Ethereum traders feel the pinch: A surge in liquidations

- The ETH price decline has led to consecutive long liquidations.

- ETH has declined by over 3% in the last three days.

Ethereum [ETH] experienced consecutive uptrends that nearly brought it back to its all-time high recently. However, a trend reversal halted this progress, resulting in significant losses for long traders over the past few days.

Ethereum uptrend stalls

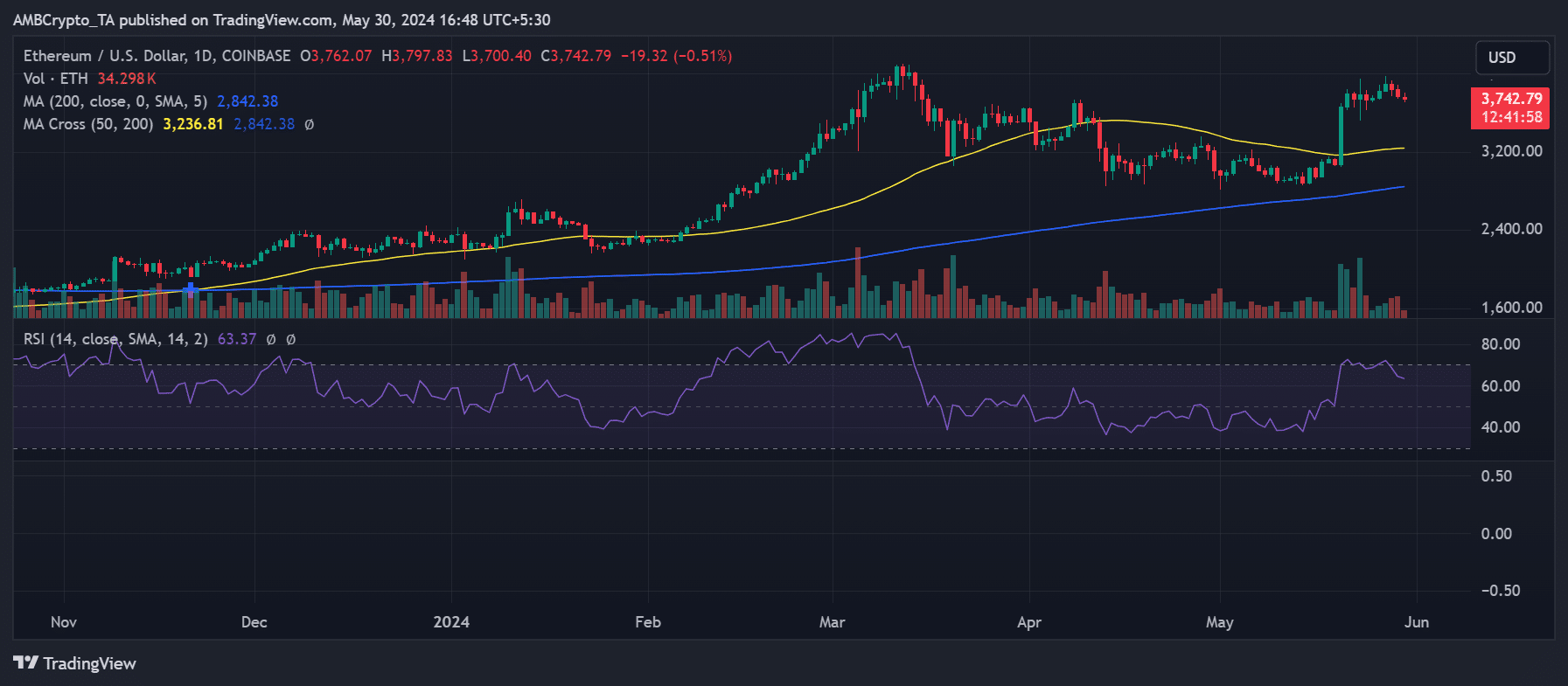

Analysis of Ethereum on a daily time frame indicates that it has experienced consecutive downtrends over the past three days.

