Ethereum [ETH]: Assessing if sliding fees can hasten relay to $2k

- Increased demand and a decline in fees could help ETH reach $2,000.

- Unfiltered ETH transactions dominated the network as Ethereum struggled to register new addresses.

Holders of Ethereum [ETH] savored the surreal rise of the cryptocurrency over the last two weekends. Because of the hike in value, the demand for the altcoin king significantly increased even as the price touched $1,800.

Is your portfolio green? Check the Ethereum Profit Calculator

However, there is one part that could affect the ETH and might have gone unnoticed. But thankfully, Santiment mentioned it in its 20 March tweet. According to the on-chain analytic platform, Ethereum transaction fees fell below $2 as demand continued to heighten.

? #Ethereum's price hadn't eclipsed $1,840 since August 18th. Despite this 7-month high, the network hasn't appeared to heat up and create notable transaction barriers due to high demand. This is a good sign that $ETH has a door open to $2k and beyond. https://t.co/BRPXA48BUq pic.twitter.com/0J5teo4Rh9

— Santiment (@santimentfeed) March 20, 2023

Trading sideways could still be an option

A look at data from the platform revealed that the average fee reached a Year-To-Date (YTD) high of $4.26 on 14 February. At this time, ETH’s price was around $1,670. But before the press time value of $2.82, the aforementioned drop had happened.

A situation like this could trigger increased investor participation and possible accumulation. Santiment went further, noting that sustaining this fee region was a good sign for ETH to hit $2,000. The last time the altcoin reached such levels was in May 2022. So, is there a chance of a repeat sooner than later?

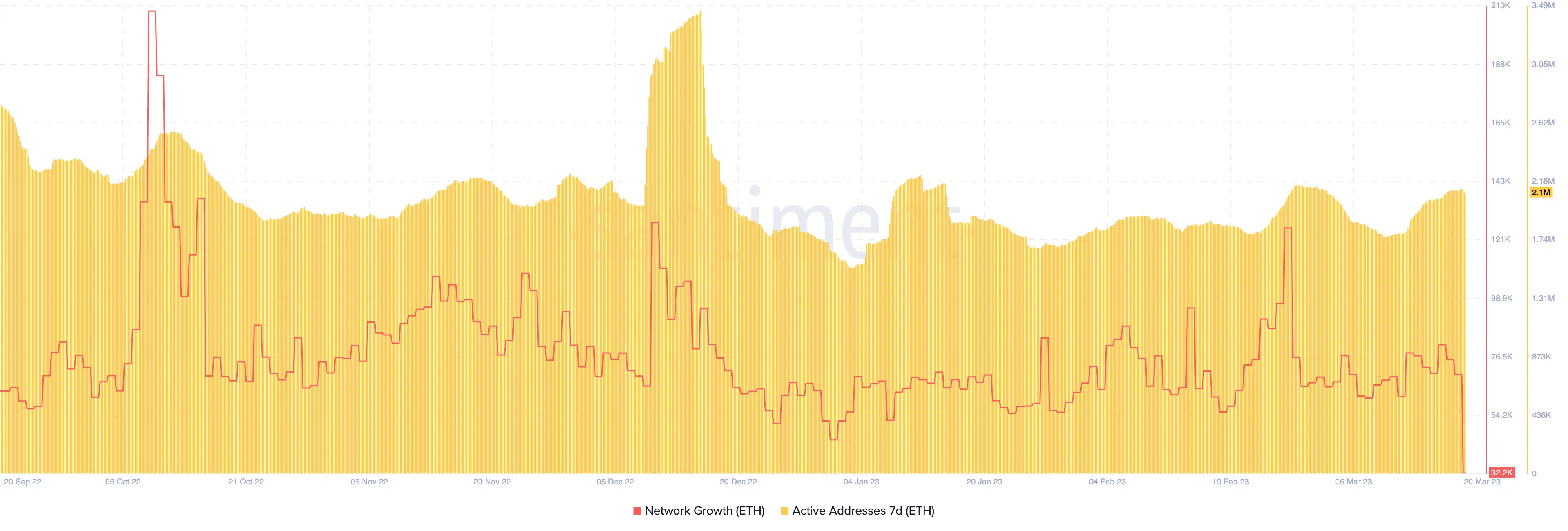

Considering Ethereum’s network growth, this could be some sort of hurdle. This deduction was taken from the metric’s sublime decrease to 32,200. The network growth shows the number of new addresses being created on a network. So, the fall means that ETH was not gaining notable traction among new folks in the crypto ecosystem.

