This is ‘a nice leading indication’ of where Ethereum will move next

Ethereum, the market’s leading altcoin, has been striving to compete with Bitcoin’s dominance in the market. Of late, however, the second-largest alt has been bridging the gap with BTC. In fact, despite some bearish trends over the past few months, ETH was fetching 300% year-to-date returns to investors, at press time. As its value began to recover in late July, more users were drawn to it.

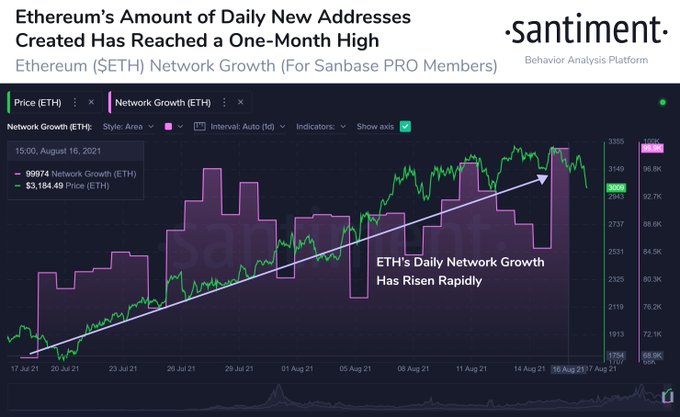

According to data collected by Santiment, as the value of Ether pushed aggressively close to $3,000, more users rushed into the Ethereum market. This resulted in the number of Ethereum addresses hitting a four-week peak.

Source: Santiment

According to the crypto-analytics platform,

“Ethereum is hovering at the $3,000 level right now, and behind the curtains, we’re seeing that network growth has been steadily rising this month. New addresses being created on the ETH network is a nice leading indication of where prices move next.”

The attached chart pictured the rapid rise in ETH’s daily network growth. Despite the crypto’s restricted movement on the price charts, ETH has grown more popular among traders. Both retail and institutional traders.

Backed by popular demand

Interestingly, a recent report from Gemini highlighted that the most popular cryptocurrency in Singapore is Ethereum. Nearly 78% of the nation-state’s crypto-population now holds the digital asset.

What’s more, institutions such as the NYDIG and Fidelity are also noting an increase in demand for crypto-services. As per sources, the NYDIG has already been offering custody to select clients, while Fidelity clients are urging support for Ethereum.

As traders from both realms come together demanding more Ethereum products and support for the digital asset, the optimism in the market is evident. In fact, Chicago Mercantile Exchange [CME] Futures are already pointing to a bullish sentiment within the market towards ETH. As the network develops and the price recovers, this growth in demand may be reflected in the spot market too.