These recent downtrends followed consecutive uptrends, which had driven its price to approximately $3,890 on 27th May. As of this writing, ETH was trading at around $3,740, reflecting a decline of less than 1%.

Furthermore, despite the recent decline, the overall trend for ETH remained bullish. The chart indicated that, as of now, it was trading above its short Moving Average (yellow line), which is a positive signal.

Additionally, analysis of its Relative Strength Index (RSI) shows a reading above 60, reinforcing the presence of a strong bullish trend.

Ethereum long traders take hits

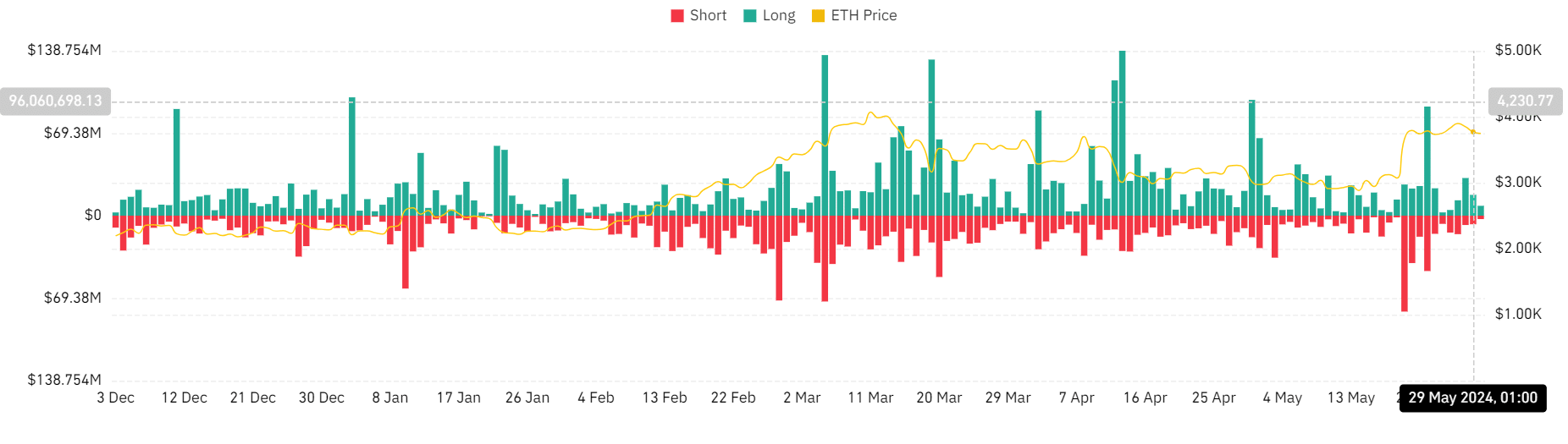

According to the analysis of liquidation data on Coinglass, Ethereum long traders have experienced increased liquidations over the past few days.

On 28th May, when the price decline began, the long liquidation volume was approximately $31.6 million.

The following day, it was around $17.5 million, and as of the current writing, it is over $8 million.

This brings the total long liquidation volume over the last three days to more than $57 million, compared to just over $18 million in short liquidation volume.

Ethereum Open Interest remains high

Despite the decline in price, interest in Ethereum remains strong. Analysis of the Open Interest chart on Coinglass reveals that Open Interest peaked at $17 billion on 28th May, marking the highest level in over a year.

As of this writing, the Open Interest was around $16.7 billion, which is still one of the highest points in over a year. This indicates sustained investor engagement and interest in Ethereum.

Read Ethereum (ETH) Price Prediction 2024-25

Additionally, an analysis of the funding rate indicated that sentiment around ETH remained positive. The chart showed that the funding rate has stayed above zero, currently at 0.013%.

This suggests that buyers continue to dominate, indicating a strong belief in a potential further rise in ETH’s price.