Ethereum retail investors’ sentiment looks bullish, but will it help ETH?

- Investors sentiment toward Ethereum improved of late.

- Key metrics such as the MVRV ratio and long/short difference suggest that there may be some selling pressure on Ethereum in the coming days.

Ethereum faced a lot of volatility over the past year, especially after the merge. However, according to Santiment’s recent data, the tides may soon turn in Ethereum’s favor as investor sentiment appears to be highly bullish at the moment.

Read Ethereum’s Price Prediction 2023-2024

The public sentiment

According to the data provided by Santiment, traders were interested in Ethereum over other cryptocurrencies such as BNB, BTC, and ADA.

Well, interestingly enough, the sentiment for Ethereum remained positive despite the declining activity on the social front. According to data provided by LunarCrush, the number of social mentions and engagements for Ethereum decreased materially over the last month.

To be precise, social mentions for Ethereum decreased by 33.7% and the number of engagements fell by 12.8%.

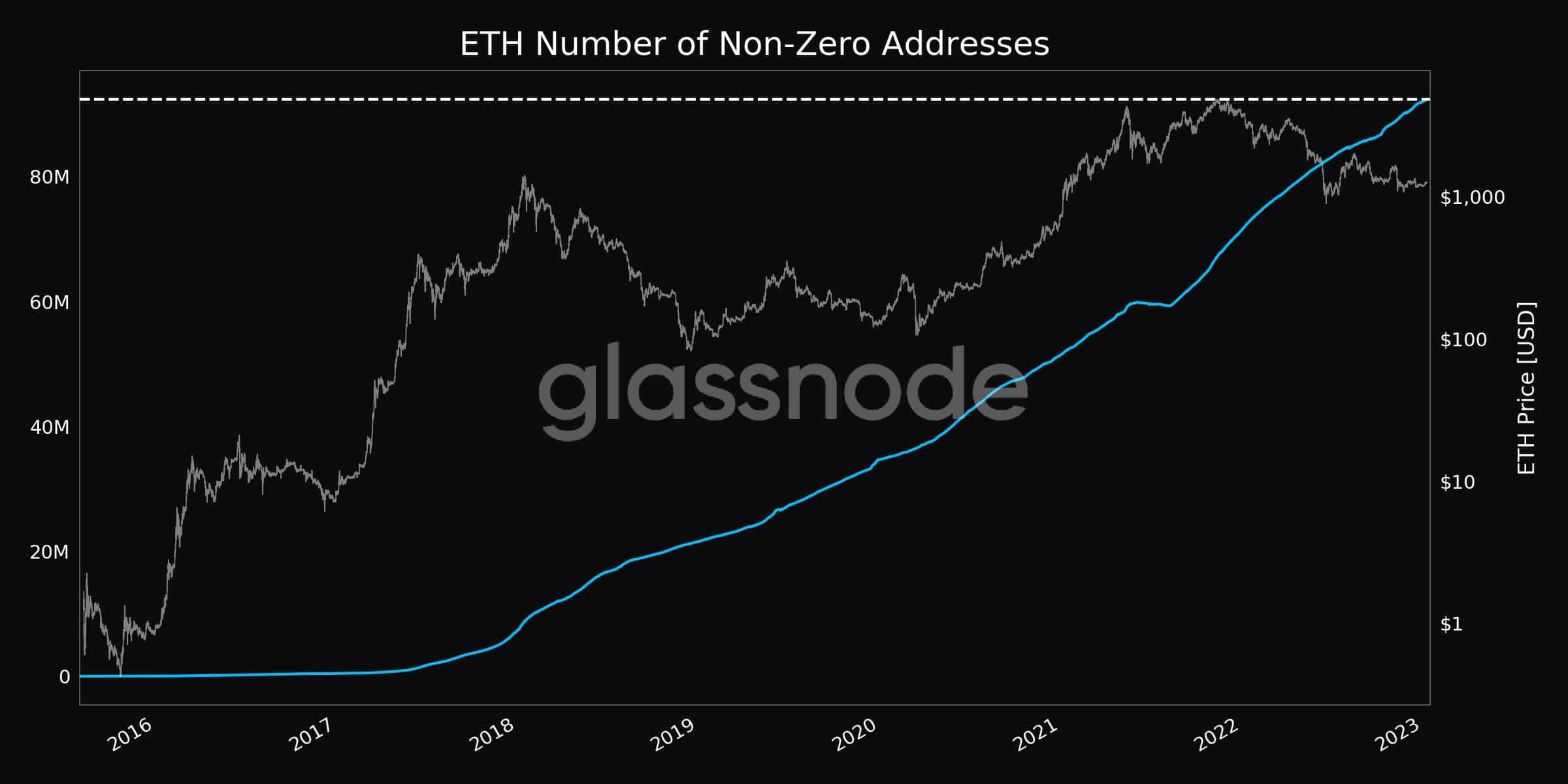

Now, the behavior of the retail and big-pocket investors was in alignment with the bullish demand. Based on the information provided by glassnode, the number of addresses holding more than 10 Ethereum, at the time of writing, reached an all-time high of 352,360 addresses.

In fact, the number of non-zero addresses on the Ethereum network grew considerably over the last few months. During press time, this metric was at 92.36 million.

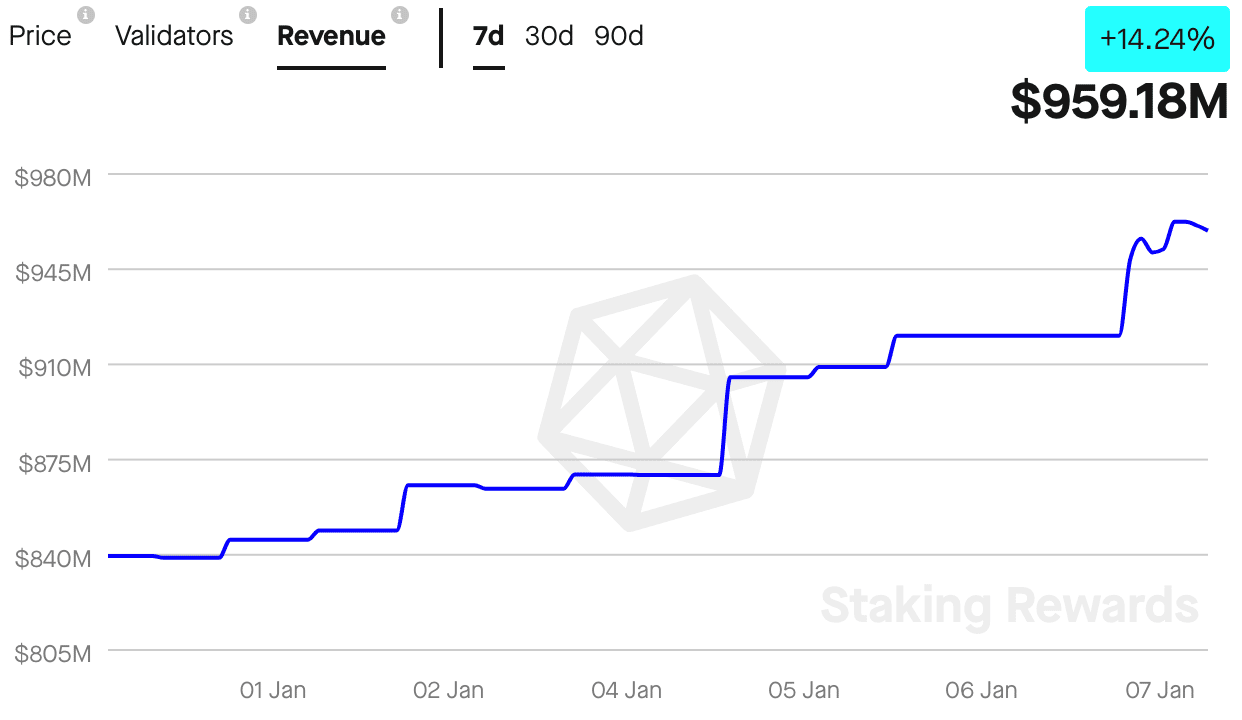

Along with the investors, the validators also supported the network. Based on data provided by Staking Rewards, the number of validators on Ethereum grew by 2.3% over the last 30 days. At press time, there were 496,462 validators.

