Ethereum [ETH] pulls off something unexpected amid $1.9 billion in losses

Ethereum, known as the altcoin king, is supposed to lead the altcoins for good. However, the case has not been the same for the last few weeks since Ethereum became a victim of the bear attack. It has been struggling to get off the ground it fell during the May crash.

Ethereum can’t find support

At press time, ETH was trading at $1,982, it fell below $2k, a psychological level that played a crucial role during the rally of July 2021. However, the actual critical support level is set at $2,321, a bounce from which would allow Ethereum to rally on towards $3k.

Ethereum price action | Source: TradingView – AMBCrypto

But ETH is standing far away from all of this since the panic that spread throughout the market in the last month witnessed investors pulling away from being subjected to another course of history repeating itself.

As ETH started showing signs of a decline towards the end of April, Ethereum holders began selling their holdings, and within a month, the total ETH sold crossed one million. Valued at $1.9 billion at press time, this was the largest selling observed in 2022 in the case of Ethereum.

Ethereum supply on exchanges | Source: Santiment – AMBCrypto

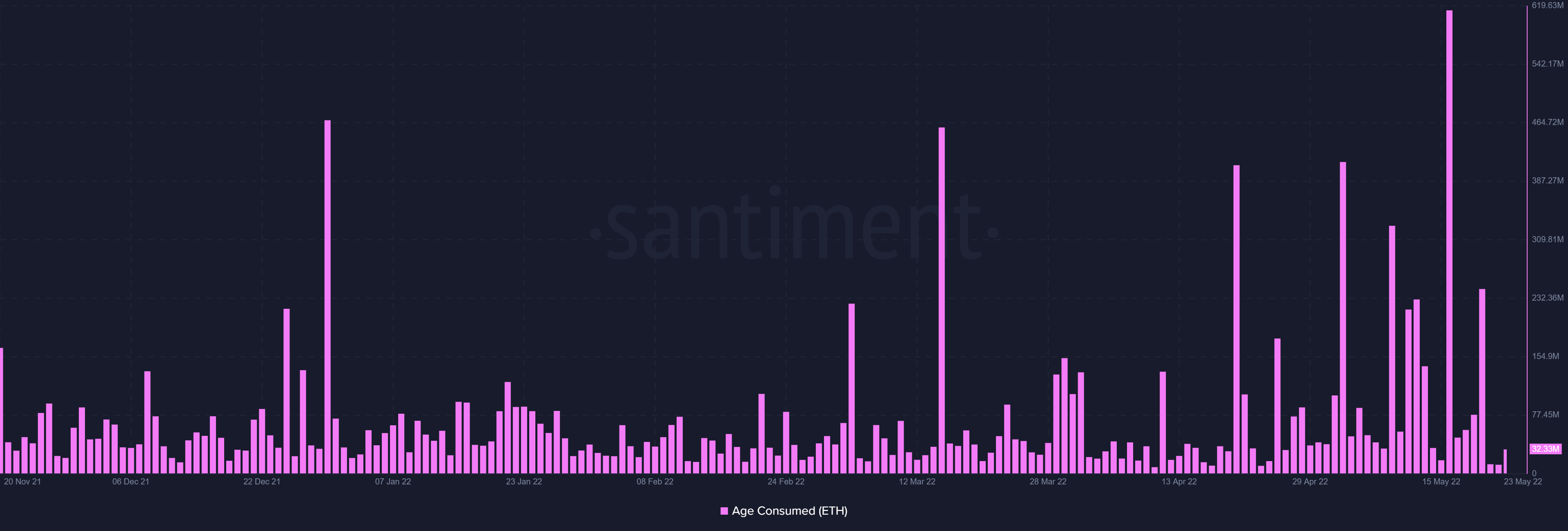

Albeit, not too excessive, a bunch of long-term holders also sold their ETH after keeping it unmoved in their wallets for more than a year. Thus, destroying almost 1.3 billion days in the process.

Ethereum long term holders selling | Source: Santiment – AMBCrypto

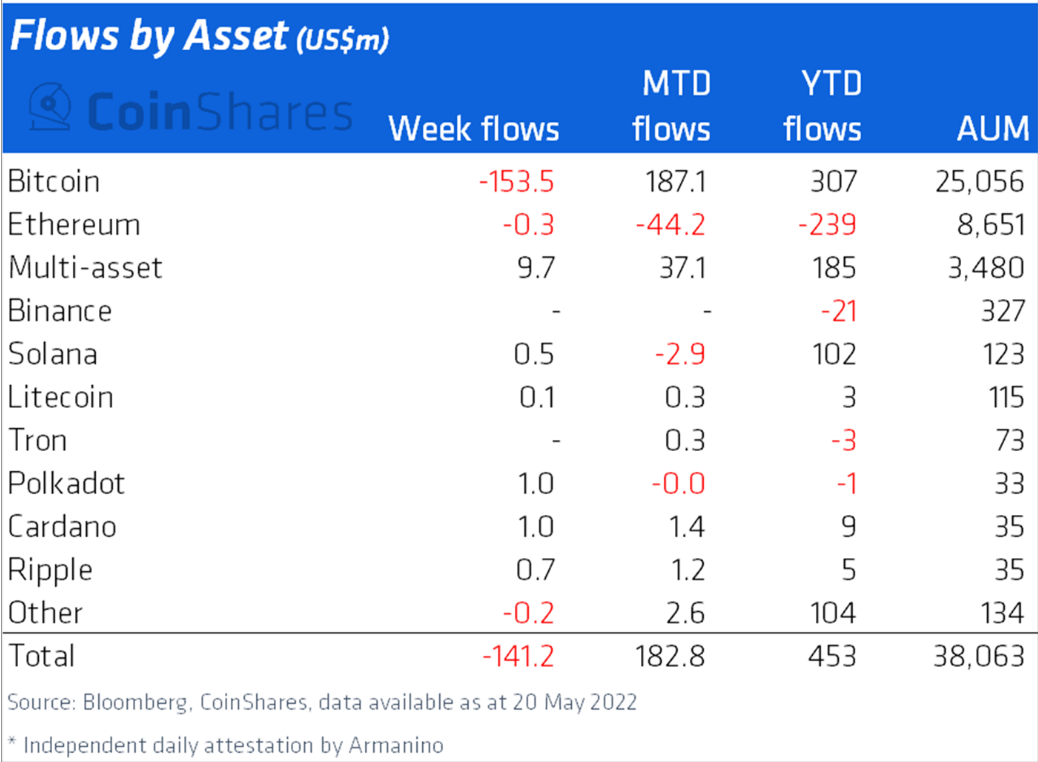

However, this bearishness did bring a shift in winds for good as, for the first time in months, Ethereum gained the interest of institutional investors. This cohort has had an unknown beef against the asset since the beginning of this year, as funds have mostly been pulled out of the altcoin instead of being directed towards it.

This week, only $300k worth of the ETH was withdrawn. This is a big step up from the $10 million $100 million figures witnessed in the past, which caused the year-to-date net flows of Ethereum to stand at a negative $239 million.

Although the brunt of the bears was taken by Bitcoin this time around, registering $153.5 million in outflows, it still had a YTD net flow of positive $307 million.