Ethereum options (OI) saw 32% more value than BTC- Here’s why

The battle of the two aces, Bitcoin and Ethereum have waged for years. Although, the battleground might differ. Within the spot market, BTC continues to remain at the number one spot. However, recently, ETH has overtaken the king coin in the options market battleground.

Choosing my arena

Ether [ETH] overtook industry leader BTC in the options market for the very first time. Open interest in Ethereum options exceeded that of Bitcoin on 1 August.

According to Glassnode, the open interest of Deribit Ethereum options with a notional value of $5.6 billion exceeded the open interest of Bitcoin options for the first time in history.

Herein, the Bitcoin options open interest recorded about $4.3 billion, which is 32% less compared to the value locked in open ETH options trades.

ETH is dominated by bullish call options traders as the Put/Call ratio stood at 0.26. Interestingly, most of Ethereum’s option bets were placed for 30 September and 30 December.

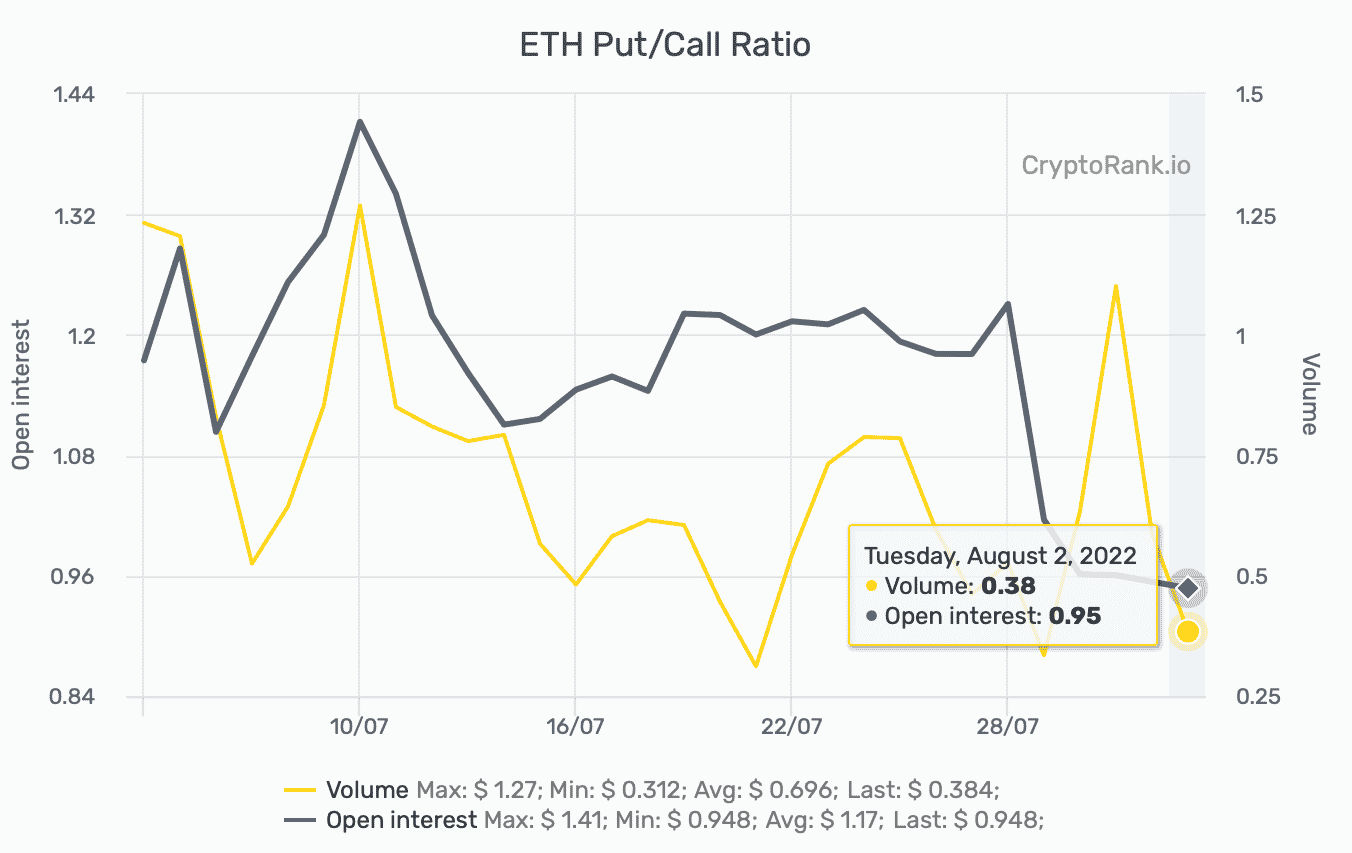

In fact, ETH put/call ratio even increased at the time of writing to 0.95 as seen in the graph below.

Source: Cryptorank.io

This, indeed, shed light on traders’ bullish bets on a potential ETH rise after the Merge. The much-anticipated Merge would lead to a reduction in ETH issuance and bring a store of value appeal to the asset.

Choose wisely

Interestingly, ETH has achieved a lot of popularity which could be seen in the insights above. Investors/traders have been placing bullish bets on ETH. Does that mean ETH is going to dethrone the king coin?

Well, only time would tell. However, remember the sheer difference in market capitalization. At press time, Ether’s market cap stood at $199 billion. It is still half the size of Bitcoin, whose market cap stood at $443 billion at press time.