Ethereum to $3k in 48 hours or will 580k option contracts expire in losses

Ethereum is not only the second-biggest cryptocurrency in the world, it is also one of the most significant social coins given its demand amongst the people. For that coin, $3k has been time and again tested level, which is crucial in determining the trend of the price action going forward.

Ethereum back to $3k

$3k and $2,321, these two levels have been significant in ETH’s history as, since May 2021, the altcoin king has tested them both as resistance and support at times. While for most of the second half of 2021, ETH kept above $3k, it flipped it into resistance as 2022 began.

Ethereum Price Action | Source: TradingView – AMBCrypto

And after multiple retest as resistance, ETH might be heading back to close above it since more than just the price, a lot more is riding on this occurrence.

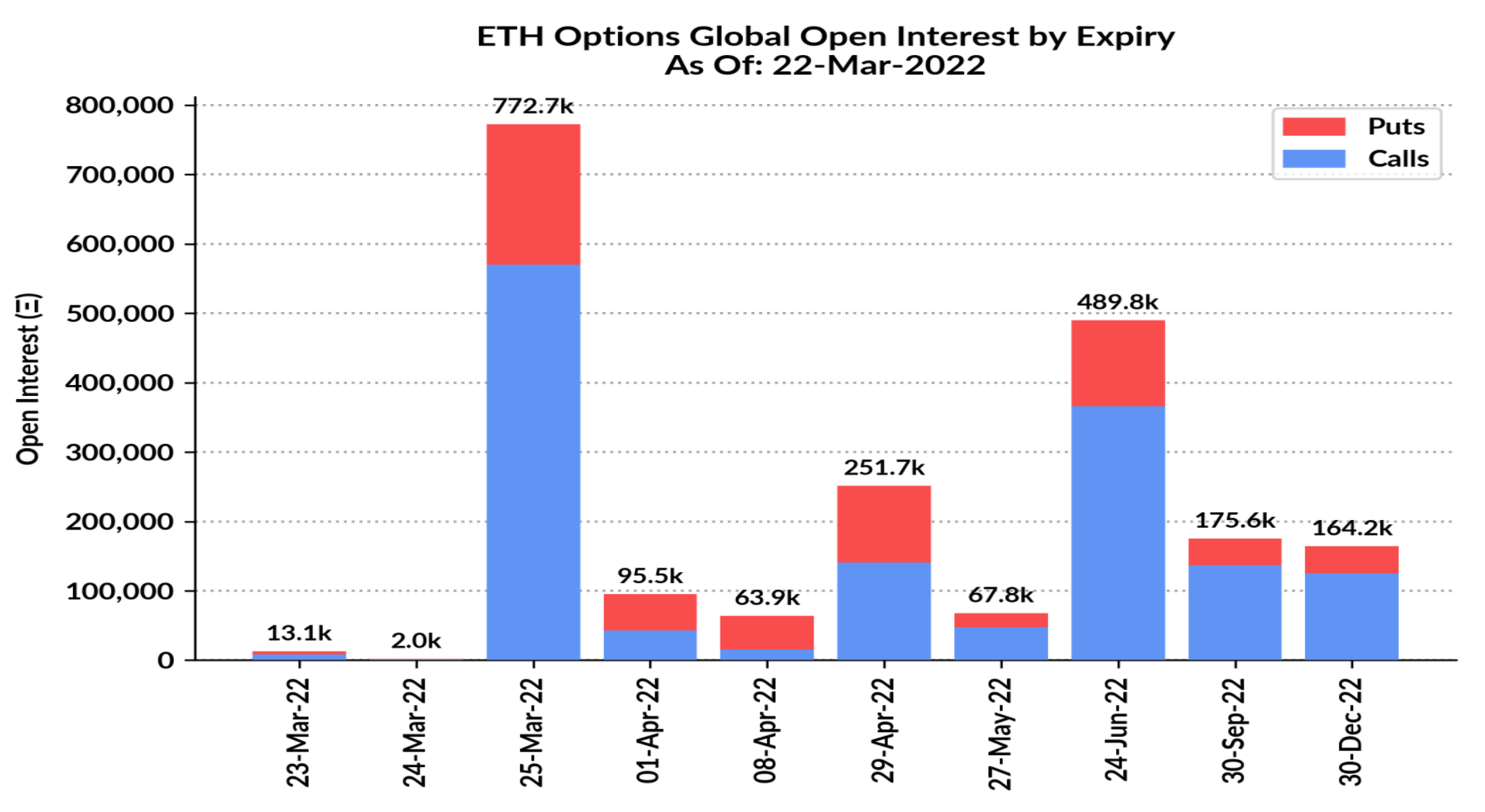

On 25 March, Ethereum will be facing a major expiry with 772.7k contracts about to close. Of these, about 580k contracts are looking for bullish close with significant demand for a close at $3k at the least or above.

