Ethereum will reach for all-time-high when these metrics deliver

Ethereum, after falling by almost 30% in September from its local high of $3800 has finally paced up. The flash-crash and subsequent FUDs pulled the total crypto market cap down by almost 20% in the last three weeks. Nonetheless, with Bitcoin and Ethereum climbing by 4% and 7% on their daily charts, investors are looking forward to closing the quarter on a high note.

Ethereum leads recovery

Even though BTC’s recovery has fueled the larger market recovery, Ethereum’s quick rebound back to $3,100 seems to be leading the recovery for the top coins. In fact, at the time of writing data from Coinmarketcap highlighted that Ethereum was the top gainer on daily charts, showing over 4% gains second only to Solana.

Ethereum’s relative strength index on a shorter time frame presented a rising buying pressure which was a good sign for the top altcoin alongside rising prices. However, trade volumes in the spot market for ETH still remained low and the same was indicative of reluctance from the market participants after a crash.

While the market was still skeptical of ETH’s path as Q4 approached, there were some signs that pointed towards a good growth trajectory and possible gains for the top coin before 2021 ends.

Long term metrics looking good

Notably, over the past year, one-third of the ETH supply that was on exchanges has been moved off which is indicative of the patience that holders have even during market crashes.

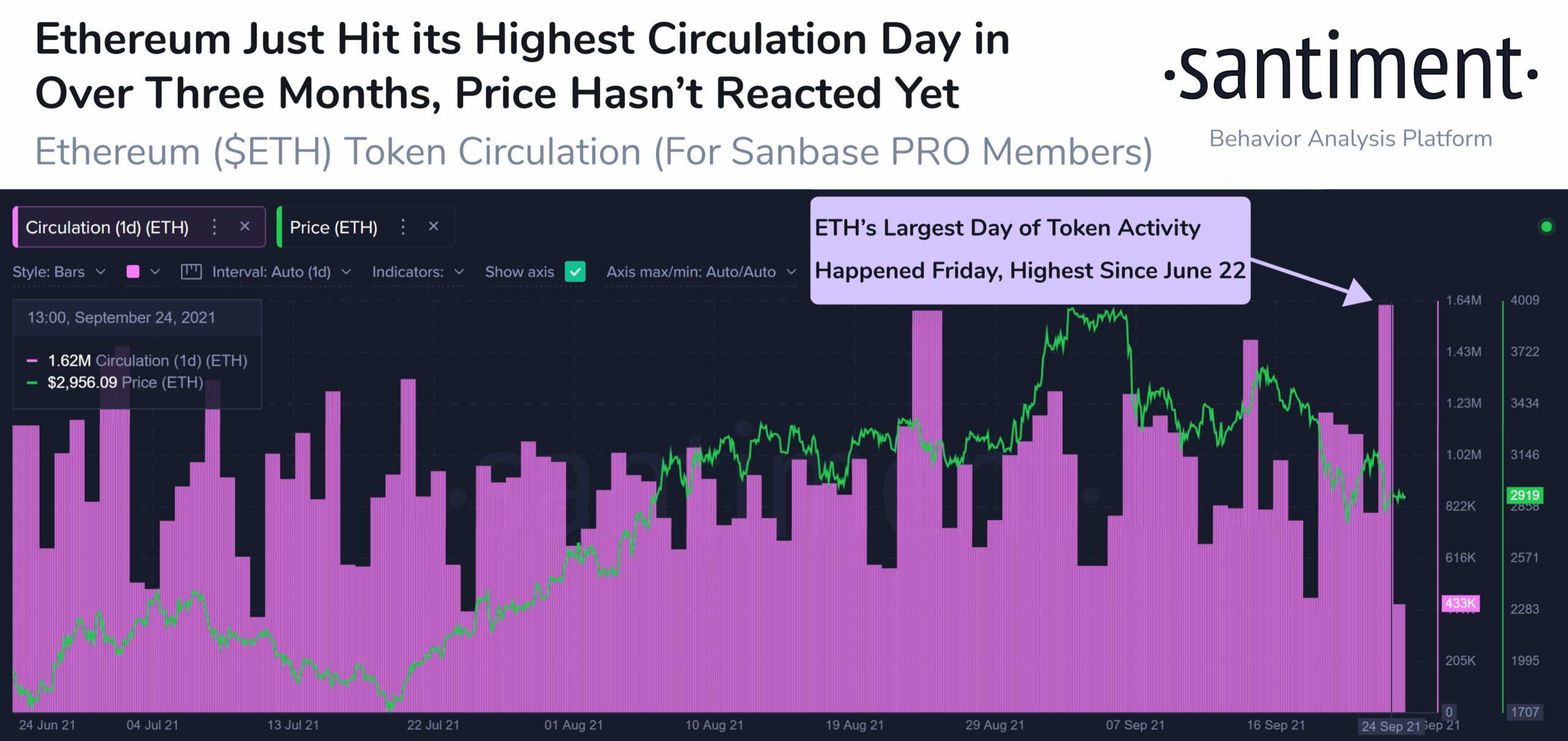

In fact, Ethereum’s token circulation soared on September 27, to its highest level since June 22. A Santiment post pointed out that if signs of ETH utility and tokens being moved continue to grow then the prices are bound to follow.

