidity within exchanges. However, it is important to note that a decrease in ETH on exchanges does not necessarily indicate a decrease in ETH holders.

Ethereum holders remain steady

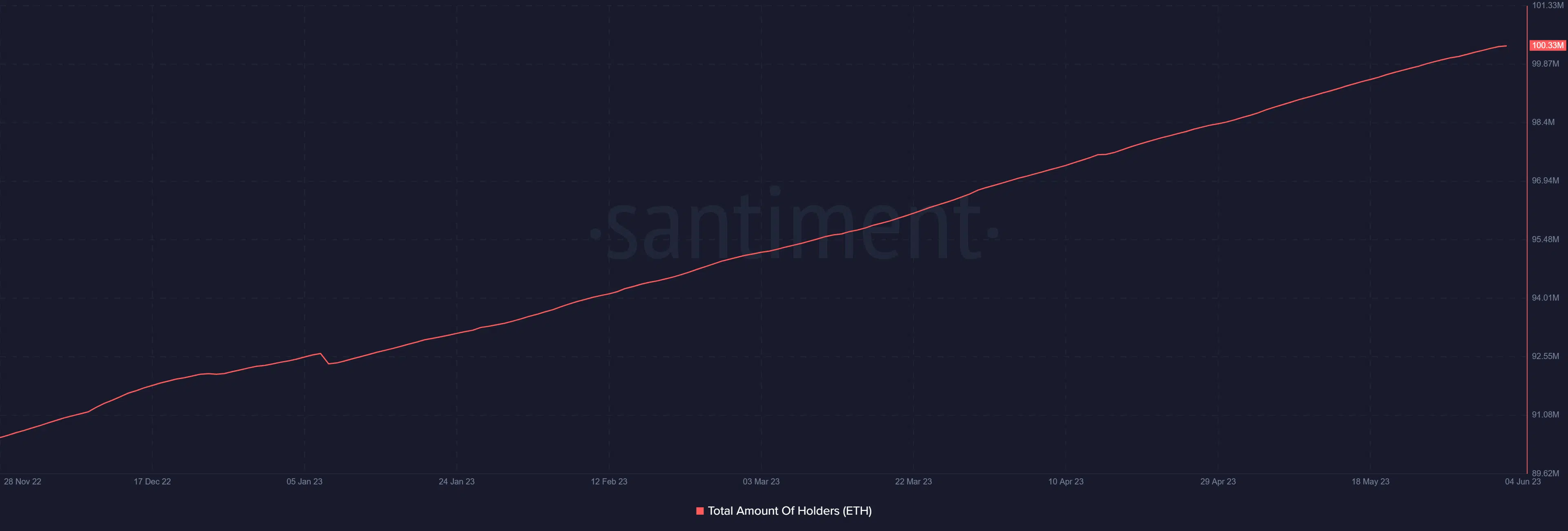

While it may seem that Ethereum is leaving exchanges at a higher rate than it is being deposited, the dynamics surrounding the total number of ETH holders tell a different story.

The Santiment chart showed a steady increase in the number of ETH holders. Currently, approximately 100 million individuals hold varying amounts of ETH.

This growth has been gradual, with around 98.4 million holders reported at the end of April.

The declining balance on exchanges and the simultaneous growth in the number of holders can be attributed to two main factors: self-custody and staking.

Firstly, more individuals opt for self-custody, holding their ETH in personal wallets rather than leaving them on centralized exchanges. It provides users with greater control and security over their assets.

Secondly, staking has become increasingly popular. Staking involves locking up a certain amount of Ethereum to participate in the network’s proof-of-stake consensus mechanism.

In return for securing the network, stakers receive rewards in the form of additional ETH. It incentivizes users to hold their ETH in staking contracts rather than on exchanges. As of this writing, the total number of ETH deposits for staking was over 780,000 and growing.

The ETH TVL and price

According to data from DefiLlama, Ethereum’s dominance in terms of Total Value Locked (TVL) remained steadfast. As of this writing, the TVL stood at approximately $27.35 billion, accounting for over half of the overall TVL.

This signified a continual influx of liquidity into the Ethereum ecosystem, emphasizing ETH’s ongoing relevance and significance.

How much are 1,10,100 ETHs worth today

Additionally, a glance at CoinMarketCap data revealed that ETH boasted the third-highest trading volume in the last 24 hours. The total volume of the entire cryptocurrency market surpassed $19 billion, with ETH contributing over $3 billion in trading volume.

Furthermore, ETH maintained its position as the second-largest cryptocurrency by market capitalization, trailing behind Bitcoin. As of this writing, ETH was trading at approximately $1,900.