Ethereum OI by expiry | Source: Skew- AMBCrypto

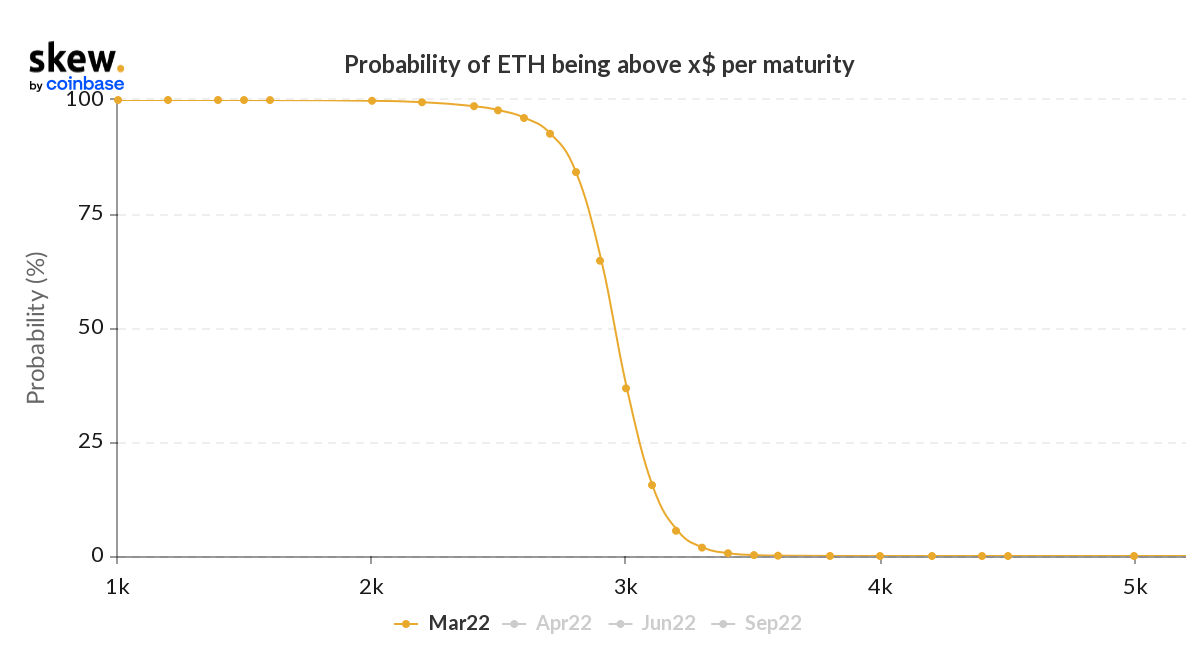

For Ethereum reaching $3k does seem like a possibility in the next 48 hours. The probability for the same is above 37%, which is significantly better than most targets set towards the end of the month. Plus, with ETH trading at $2,956, it only needs a 1.82% rally to do so.

Probability of Ethereum reaching $3k this month | Source: Skew- AMBCrypto

It already has the support of the price indicators, most notably from the 50-day SMA, which it reclaimed four days ago. (ref. Ethereum Price Action image)

But the Implied Volatility – Realized Volatility spread might be a concern as it is indicating a bearish sentiment across the board. That could lead to ETH not closing above $3k and then falling back below it before 25 March.

Furthermore, climbing back above $3k would also act as a major incentive for the investors who have been keeping themselves at bay since January, waiting for a solid recovery. Most of their sudden spike in activity has been observed around instances of testing $3k.

