Ethereum, Tezos, Uniswap Price Analysis: 25 January

Ethereum broke its ATH and showed signs of bullishness as it projected a target of $1632 to achieve over the next week. Tezos was in an uptrend but faced some resistance above the $3 region and Uniswap surged to $12.5 but could witness a pullback.

Ethereum [ETH]

Source: ETH/USD on TradingView

For the move from $905 to $1440, the previous high, Fibonacci retracement levels were plotted. The 38.2%, 50%, and 61.8% levels have been particularly important, along with the highlighted region from $1215 to $1270, which will serve as support should ETH see a dip.

ETH dropped to test the 61.8% level as support but recovered just as quickly from the $1040 lows it revisited and has surged by nearly 40% since.

The Awesome Oscillator showed rising bullish momentum, and the trading volume was also significant. The 27% extension for this move upward from $905 gives a target of $1632 for ETH.

Tezos [XTZ]

Source: XTZ/USD on TradingView

XTZ has gained 60% in the month of January, rising from lows of $1.95 to trade at $3.12 at the time of writing. Important levels of resistance are $3.23 and $3.58. Support levels to watch out for lie at $2.77 and $2.24.

The RSI rose above neutral 50 and retested it as support to indicate an uptrend in progress, while the price also made a series of higher lows to confirm the trend.

The Stochastic RSI was in the oversold territory, pointing toward a move to the upside for XTZ. Yet, over the past ten days, the $3.15-$3.35 has been a region of supply for XTZ- the price needs to climb above and flip it to one of demand before it can register further gains.

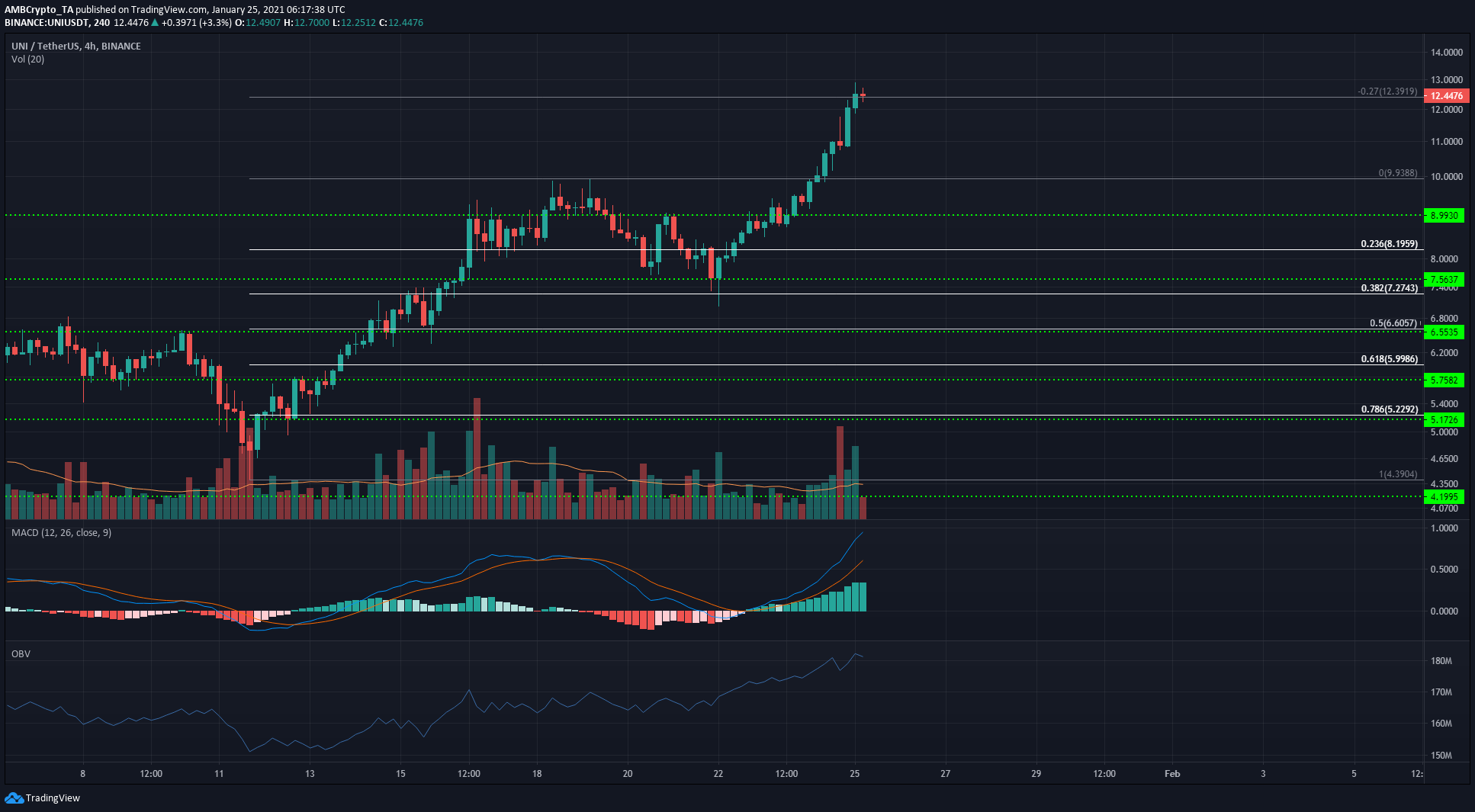

Uniswap [UNI]

Source: UNI/USDT on TradingView

The distance between the MACD and the signal line showed that the market was possibly oversold and could see a pullback in the short-term. Trading volume has been consistently high for UNI as it surged to a local high at $12.89, near the 27% extension level.

The OBV was in an uptrend alongside price to show genuine buying behind the price rally.

A dip could ree UNI revisit the $11 region.