Ethereum, Chainlink, OMG Price Analysis: 13 November

While the broader market refrained from being highly volatile, OMG lost over one-third of its value. Though its near-term technicals visibly preferred the sellers, it hinted at a possible revival.

Altcoins like Ethereum and Chainlink registered a daily loss while flashing mixed near-term signs.

Ethereum (ETH)

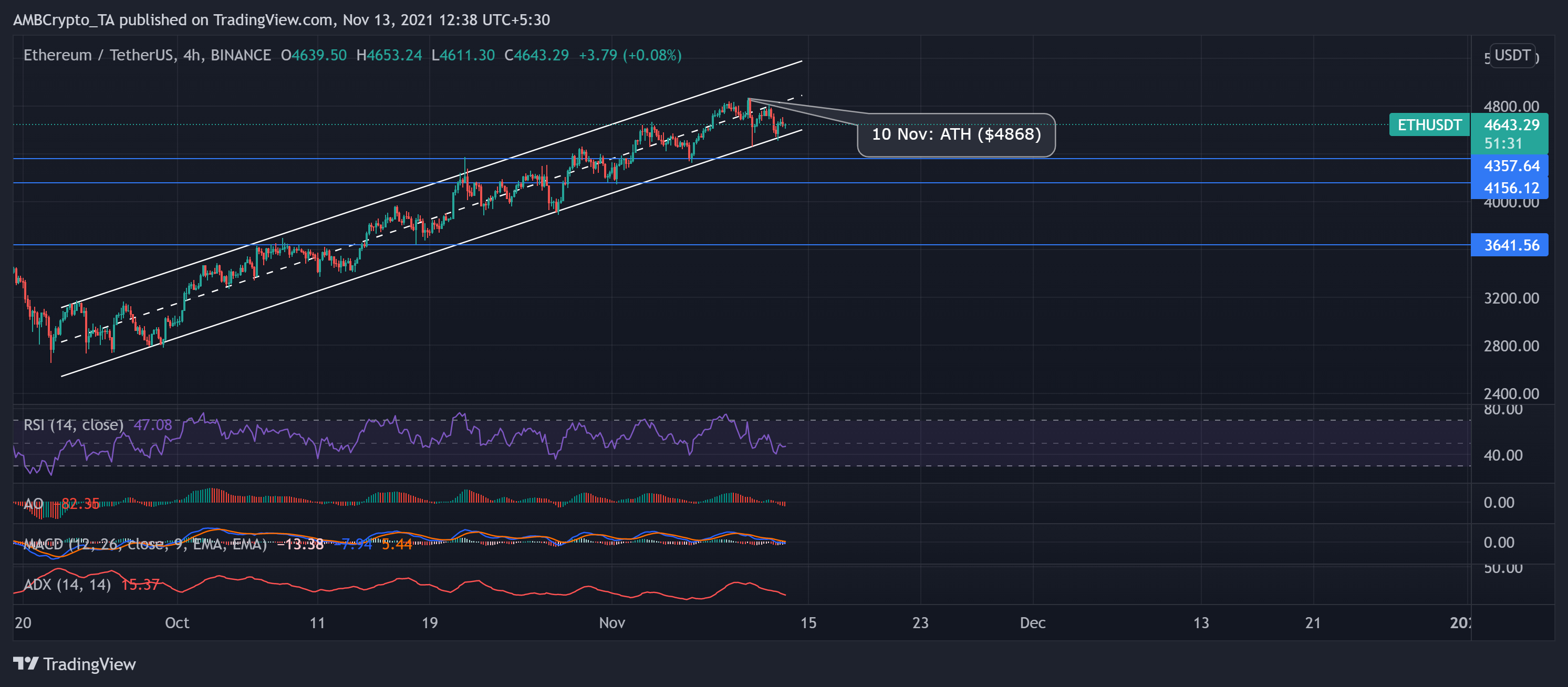

Ether escalated in an ascent between two parallel channels over the past six weeks. It performed strongly in the past month after maintaining its growth and noting a 65% 44-day ROI. Consequently, the largest altcoin touched its ATH on 10 November at $4,868-mark.

After which, the price action withdrew on its 4-hour chart as the bears tried to breach the lower channel. Accordingly, ETH saw a 4.5% decline in the correction phase over the past three days.

However, the bulls continued to demonstrate strong support at the lower trendline, visually confirmed by the price rebounding between the channels. Now, the near-term technicals indicated mixed signals after slightly favoring the sellers.

At press time, Ether traded at $4,643.29. The AO flashed red signs while the RSI stood below the midline after a downtrend. Nevertheless, it seemed to gather momentum in the near term while the MACD displayed signs of a possible bullish revival. Besides, the ADX continued to exhibit a weak directional trend.

Chainlink (LINK)

Since last month, LINK was on an incline as it traversed between parallel channels heading north. The Ethereum powered oracle network registered a monstrous 46.54% monthly ROI. As a result, LINK reached its nearly six-month high on 10 November at $38.31.

However, the bears quickly challenged this milestone as the price reversed toward the lower channel after breaching the $34.92-mark. Regardless, the bulls found support at the lower channel. At press time, LINK traded at $33.94.

The RSI was marginally below the half-line after a 32-point plunge in just two days. Also, the AO flashed red signals while the DMI lines confirmed an edge for sellers. Nevertheless, the ADX continued to exhibit a weak directional trend.

OMG Network (OMG)

OMG network’s native token saw an unusual trajectory over the past few days. At first, it rallied by over 67% to reach its 3.5 year-high on 6 November. After which, there was a slight retracement until the bulls snapped the $17.6435 resistance and touched the $19-mark on 11 November. Immediately after which, the price crashed by marking a nearly 40% decline to touch its six-week low on 12 November.

The completion of the snapshot for an airdrop from the Boba Network perceivably caused the dip. After the snapshot, OMG holders were to receive the governance token for BobaDAO for free on 19 November.

At press time, OMG traded at $12.37. The RSI was near the oversold region and visibly preferred the sellers. Additionally, AO and MACD agreed with the bearish vigor but showed signs of possible revival if bulls re-demonstrated their power.