Ethereum: Assessing what exactly ETH has going on for itself

It hasn’t been the best of years for Ethereum [ETH], the world’s most popular altcoin. While its price action has often been found wanting, many in the community remain optimistic thanks to the hopes attached to the upcoming Merge.

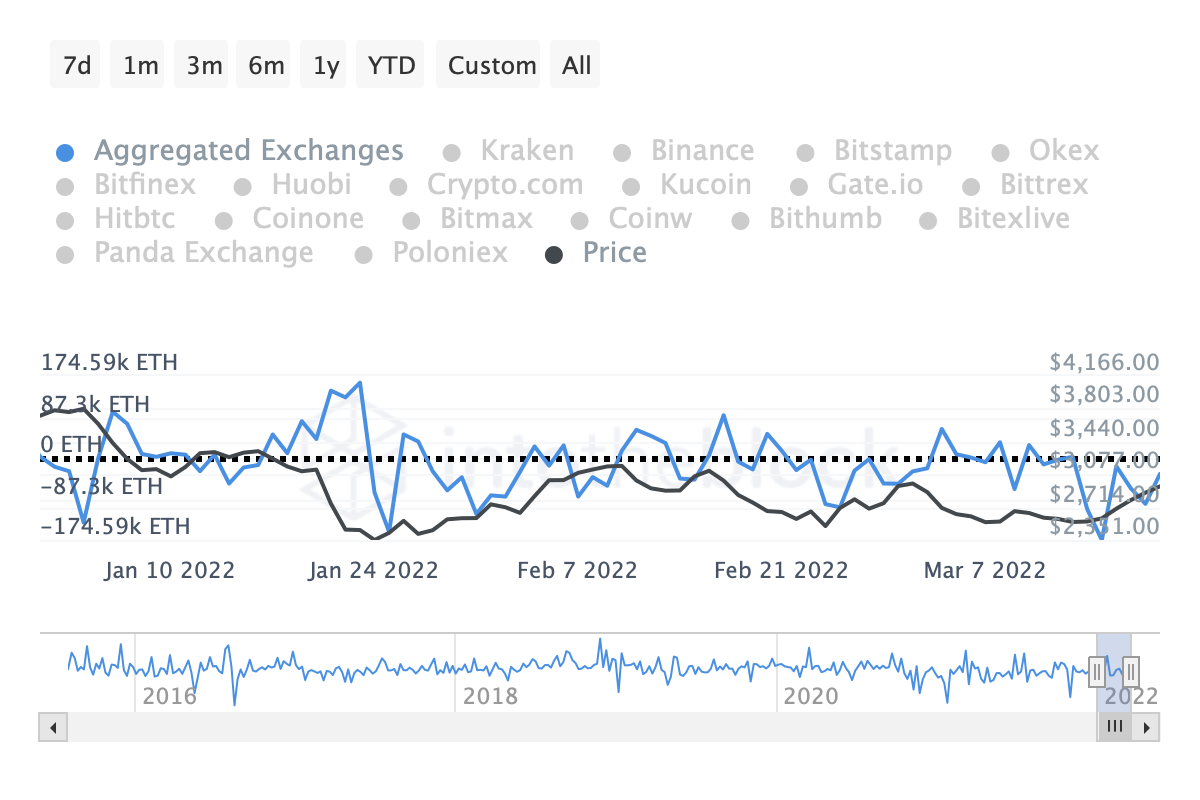

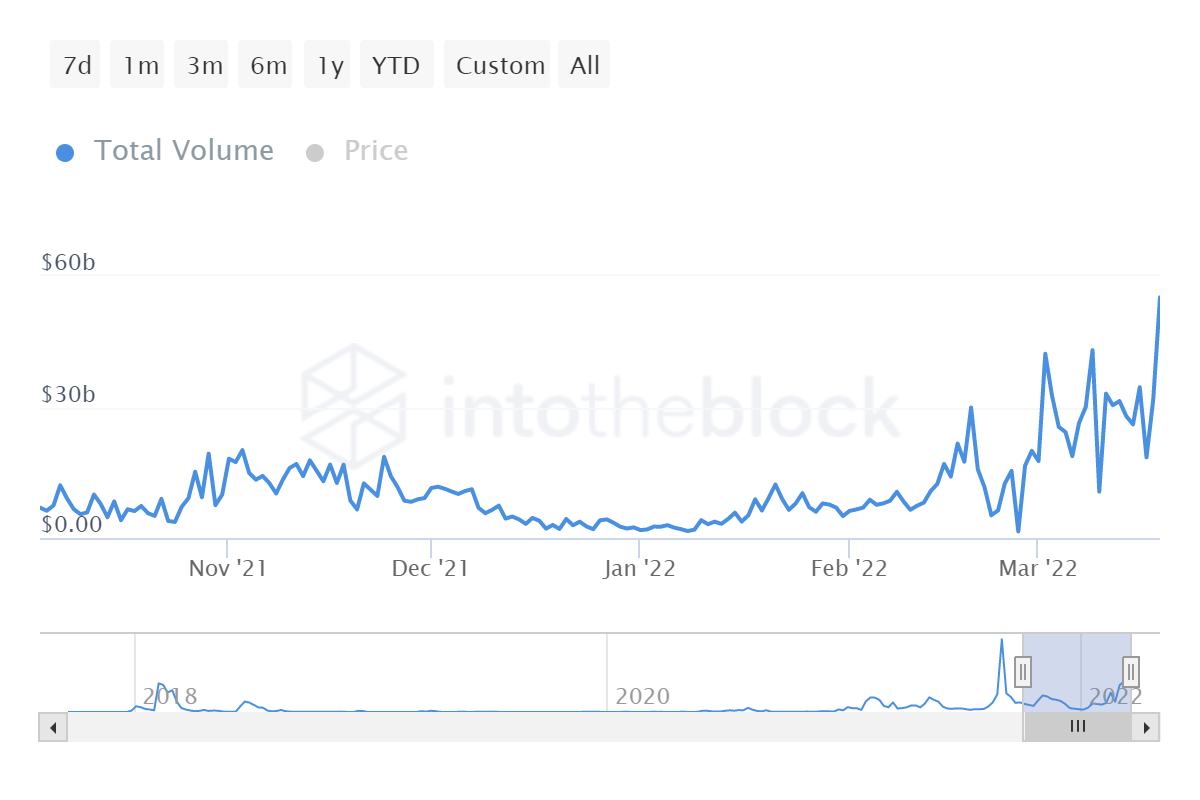

This optimism can be evidenced by Ethereum recording its largest single-day exchange outflows in 2022, according to a recent report by IntoTheBlock.

Withdrawing a cryptocurrency from centralized exchanges has often led to price surges on the charts. It is a sign that investors are confident in the long-term standing of the asset and are willing to move it off exchanges into wallets and cold storages. By extension, outflows are also a sign of falling selling pressure in the market.

The last time such numbers were reported by Ethereum was back in October 2021. It was followed by a 15% surge within the next 10 days. Can the same be expected this time around? Well, some promising developments do seem to imply the same.

In addition to the aforementioned data, there are further positive affirmations coming from the Ethereum 2.0 camp.

There has been an increase in the amount of ETH staked. The same has risen by 20% in 90 days and by 10% over the last 30 days alone. These figures represent growing confidence in the community as it looks likely to be a major part of ETH 2.0. Over 10 million ETH has been stored in the proof-of-stake contract that accounts for 8.3% of the total available Ether in circulation.

Wait…. There’s More!

“We’re working on bringing NFTs to Instagram in the near term,” Meta CEO Mark Zuckerberg said earlier this week.

While details of the launch are still unclear, the announcement has kickstarted a lot of bullishness within the Ethereum community. This, especially since the blockchain already supports around 80% of all NFTs traded, as per IntoTheBlock.

On the contrary, Zuckerberg might even decide not to go along with Vitalik Buterin’s Ethereum. Instead, he might head for more efficient models of Solana or Polygon. Worth pointing out, however, that the Meta NFTs are still in the early stages and more information should follow soon.

What’s next?

Ethereum Core Developers wrapped up their latest meeting on 19 March 19. The agenda for the same included the Merge, Beacon Chain Withdrawals, EIP- 4844, and the future of Core EIPs.

While the meeting was scheduled well in time, the same coincided with one of Ethereum’s team leads and developers commenting,

“There have been engineering attempts to reduce the complexity (module split in Erigon, responsibility split in The Merge). Yet there was never an attempt to reduce the protocol complexity. We are already past the point of anyone having a full picture of the system. This is bad.”