Ethereum: The formation of this local top might mean this for ETH investors

During the intraday trading session on 4 November, leading altcoin Ethereum [ETH] traded at a seven-week high of $1,674, data from Santiment revealed. According to the on-chain analytics platform, this jump in price was not restricted to just ETH as other altcoins enjoyed from the “strong Friday market-wide pump.”

Here’s AMBCrypto’s price prediction for Ethereum [ETH] for 2022-2023

While noting the positive impact of the widespread FUD on the prices in the past few days, Santiment confirmed that the current market was marked by “euphoric sentiment”. This typically “foreshadows a cooldown.”

Continued growth in an asset’s social activity without a corresponding growth in its price usually means that a price local top has been reached. And the sad news remains that a decline is due to follow. So, what does the outlook look like for ETH in the short term?

An all-you-must-know buffet

As of this writing, the leading altcoin exchanged hands at $1,648.69. While ETH’s price might have fallen from the intraday day recorded on 4 November, data from CoinMarketCap revealed a 6% growth in price in the last 24 hours. Furthermore, a 63% growth was recorded in the trading volume within the same period. This indicated that investors continued to harbor convictions of a further price rally.

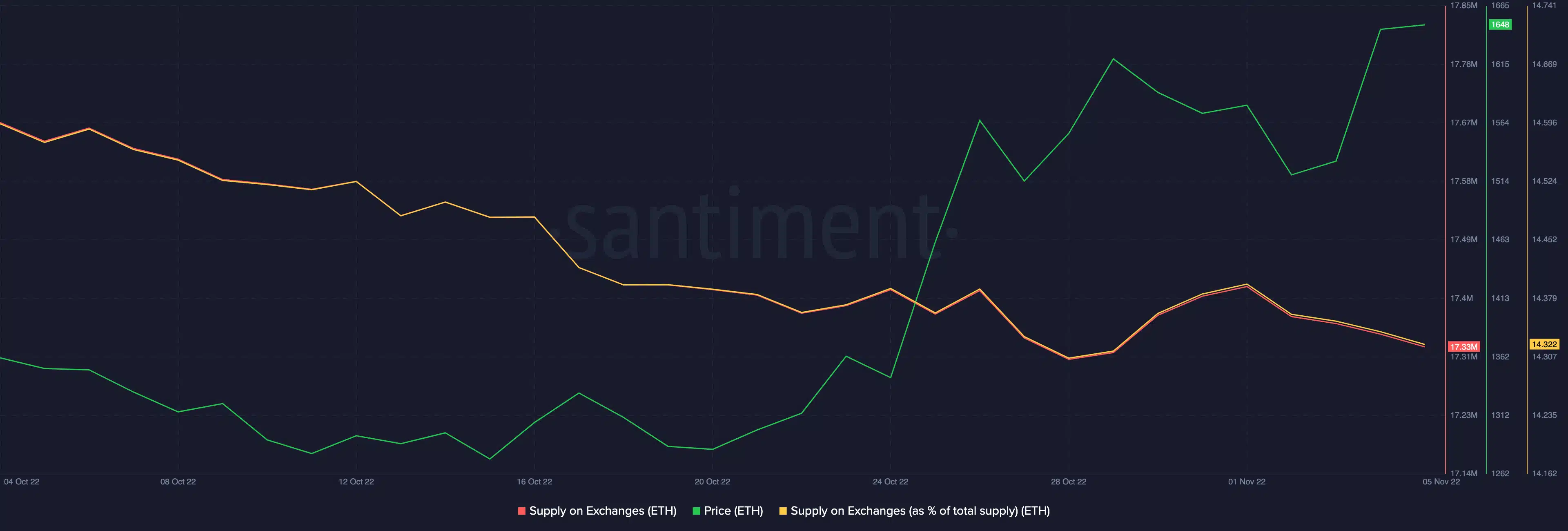

Additionally, on-chain data from Santiment showed a persistent decline in ETH’s supply on exchanges. ETH’s supply on exchanges fell by 2% in the last month. As of this writing, 14.32% of ETH’s total supply was found on exchanges, per data from Santiment.

The drop in ETH’s supply on exchanges in the last month suggested significant coin accumulation in the past 30 days. This was accompanied by fewer ETH sell-offs. This was another indication that holders remained confident that ETH’s price would see more growth.

Not without warning signals

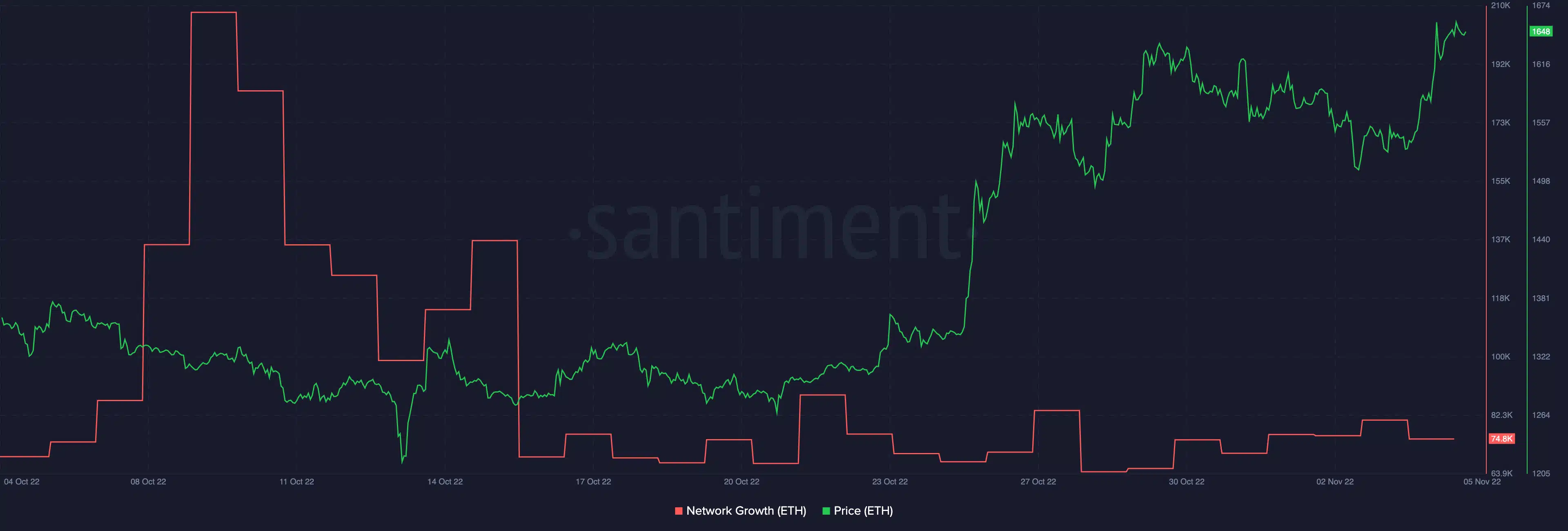

While investors remained positive about further growth in ETH’s price, the consideration of another key on-chain metric suggested that a price reversal might be underway. In spite of the positive price performance in the past new month, the daily count of new addresses on ETH network plummeted. According to data from Santiment, this fell by 64% since 18 October.

This was a classic case of price/network growth divergence, which signaled the formation of a local top as no new addresses were coming in. Eventually, the current buyers on the network will experience exhaustion, and a price reversal might follow.

![Injective [INJ] drops 73% from ATH, but will THIS spark a rebound?](https://ambcrypto.com/wp-content/uploads/2025/02/Editors-25-400x240.webp)