But in the last seven days, existing users of the network took it upon themselves to increase participation. This was because active addresses, at the time of writing, had risen to 2.1 million. Invariably, this confirmed that the increased demand was likely between short to long-term holders, not newly created wallets.

Sellers stay out of control

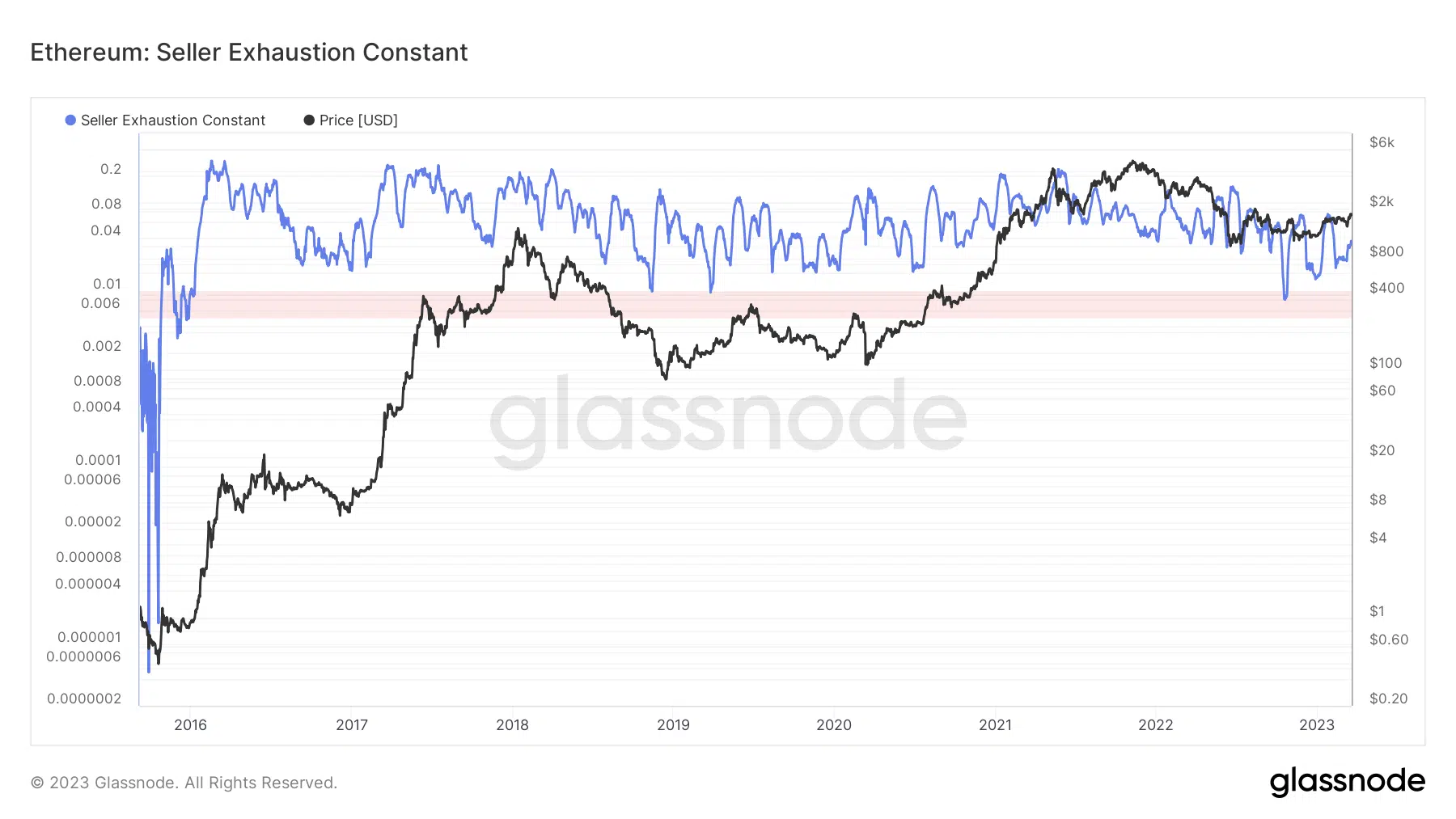

However, ETH could still have the chance to hit the milestone beside the trend displayed by the active addresses and network activity. One metric that supports the possibility is seller exhaustion.

How much are 1,10,100 ETHs worth today?

