Ethereum: What does the lack of strong support levels mean?

The month of April began with Ethereum, the world’s largest altcoin, climbing up the charts to hit a new ATH of $2,153. On the contrary, Bitcoin, the world’s largest cryptocurrency, has spent most of the month trading sluggishly under $60k following yet another failed breach of the level.

On the face of it, this sounds like point Ethereum, right? Well, yes. But, look closely, and that may not be the case, with blockchain analytics telling a very different story. The same was the subject of a recent Chainalysis Intelligence report shared by Philip Gradwell.

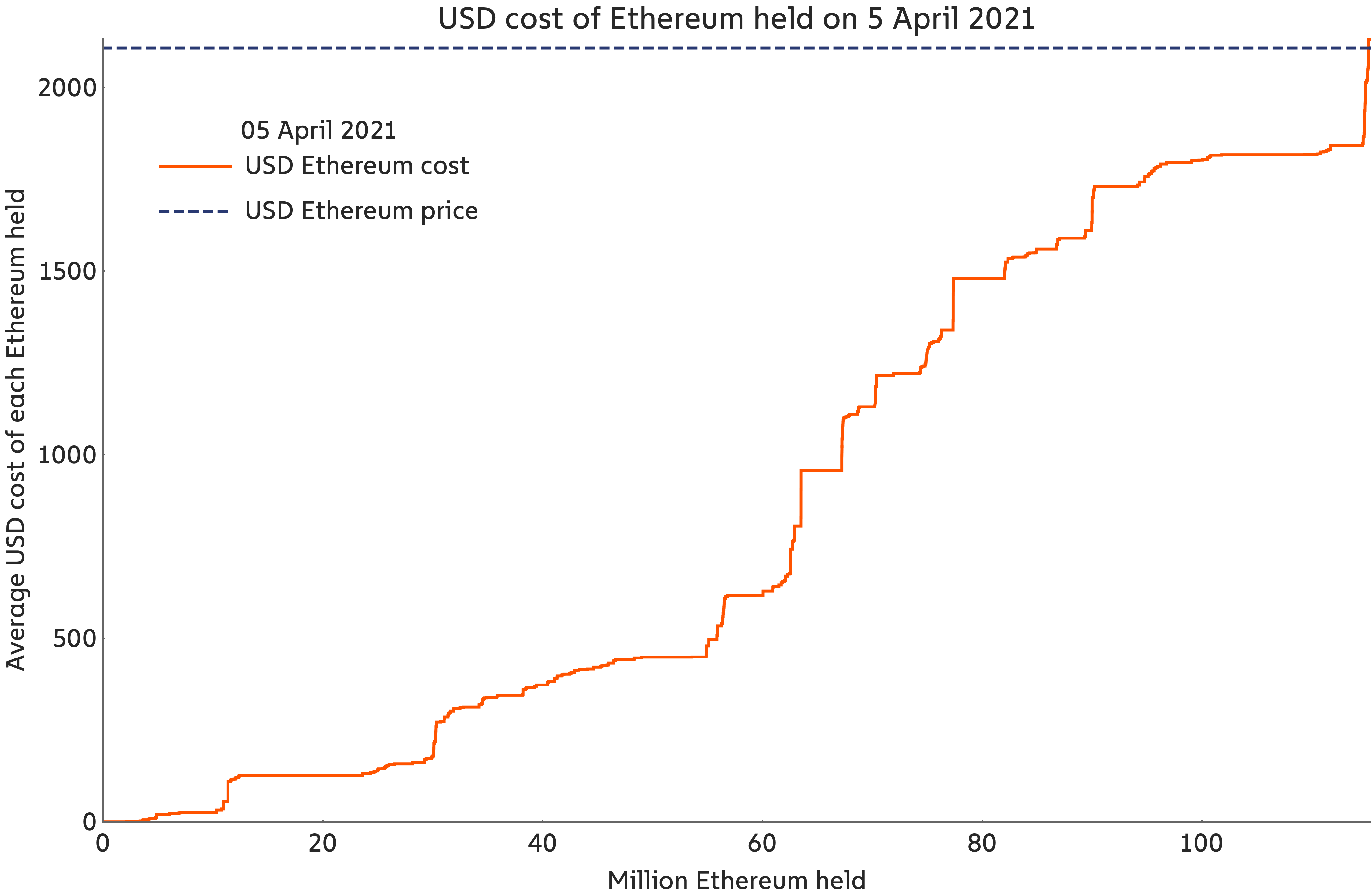

According to Chainalysis’s Chief Economist, the cost of acquisition is a good place to start, with the same underlining “how much of a cryptocurrency is held by people who are willing to buy and hold at least at their cost of acquisition.” What this also does is identify prior demand at different price levels, and by extension, support levels on the price charts.

After analyzing the same across 115 million Ethereum held by 1,525 entities and grouping them on the basis of age, USD gain, and liquidity, Gradwell found that,

“…. a very large amount of Ethereum is held by entities that acquired it at around $1,800. Relatively little Ethereum, about 700k, has been acquired above $1,850, costing a total of $1.4 billion.”

What does this mean? Well, it means that ETH’s ATH is well away from a support level of any notable strength. By extension, what can also be deduced is that the altcoin’s latest breach of $2,000 and its new ATH were fueled by a “relatively small amount of demand.”

What’s more, these findings are diametrically opposed to the findings attached to an analysis of Bitcoin, with the latter finding that demand for the world’s largest cryptocurrency is a little more spread out across price levels.

