Ethereum clients run merge event to prepare for PoS transition

A photo of one Twitter user’s computer screen as the system executed a convoluted process provoked both excitement and confusion recently.

Merge event, day 1: @ethnimbus and @nethermindeth does #themerge transition! pic.twitter.com/eyRlygTMbV

— Jacek Sieka (@jcksie) October 3, 2021

As it turns out, in doing so, Jacek Sieka announced that Ethereum clients Nimbus and Nethermind were carrying out a “merge.” This would ideally begin Ethereum’s transition from a proof-of-work consensus mechanism to proof-of-stake.

How does this work?

Ethereum’s mainnet and the Beacon chain are separate. While the mainnet deals with smart contracts and uses proof-of-work, the Beacon Chain will bring the proof-of-stake mechanism to Ethereum. The referenced merge would let developers combine the two before Ethereum switches to proof-of-stake as a whole.

After the merge, the Beacon chain would drive the proof-of-stake consensus mechanism.

A new graphic for Ethereum's Upgrade Path: leading to the Merge and beyond ??

⛏️ Proof Of Work ❌

? Proof of Stake ✅ pic.twitter.com/hKqYaAWlxY— trent.eth (@trent_vanepps) July 15, 2021

Furthermore, the Beacon chain would bring in staking and also allow shard chains to come into the Ethereum ecosystem.

Meanwhile, Ethereum 2.0 or “the docking” should take place by the end of 2021 or in 2022. However, Nimbus and Nethermind’s merge is a good sign that progress is taking place.

What’s more, it was also possible for other interested users to try out the merge for themselves.

Try it at home: https://t.co/1oxRbAF9rZ

— Jacek Sieka (@jcksie) October 3, 2021

Updates and clients

Ethereum’s Altair upgrade, scheduled for late October, will introduce support for light clients in the core consensus, among other changes.

Here, it’s also important to note that Nethermind and Nimbus were two of the five recipients of donations totaling $1.5 million for the development of the Ethereum ecosystem.

Moreover, Ethereum has also announced a bug bounty program with doubled rewards until the upgrade happens. This can be seen as a signal of how much Altair means in the overall scheme of Ethereum’s developmental roadmap.

What do the metrics tell us?