The metric measures the percentage of supply in profit in relation to the 30-day price volatility. With both factors, the metric can point out possible bottoms. At press time, the seller exhaustion constant had risen to 0.033. This suggested that the number of traders willing to sell had dwindled. Hence, ETH possessed the potential to increase further.

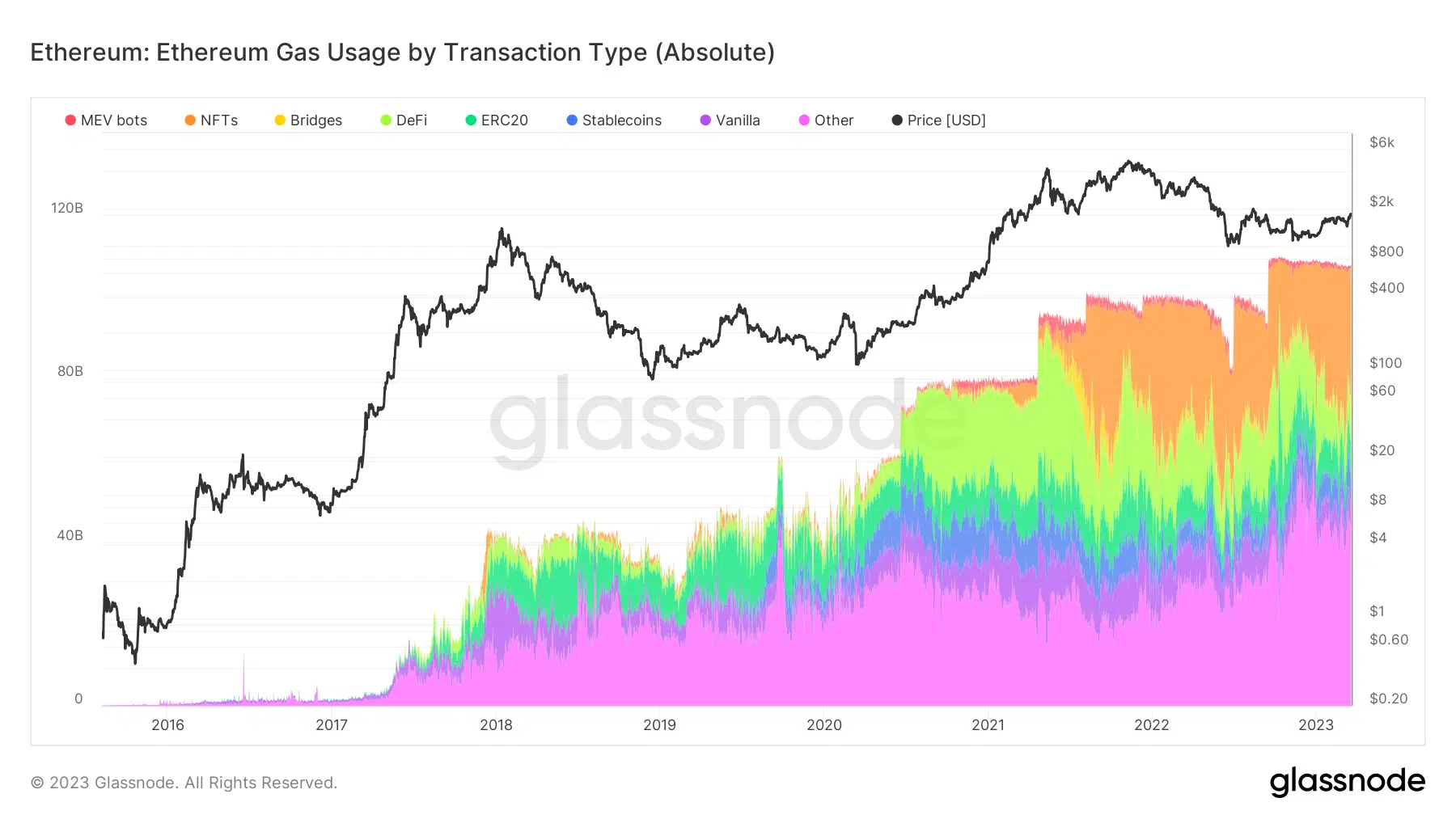

In addition, Glassnode’s data showed that pure ETH transactions, denoted by the pink color below, dominated gas usage on the network. From the chart below, NFT transactions and ERC-20 bridges via the Ethereum blockchain fell behind it. While this supreme could positively impact the ETH short-term price, several other factors excluding do have a part to play.