Ethereum on exchanges hit a 2-year low; so what does this mean for its price?

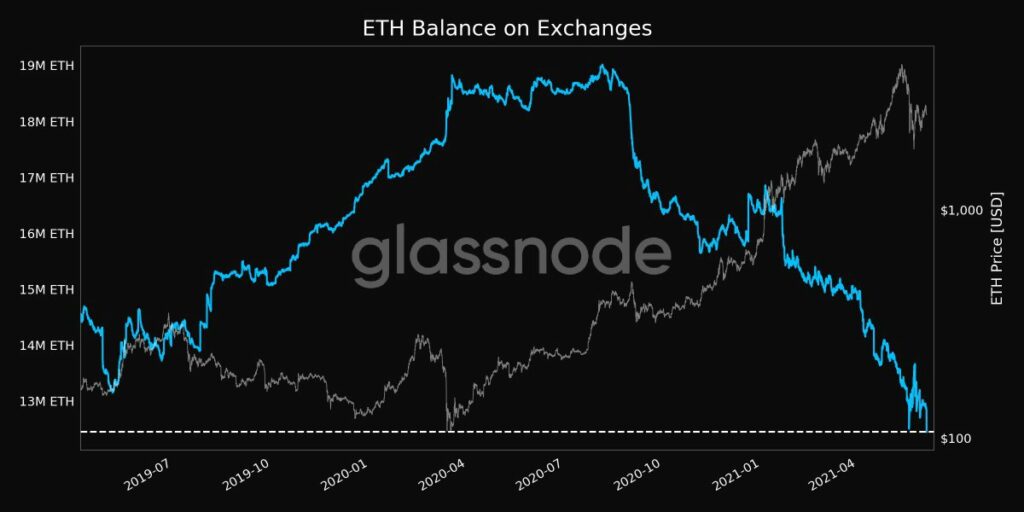

Ethereum’s recovery is ongoing with the asset just around the $2,500 level. The market capitalization was at $323.4 Billion, based on data from coinmarketcap.com and with the ongoing rally, the percent ETH balance on exchanges has hit a 2-year low. The Ethereum balance across exchanges continued dropping over the past months, however, it has hit a low now. Based on data from Glassnode, Ethereum’s balance on exchanges has dropped steadily since July 2020 and it is now below 8 Million ETH.

ETH Balance on Exchanges | Source: Twitter

The amount of Ethereum on exchanges is a significant metric since it reflects the demand across exchanges, selling pressure and the HODLer composition. The percent supply was dropping for the past eight weeks alongside Bitcoin’s rangebound price action and top DeFi project’s rally. This is a bullish signal for Ethereum.

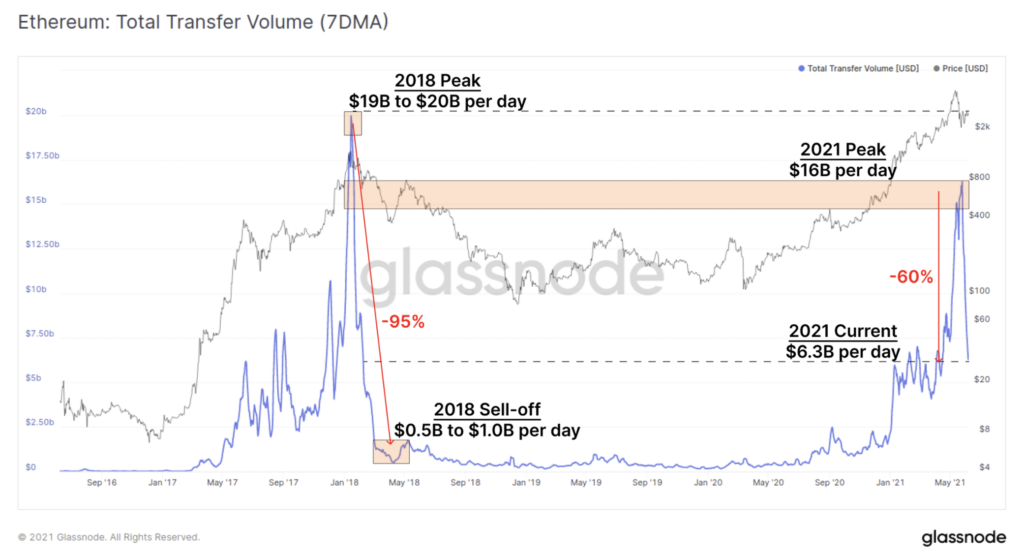

ETH Total Transfer Volume | Source: Glassnode

The demand for on-chain Ethereum transactions has dropped based on the above chart and the average transaction fee has dropped. Following several short spikes that crossed $50, the fees hit a high in April and May 2021. The fees are now back to the early 2020 level based on Glassnode data.

The volume of several on-chain activity metrics has declined rapidly; despite this rapid decline, the price has resisted selling pressure. In the event when the selling pressure increases, Ethereum’s price may drop below the $2400 level, just as it did in the May 19 flash crash.

EIP 1559 update is expected to reduce supply and redistribute yield. Following that, EIP 3074 and rollups are expected. The transaction fees are expected to reduce dramatically. Additionally, the merge and ETH2 POS are anticipated to offer energy sustainability.

Though Ethereum’s correlation with Bitcoin is high, Ethereum is not consolidating yet. However, it is likely that consolidation will occur when Bitcoin continues to remain rangebound. While altcoin traders are buying Sushiswap, Shiba Inu coin and Sanshu Inu coin in high volume transactions, high market capitalization altcoins like Ethereum are likely to experience a drop in demand in the following two weeks.

Additionally, the slowdown in on-chain activity has caught up with Defi projects and NFT marketplace tokens as well. The aggregate transfer count and the transfer value in terms of USD have dropped significantly. Thus, ETH balance on exchanges hitting a two-year low is bullish in the short-term.