Ethereum: Does a price rally make sense?

Ethereum’s price is breaking all ceilings, with the cryptocurrency rallying by over 50% over the last 7 days, based on data from CoinMarketCap. The rally, similar to Bitcoin’s narrative, is pivoting on a drop in active supply. In fact, it is expected that the only outcome of the drop in supply will be a price rally.

However, despite Ethereum’s Active Supply 1y-2y (1d MA) touching a 3-year low of 15930280 ETH, the network continues to face lower levels of growth in the number of users with 10000+ ETH in their wallet. Though an all-time low active supply is being observed, it doesn’t correspond directly to a price rally.

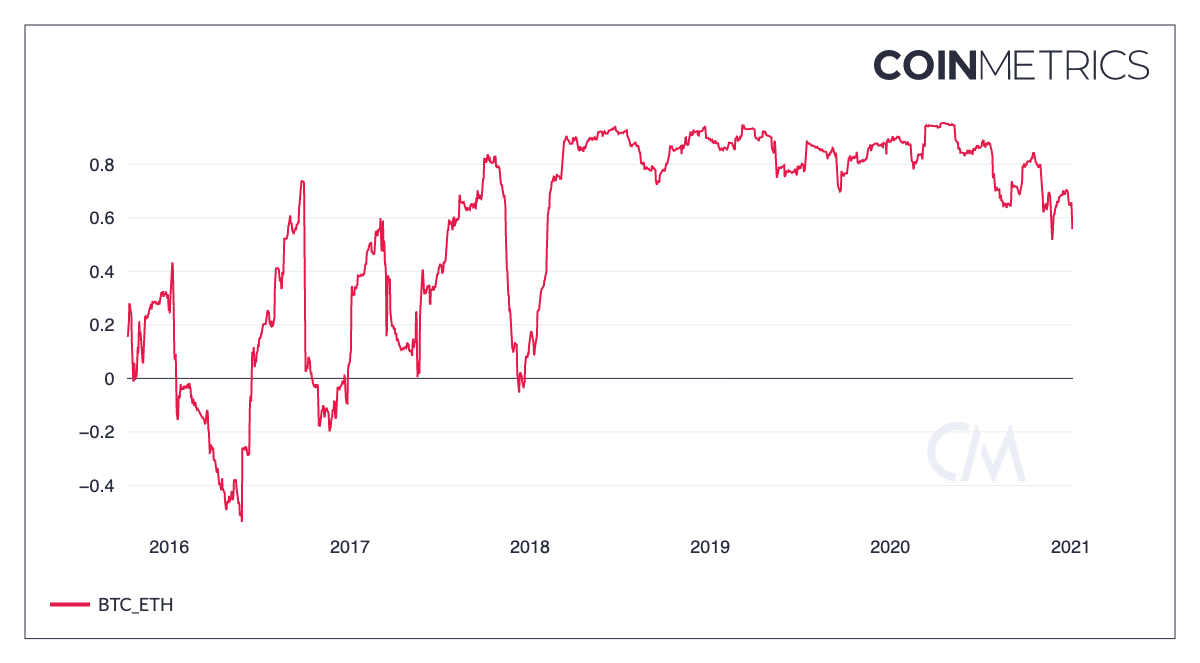

The drop in supply may be a temporary drop in liquidity as the price is continuing to rally beyond $1,200 and price discovery beyond the level is certain. Post that, a price drop may follow. Besides, Ethereum has not always enjoyed a high correlation with Bitcoin. Bitcoin-Ethereum correlation, which was nearly 0.9 in 2019, dropped to 0.55. In fact, the 2020 high of the Bitcoin-Ethereum correlation was 0.954, based on data from CoinMetrics.

Source: Coinmetrics

The Ethereum-Bitcoin correlation drops as easily as it spikes, and based on the attached chart, it points to the fact that a price drop is very likely. Though it may be the less likely outcome, Ethereum has struggled to cross key price levels in the past and it is likely that the same might repeat itself.

In fact, an on-chain analysis of the asset suggests that the number of large-value transactions has dropped to 8%, and the net sentiment is bearish. Such a sentiment may be attributed to the fact that the correlation with Bitcoin is dropping. A dropping correlation means Ethereum may not follow Bitcoin’s trajectory and price trend.

Dropping supply clearly signals a price rally; the question is when, where, and how. Just as Bitcoin events are not as coordinated, the price rally may come to a sudden halt. Similarly, Bitcoin’s Black Thursday is fresh in the minds of investors who have survived the two phases of the market cycle this year and they may be looking at Ethereum to meet their expectations. Thus, a drop in supply, in the background of alternative currencies booming, might mean an ideal start to the year.