Ethereum [ETH] could be set for another round of explosion, only if…

![Ethereum [ETH] could be set for another round of explosion, only if…](https://ambcrypto.com/wp-content/uploads/2023/03/po-2023-03-06T093459.000.png)

- ETH’s short-term recovery could depend on the USD and interest rates trend.

- Technical indicators suggest short-term consolidation.

The first few days of March have failed to give Ethereum [ETH] holders a much-desired breather. Despite the reality of despair, any hope for respite could depend on one condition, according to Chris Burniske.

The ex-crypto investment head at ARKInvest opined that ETH, alongside Bitcoin [BTC], would only recover if the dollar and interest rates drop.

For much of February the dollar and rates went higher, while crypto hung in there. If the former two start to drift lower, $BTC could push through $25K, and if $ETHBTC pushes alongside that we could get another round of fireworks.

— Chris Burniske (@cburniske) March 5, 2023

Realistic or not, here’s ETH’s market cap in BTC’s terms

Striving for stronghold

Recall that the first two months of the year brought glaring greens to the market, with the top two cryptocurrencies earning gains for their holders.

In addition, the Fed rates increase in February had initially triggered reds in the market. But ETH, led by BTC ensured that the drawdown only lasted a few hours. So, does the ETH technical outlook appear encouraging yet?

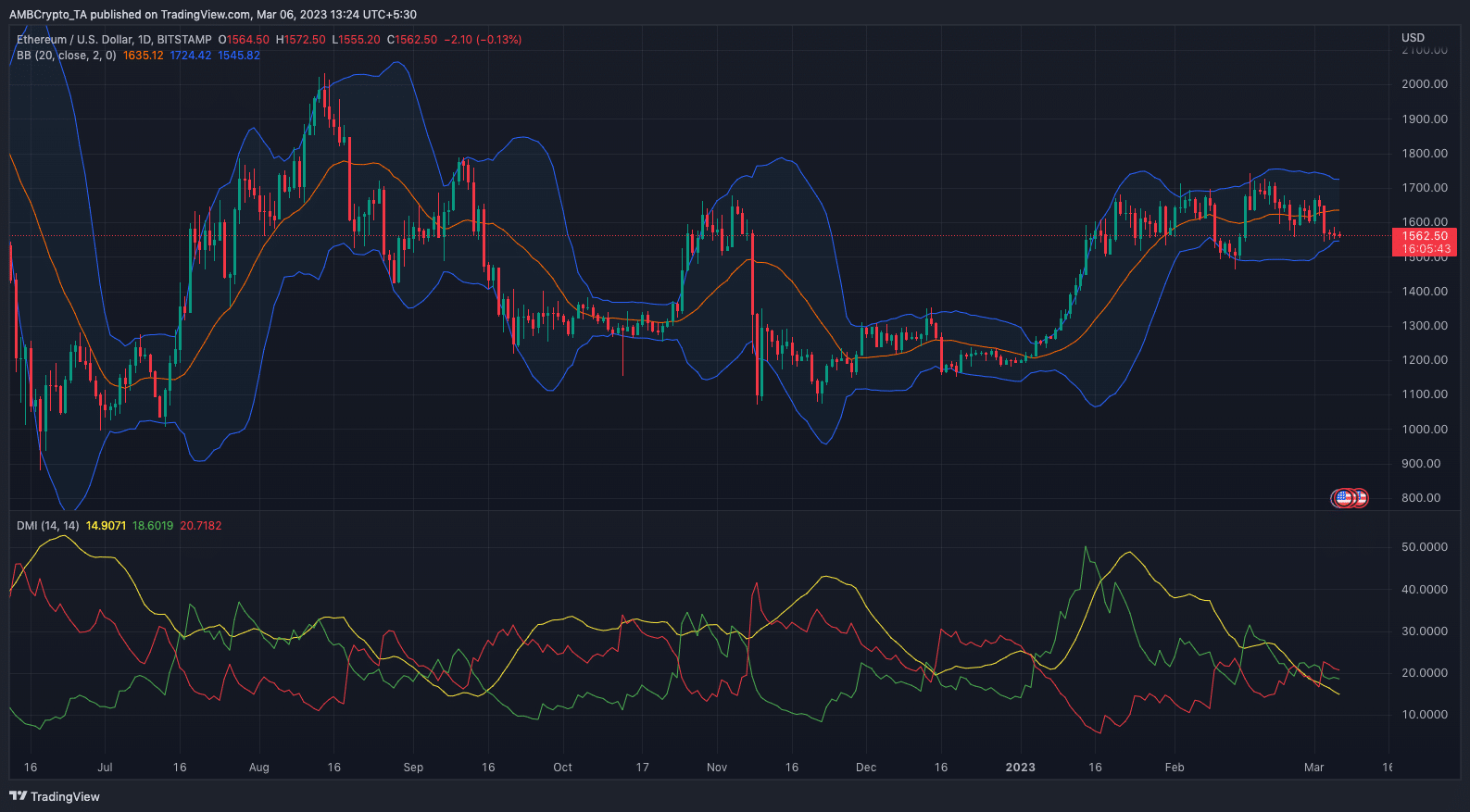

Well, the ETH/USD daily chart showed that the asset volatility was exiting its long-standing contraction status at press time.