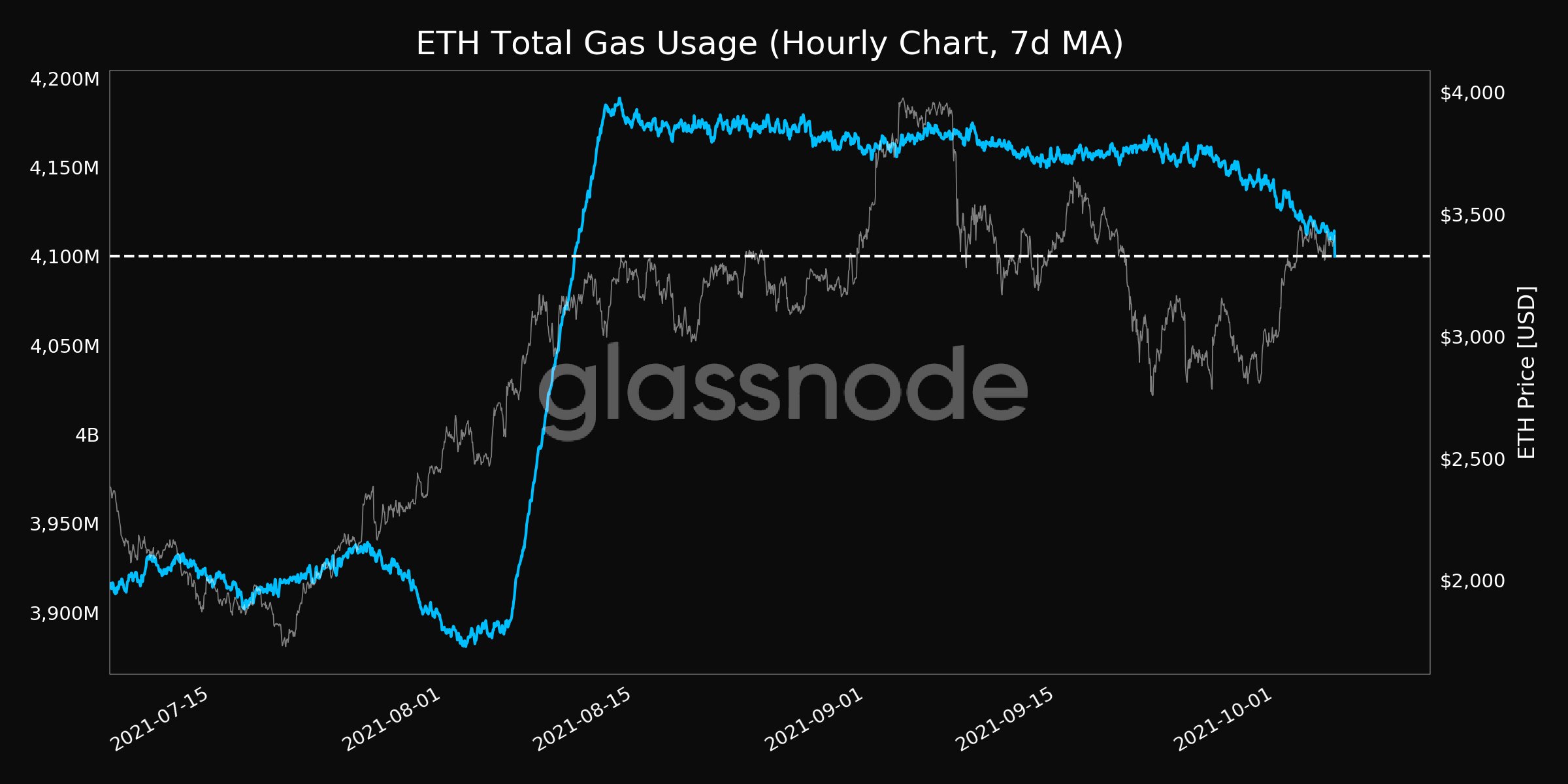

Over the last few days, Ethereum’s gas usage has been on a downward trend. In fact, it hit a one-month low, right before press time.

Source: Glassnode

Ethereum’s mining revenue also fell to an 18-month low of $65,264.58.

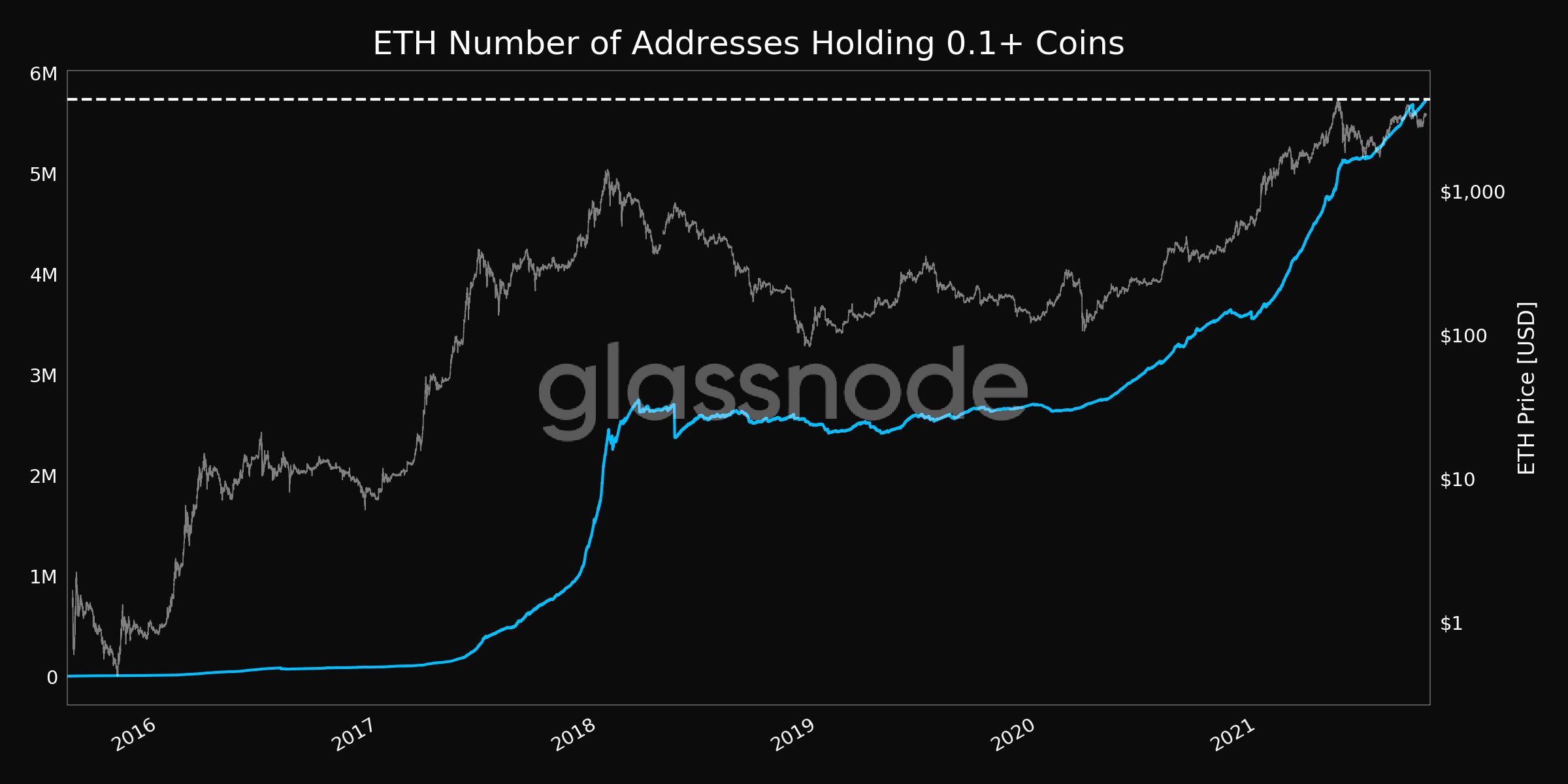

On the flip side, however, the number of addresses owning more than 0.1 coins hit an all-time high of 5,741,367. That is a very good sign for the Ethereum ecosystem.

Source: Glassnode