Ethereum: Will the tides change for ETH amid this recent accumulation

Ethereum [ETH] top ten investors holding their assets off exchanges added about 6.7% more of the number one altcoin, according to a recent update from Santiment.

The on-chain analytic platform reported that the top ten non-exchange addresses, at press time, held 23.7 million ETH. This was a clear distinction of the status of the top ten addresses on exchanges which held about 8.7 million.

Here’s AMBCrypto’s Price Prediction for Ethereum for 2023-2034

Recall that the Merge did not come with a positive price reaction much to the disappointment of investors. However, both exchange and non-exchange holders played significant roles that resulted in complacent price action.

? #Ethereum's top 10 largest non-exchange addresses have been accumulating assets after their big drop-off leading up to September's merge. They have added 6.7% more $ETH. Meanwhile, the top 10 exchanges are standing pat with just an 0.2% rise. https://t.co/h5CxDwOphX pic.twitter.com/msrrzvhB4P

— Santiment (@santimentfeed) November 1, 2022

Now, it seemed that non-exchange holders were trying to make up for their actions. Despite the change of mind, there was no certainty that it would lead ETH into more green after it registered an 18% uptick in the last seven days.

On the other hand, the recent action ensured that there was some buying pressure, but was it true?

Almost nothing to prove

On evaluating the supply outside of exchanges, Santiment showed that other ETH holders might have slackened the volume. At press time, the non-exchange supply was 103.65 million.

This figure was a slight decrease from the worth on 28 October. This implied that the accumulation by the top ten addresses had little impact on the overall ecosystem. Hence, there was less likelihood of a massive buying pressure significantly impacting the ETH price.

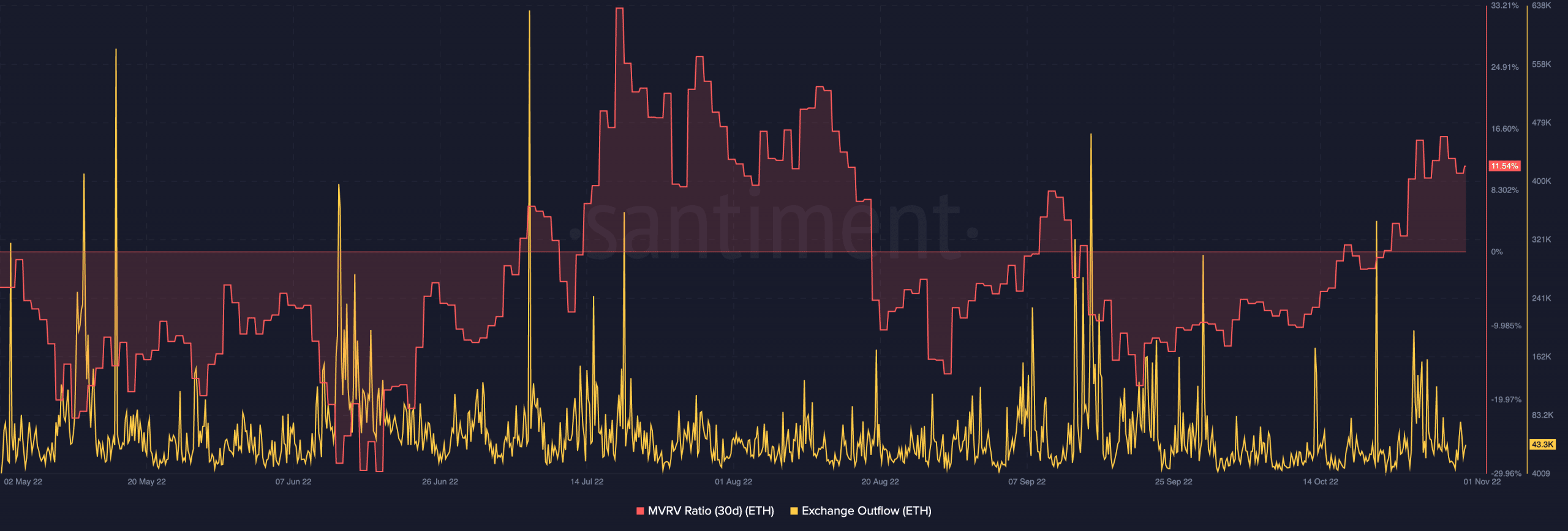

Furthermore, the Market Value to Realized Value (MVRV) ratio proved that the impact on the ETH price was almost irrelevant. As of this writing, the MVRV ratio was 11.54%. Before press time, it had risen as high as 15.77%. This implied that investors who had amassed profits from the recent uptick were now setting for some take-outs from those gains.