A wider differentiation between the Ethereum and Bitcoin markets can also be drawn out by Gradwell’s observations from ETH’s cost curve analysis. A few caveats aside, it found that,

“There has been a significant increase in the cost of acquisition for over 50 million Ethereum, out of a total supply of 115 million. Support at $1,500 is particularly strong, with 33.3 million Ethereum acquired above this level at a total cost of $58 billion.”

While a majority of those who bought ETH near its peak price sold off their holdings at a loss, only a small subset of those who remained chose to hold on to the same. “A small, but very bullish cohort of Ethereum buyers,” Gradwell calls them.

While the recent hike in ETH’s price has rewarded the patience of these buyers, the analyst was also quick to draw a juxtaposition with the world’s largest cryptocurrency, especially since a majority of the latter’s holders continued to HODL their assets over the bear market.

Simply put, Gradwell concluded, Ethereum’s highest prices have a narrower base of support. What does this mean though? “Narrower base of support?” Does it mean that the altcoin is relatively more vulnerable to significant price corrections? Well, not necessarily, because looking at the aforementioned alone doesn’t always give us a complete picture of what’s happening.

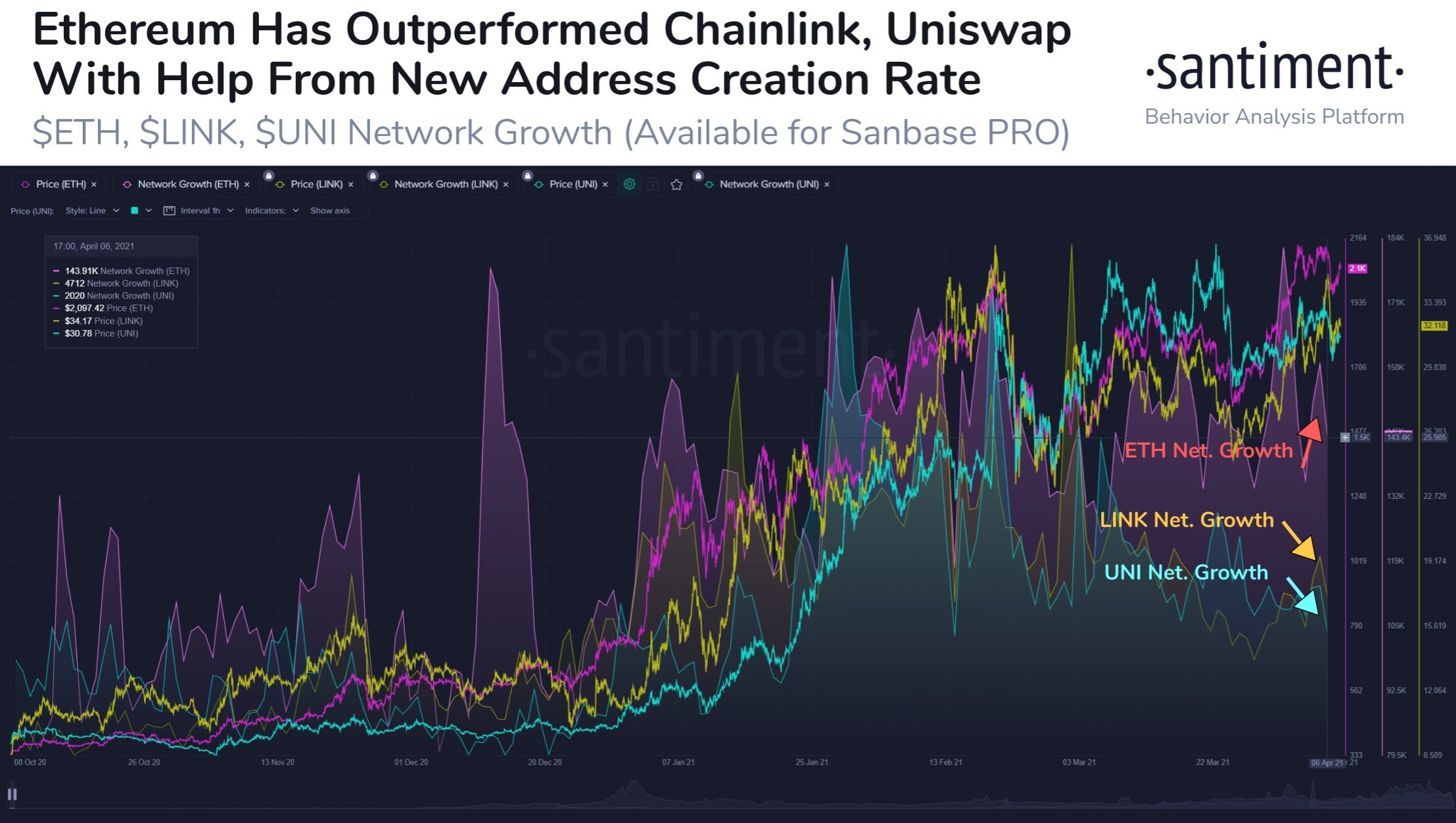

Consider the following, for instance – While the flavor of the month is lesser-known alts giving their holders double-digit gains in short periods of time, the scale of interest in Ethereum remains well above the likes of alts such as Chainlink and UNI. The same can be evidenced by the fact that the altcoin’s new address creation rate has outpaced that of well-performing cryptos like LINK and UNI.

Source: Santiment

What’s more, the crowd mood towards the altcoin reverted back to the extremely negative territory recently. While that does sound bad on paper, historically, it has been a strong bullish opportunity for those who want to get into the asset class.

Source: Santiment

Ergo, with ETH still trading around the $2,000-level at press time, one can expect its price levels to be backed by stronger buyers’ strength in time.