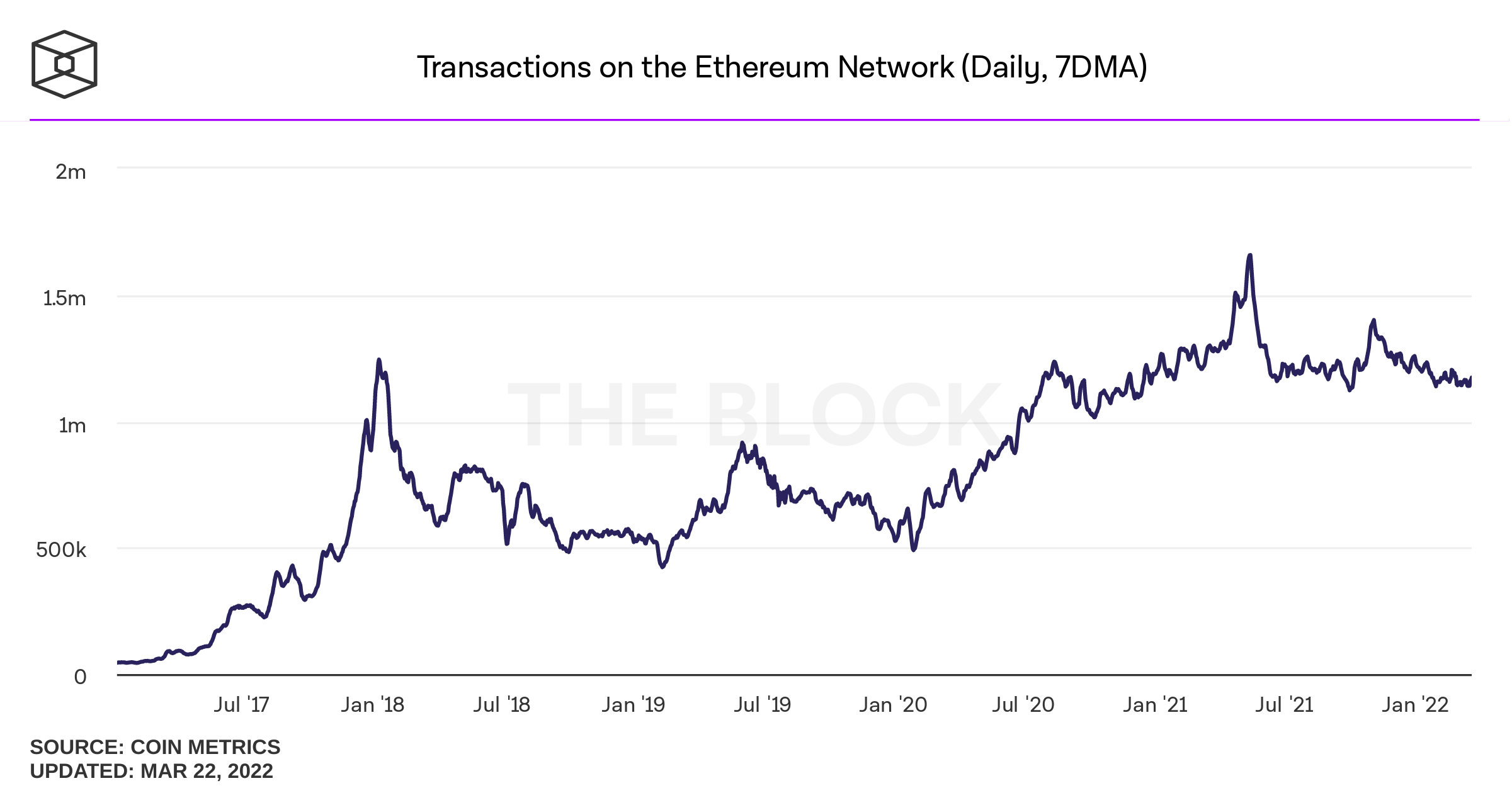

Although the overall transactions on the network have reduced, they are still keeping above the 1 million mark, which is the only thing Ethereum has retained since the May crash of 2021.

Ethereum on-chain transactions | Source: TheBlock