One of the reasons for the growing number of validators on the network can be increased revenue. Over the past week, the revenue generated by these validators increased by 14.24%. And at press time, the overall revenue generated by the validators was $959.18M.

The “Trade” off

That said, the derivative market of Ethereum had a lot of things going against it.

According to data provided by coinglass, the number of short positions being taken against Ethereum increased substantially over the last few days. At the time of writing, 51.53% of all positions taken against ETH were short.

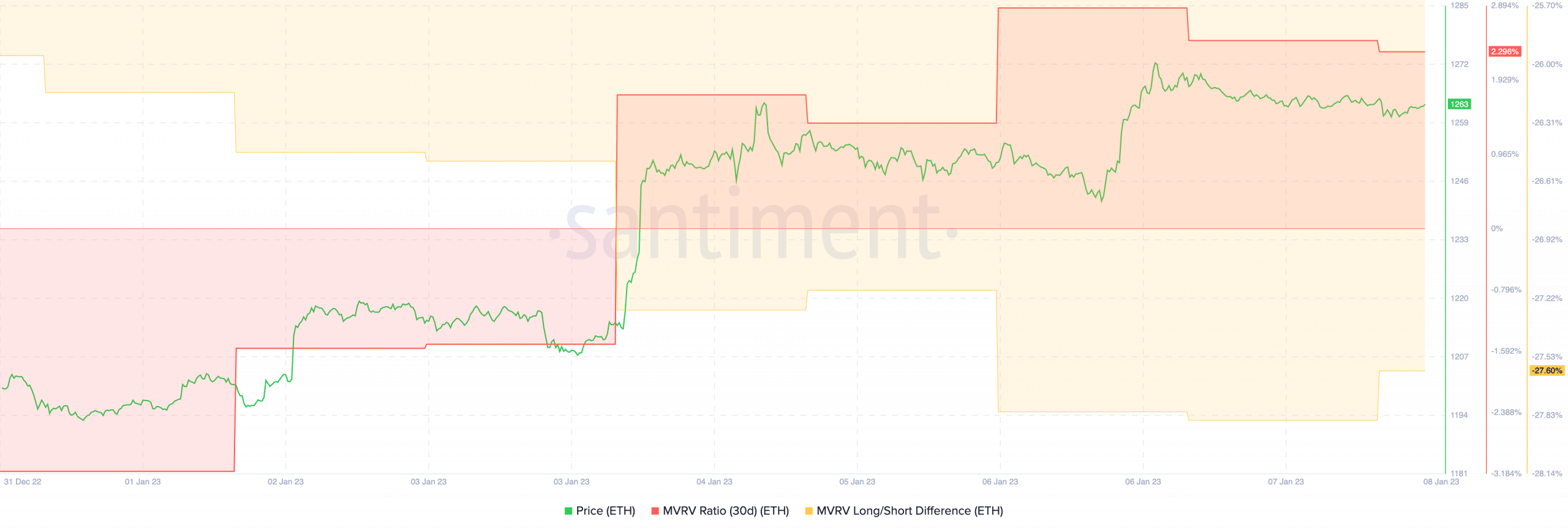

Meanwhile, the MVRV ratio for Ethereum increased over the last last two weeks, according to information provided by Santiment. This suggested that most Ethereum holders would profit if they decided to sell.

A lot of these Ethereum holders who were profitable were short-term holders. This was indicated by the negative long/short difference for Ethereum.

Are your ETH holdings flashing green? Check the profit calculator