Ethereum, Dogecoin, Maker Price Analysis: 15 January

Ethereum’s price was on the verge of registering a new ATH, before a massive correction hit once again. Since then, ETH has been on a recovery run. By and large, however, the past few days have seen mostly sideways movement from the likes of ETH, Maker, and even Dogecoin.

Ethereum [ETH]

Source: ETH/USD, TradingView

Ethereum cemented its position as the market’s largest altcoin. At press time, the coin was being traded at $1231.2 after having seen a 7.9 percent hike in price in 24 hours. As per the 4-hour chart of ETH, the coin stumbled upon a bit of resistance around the $1,263 price level. However, if the coin sees another dip in price, it can rely on the support at $1,027 and if it manages to breach the current resistance then, ETH is only likely to endure resistance around $1,391.

The MACD indicator looked promising after having seen a bullish crossover. The RSI indicator echoed a similar sentiment, with it being positioned close to the overbought zone. While the RSI indicator may retrace towards the neutral zone, the short-term sentiment continued to remain bullish.

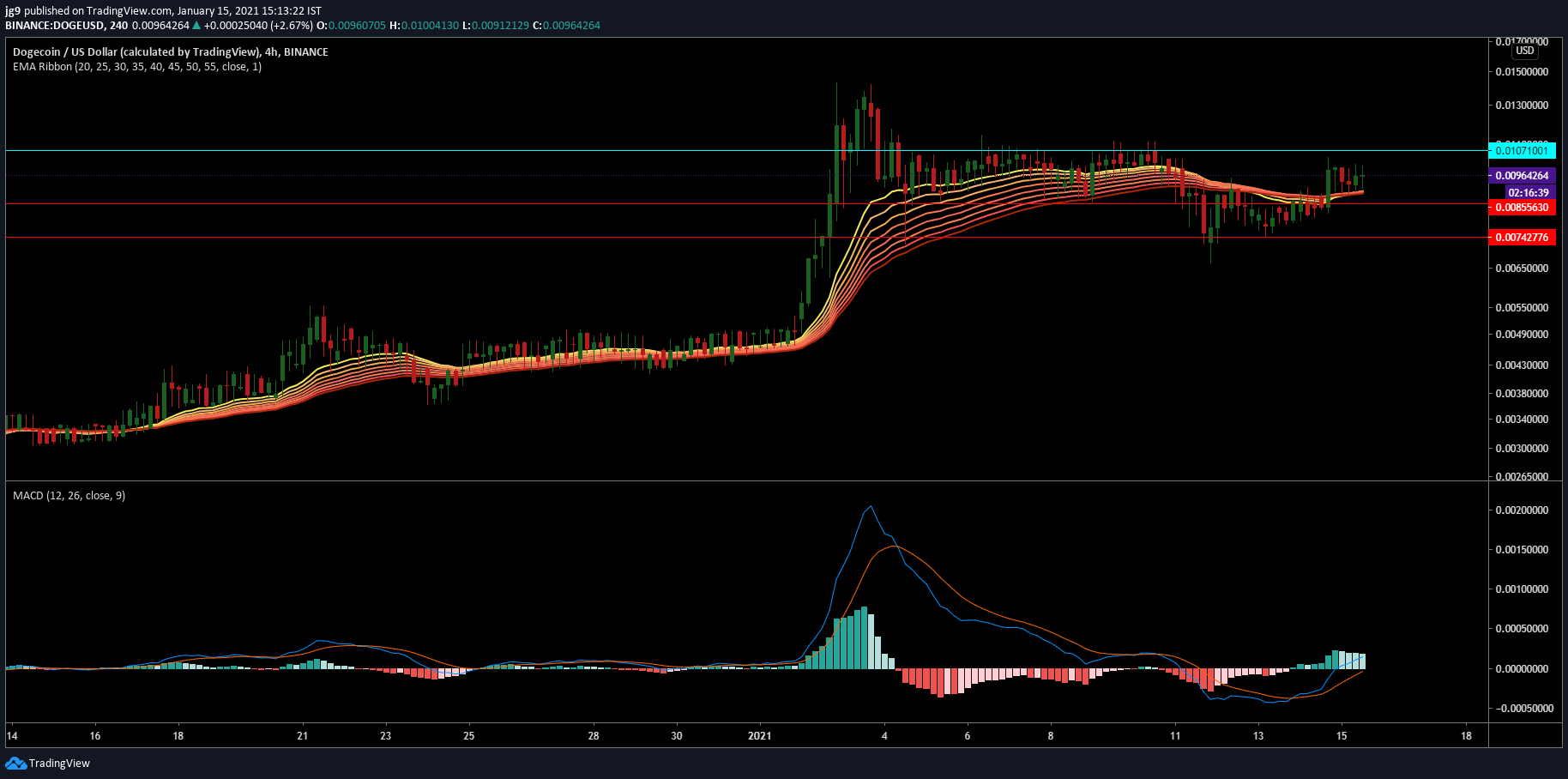

Dogecoin [DOGE]

Source: DOGE/USD, TradingView

Dogecoin was ranked 33rd on CoinMarketCap, at press time, with the crypto trading at $0.0091. Over the past few trading sessions, DOGE wasn’t able to breach its immediate resistance at $0.010. Instead, it took the support of the $0.008-price level. The coin also enjoyed strong support around the $0.007-price range.