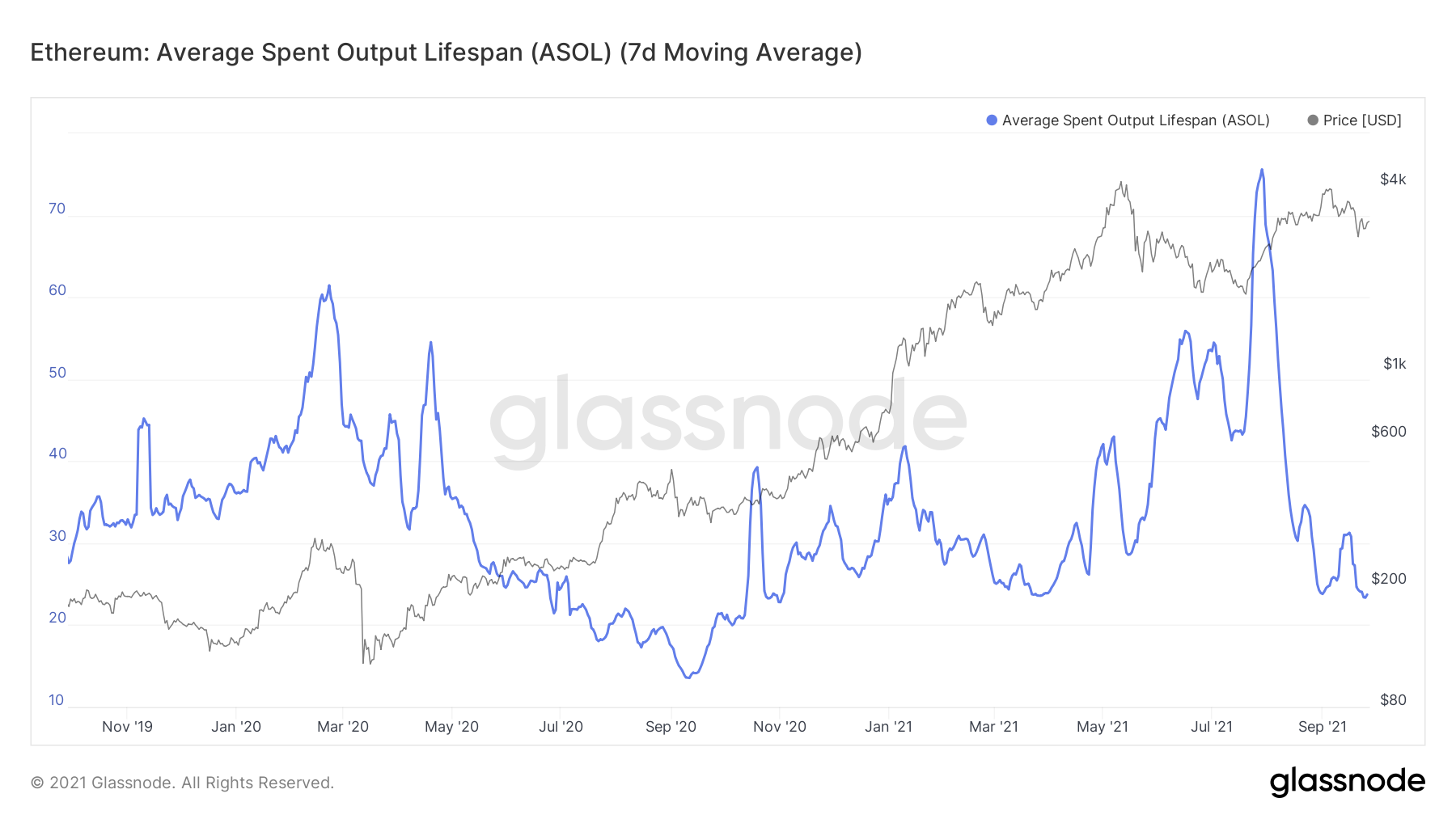

That being said, ASOL noted low values last seen in March at the time of writing and generally, such low values are indicative of day-to-day traffic comprising of young coins being spent. This also meant that older transaction outputs remain dormant, and conviction to continue holding the asset is high.

An interesting trend was that when ASOL is looked at alongside prices, such low ASOL values have been noted at the beginning of a rally. The last time ASOL measure this low, ETH’s price rallied by over 150% and saw an ATH of $4,337.

All eyes turning to ETH?

JPMorgan analysts in a recent report highlighted how big investors were turning their heads to Ethereum. Bitcoin futures witnessed weak demand as BTC futures traded below spot prices, while, Ethereum futures premium rose 1%, which highlighted a strong divergence in demand towards ETH, as per the report.

So, with prices picking up pace and institutions toppling more towards ETH, could Ethereum see another ATH? Well, while this is more of a ‘when’ than an ‘if’ question, ETH’s active addresses presented a worrying sign. Active addresses for ETH were noting a downtrend and saw low level of January 2021 at the time of writing. Ethereum’s previous rallies have been supported by high active addresses and network activity. This time too, an uptick in the same could push ETH to higher levels.