An assessment of the exchange outflow indicated that there was less pressure from buyers. With the value already decreasing to 43,300, ETH short-term investors might need to dampen their expectations of another double-digit uptick soon.

Where will ETH go from here?

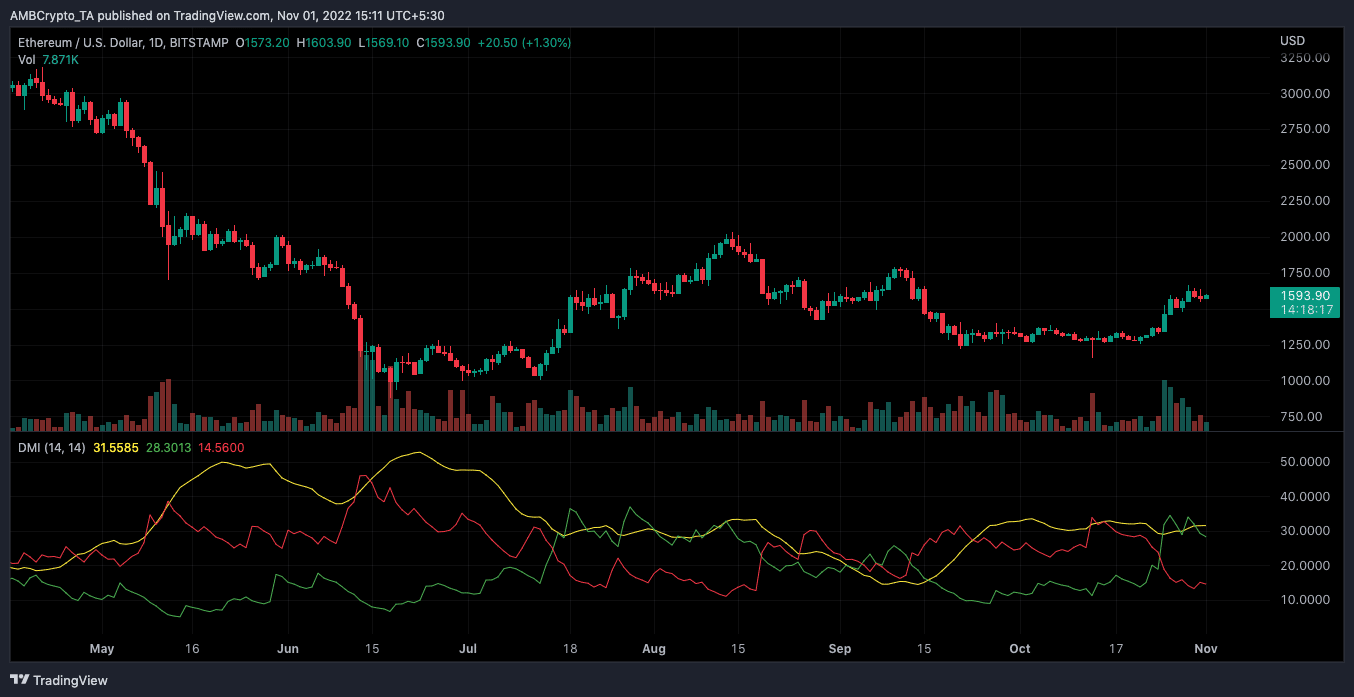

Surprisingly, ETH looks poised for the sustenance of its recent increase. According to the four-hour chart, the Directional Movement Index (DMI) was in favor of the buyers.

Indications from the DMI showed that the buying power (green) at 28.30 was well in control over the sellers (red). Additionally, the Average Directional Index (ADX) was in support of an improved ETH price. With the ADX (yellow) At 31.55, ETH had a strong movement in the upward direction.

However, with indicators and metrics on opposing sides, ETH might have to settle for minimal increases in the short term. Although, the altcoin’s volume was rising at press time. In the meantime, the momentum could favor more of a price increase.

![Bittensor [TAO] tops the AI charts once again, but 3 hurdles loom](https://ambcrypto.com/wp-content/uploads/2025/04/420567A0-9D98-4B5B-9FFF-2B4D7BD2D98D-400x240.webp)