The technical indicators for the coin looked bullish as the MACD indicator underwent a bullish crossover, with the MACD line continuing to hover over the signal line. The EMA Ribbons were offering support to the crypto’s price as they settled right below DOGE’s trading price.

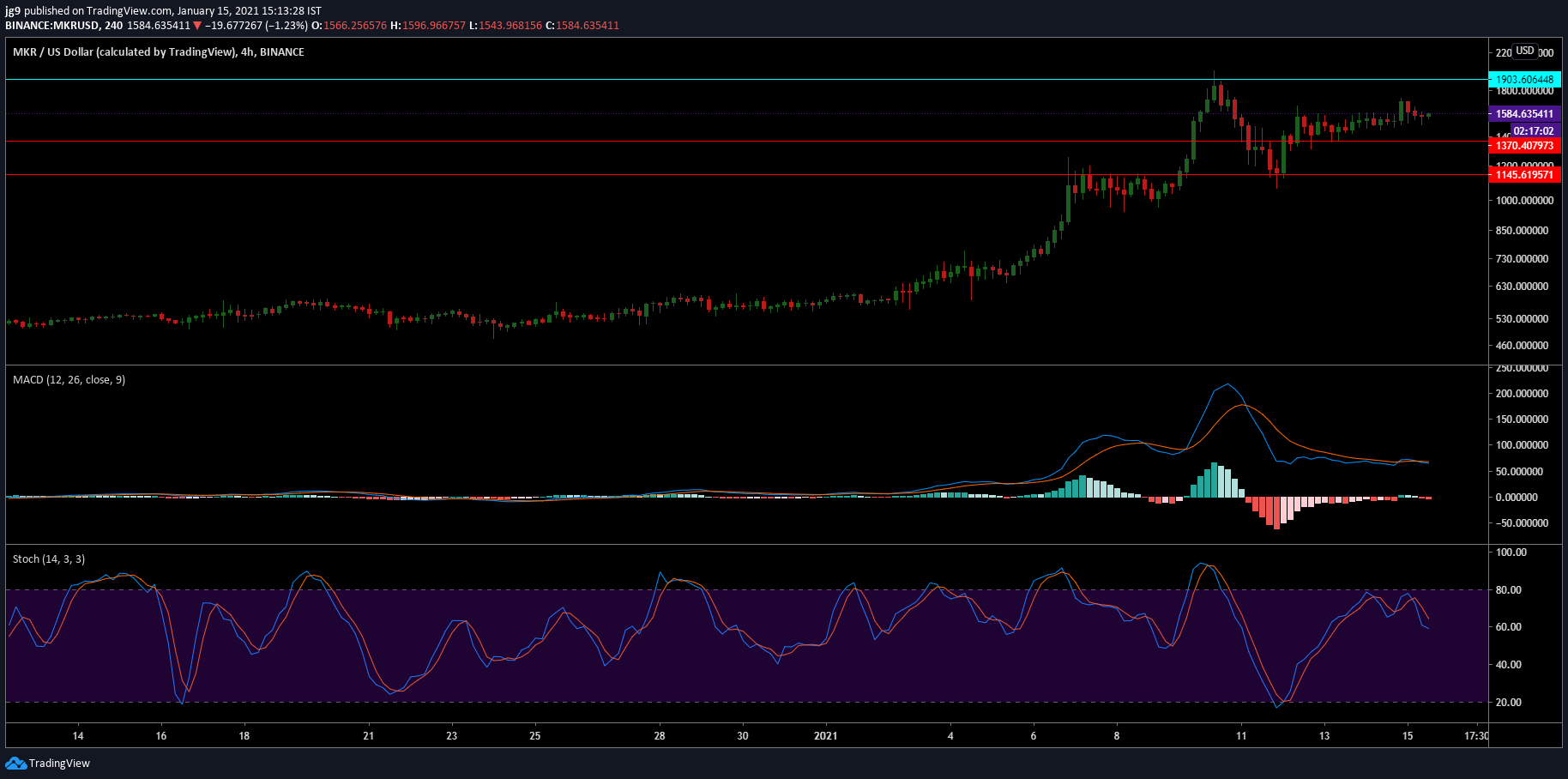

Maker [MKR]

Source: MKR/USD, TradingView

Maker saw its price surge by over 3 percent in 24 hours. The coin, at the time of writing, had a trading value of over $1,580 and was heading towards its resistance at $1903. The coin can also rely on two tested supports at $1370 and $1145 if a downtrend occurs. However, going by the technical indicators of the coin, MKR was likely to witness an upcoming price correction on the charts.

The bullish sentiment for the coin seemed to have reversed itself. The MACD indicator underwent a bearish crossover and the Stochastic indicator was moving away from the overbought zone and was heading straight for the oversold zone.