Meanwhile, the lower part of the Bollinger Bands (BB) which measures an asset’s volatile condition was at par with the ETH price. Since the bands did not squeeze, this status indicates that ETH was oversold and had fewer chances of a significant breakout.

However, the Directional Movement Index (DMI) suggested that the altcoin might not be ready for a rally, and the condition mentioned above could be instrumental.

This was because the -DMI (red) positioned higher than the +DMI (green) at 20.71 to 18.60. Moreso, the chart above revealed that the Average Directional Index (ADX) had no strong support for either a breath or bullish move.

The ADX (yellow) at 25, indicated a strong directional movement while a value below it shows a weak one. At the time of writing, the ADX was 14.90.

Portfolios hang in the balance

Apart from the downside projection of the technical indicators, the liquidations over the past few days have faded signs of a bullish crossover. But some ETH holders are optimistic that the Shanghai upgrade could offer a slide ways from the bears.

Is your portfolio green? Check out the Ethereum Profit Calculator

There have, however, been shifts in the final mainnet event after it was initially slated for March. But Ethereum developers seemed to have made progress with the Sepolia Testnet success, and Georli in view. So, how has the ETH decline to $1,561 affected its holders?

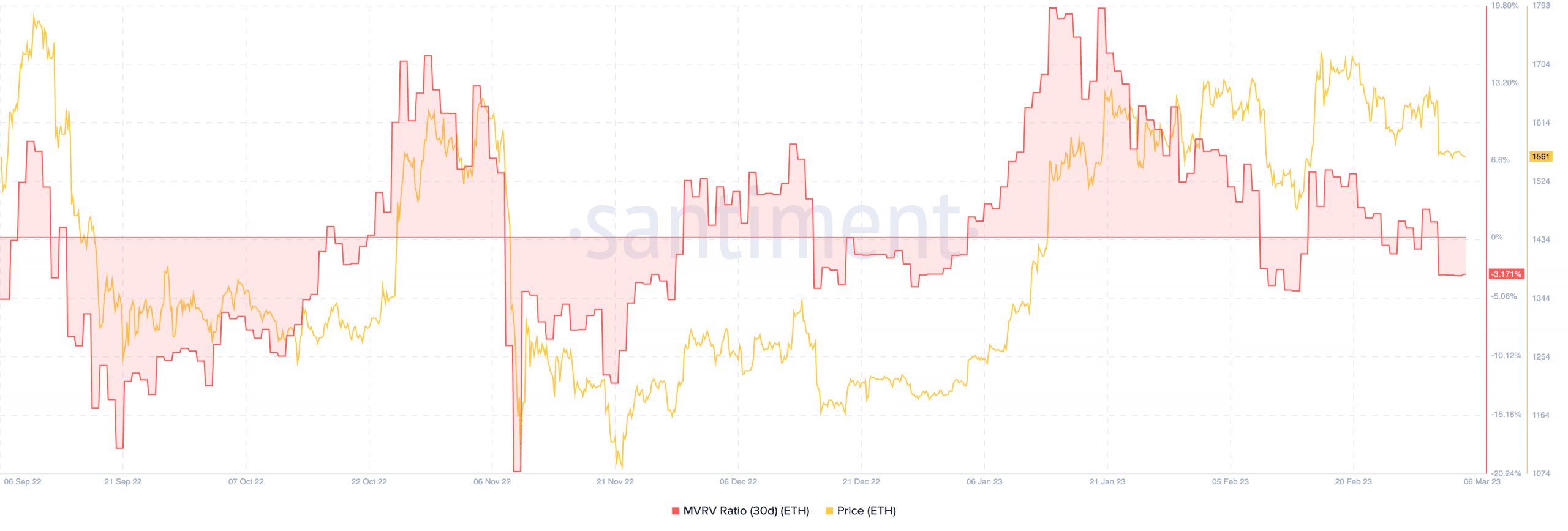

According to Santiment, the 30-day Market Value to Realized Value (MVRV) ratio was -3.171%. The metric shows the ratio between the current price and the average price acquired in relation to market profitability.

Hence, the MVRV ratio drawdown implied that most of those who acquired ETH a few weeks back remained underwater.