Ethereum [ETH]: The true meaning of >130 ‘millionaire’ whales coming back

The cryptocurrency market registered a much-needed surge recently, with the market cap up to almost $1 trillion. Ethereum, the world’s largest altcoin, led the charge with a 14% hike following recent developments around the Merge.

Joining the millionaire alley

ETH, at the time of writing, was trading around the $1.35k-mark thanks to renewed interest from enthusiasts. Whale activities just aided this cause, as highlighted by the analytical firm – Santiment. Following this jump, 131 additional whales returned to the network in the last 10 weeks alone.

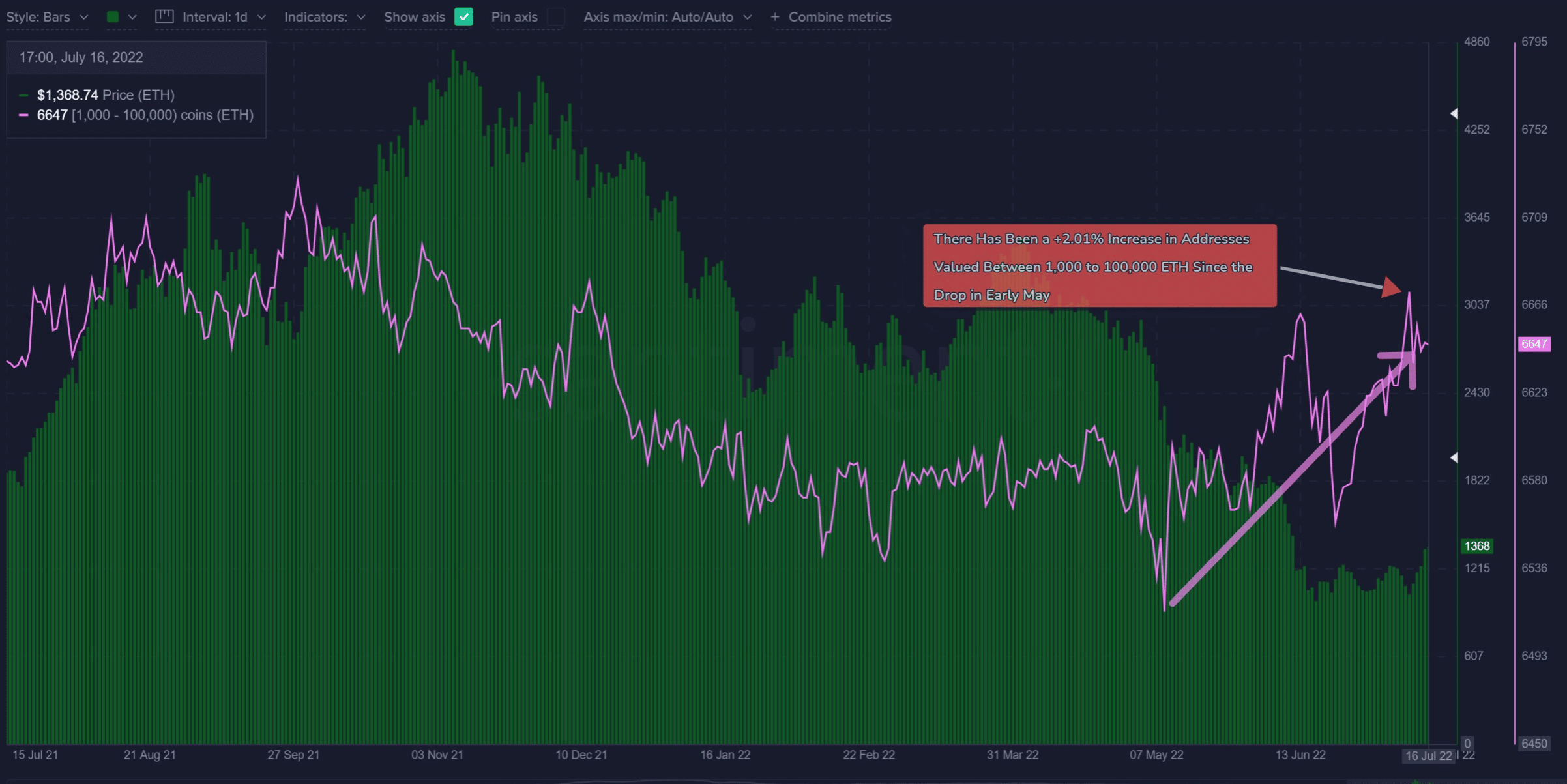

Here’s the ETH whale supply distribution status check –

Looking at the aforementioned graph, Santiment added –

“There’s an increase in the key 1k to 100k ETH address tier since early May where 131 new whale addresses have popped up on the network.”

Moreover, the number of addresses holding 1+ ETH also reached an ATH of 1,554,716. So, it’s not just dominant buyers that deep-dived into this pool.

However, are these holders, be it old or fresh ones, seeing any profits? Well, yes.

CryptoRank evaluated the profitability of the most popular blockchains. Based on the data, it published a ranking of the top-10 blockchains by revenue in seven days.

Ethereum is the undisputed king here. Ethereum leads, followed by BNB Chain, Bitcoin, and Helium.

In addition to this, the 30-day returns for Ether underlined a positive picture too, as observed by research firm Jarvis Labs. Here, the 30d returns measure the short-term profit and loss of the aggregated market at a given time.

Source: Jarvis Labs

As per the graph, the 30-day returns for Ether are now “moving towards 0% after being deeply negative since April.” This may be a sign that the market is getting more bullish as the Merge approaches.

Here, instances when the 30-day returns dip below 0% during bull markets indicate “prime buying opportunities.” On the contrary, “flips above 0% are ideal selling opportunities” during bear markets.

Good days, or is it…?

Different traders and analysts have painted a bullish scenario for the altcoin. For instance, according to Michaël van de Poppe, Ethereum could see a “significant run” after it broke through a key level.

Crucial zones for #Ethereum to watch.

Currently bouncing, while also the $EUR / $USD is showing some slight relief.

If we crack $1,140, I'm assuming we'll continue and have a significant run towards $1,400-1,500 for $ETH. pic.twitter.com/0IDB6j5fEg

— Michaël van de Poppe (@CryptoMichNL) July 12, 2022

Having said that, one needs to be careful given the previous correction that this major altcoin has had. The flagship cryptocurrency traded above $3,000 before a severe downtrend in crypto-markets saw its value plunge.