Ethereum Price Analysis: 29 March

Ethereum’s price has managed to recover its past week’s losses thanks to the renewed bullish momentum it has been able to gather in the past 24-hours. The coin continues to move upwards on the charts and despite minor corrections in the past few days, ETH’s bullishness is a continuation of the uptrend that was initiated on 25 March.

At the time of writing, ETH was trading at $1783 and had a market capitalization of over $195 billion.

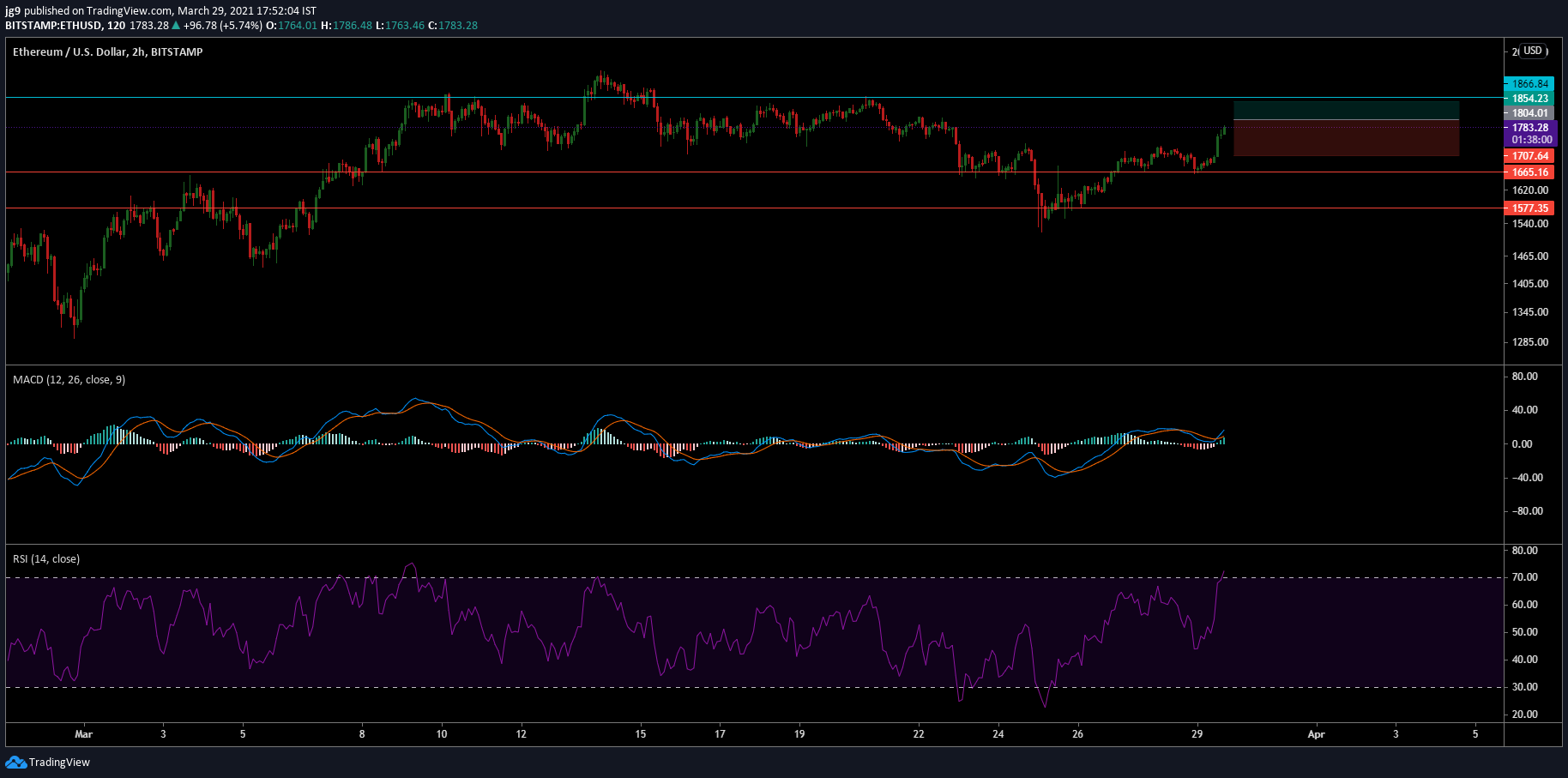

Ethereum 2-hour chart

Source: ETH/USD, TradingView

The shorter time frame charts illustrate the strong bullish momentum ETH has enjoyed in the past 12 hours. The coin now surges towards its immediate resistance range at $1866 and if a price correction were to occur in the coming hours then ETH may be aided by its tried and tested support levels such as $1665 and $1557 which helped the bounce back in the recent past.

For traders, long positions are ideal in the current ETH market as the price expected to head towards the $1800-$1900 level in the coming day’s time.

Rationale

The technical indicators for the coin paints a bullish outlook for ETH in the short term. The MACD indicator has undergone a bullish crossover with the signal line going below the MACD line. This is normally a sign that the price may see a surge in the coming hours. The RSI indicator concurs with such a verdict as it now is placed well into the overbought zone highlighting that the buyers outnumber ETH’s sellers.

Important levels to watch out for

Resistance: $1866

Support: $1665, $1557

Entry: $1804

Take Profit: $1854

Stop Loss: $1797

Risk/Reward: 0.52

Conclusion

Ethereum’s price has been on a recovery run since 25 March and the upward momentum hasn’t faded. The coin is currently surging on the price charts and in the short term, a move to its $1866 range seems highly likely at the moment. However, if the price were to be subject to a price correction, then the coin’s nearby support levels are likely to help it bounce back on the charts. Traders in such a scenario can benefit from long positions.