Ethereum’s 3% bluff: Will ETH remain above $2.5K or fall to $2.3K?

- Ethereum experienced a notable price surge, testing the crucial $2,500 resistance level.

- Will the bulls maintain momentum, or will the bears reclaim control?

Ethereum [ETH] experienced a significant pullback at the start of the last week of August, wiping out most of the gains it had achieved during the first week of the month, when the altcoin tested the $2,700 ceiling.

However, the bearish tone that kicked off September shifted as ETH surged over 3% in the past 24 hours, trading at $2,521 at press time.

Interestingly, despite the price surge, the altcoin season index fell, suggesting weak investor confidence in the ongoing bullish trend.

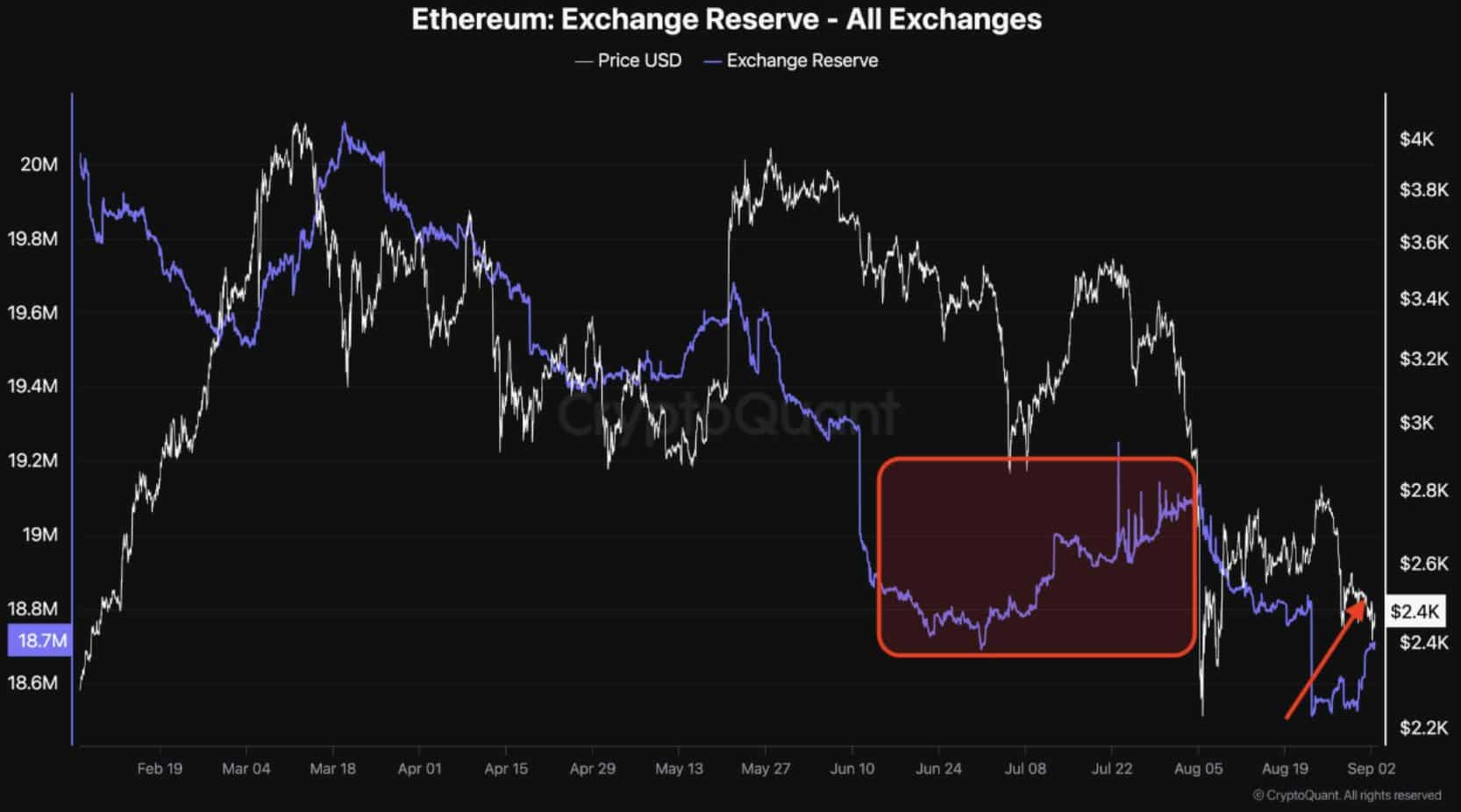

Underpinned by growing ETH exchange reserves

In a post, a prominent crypto analyst highlighted a significant development, suggesting the start of a distribution phase.

Simply put, the notable spike in ETH exchange reserves indicated that more traders are capitalizing on the recent surge by moving their profits to exchanges before the hype fades.

According to AMBCrypto’s analysis of the chart above, each time ETH has closed near its resistance level, it has been accompanied by an increase in ETH exchange reserves.

For instance, when ETH tested the $4,050 resistance earlier in March, the exchange reserves spiked from $19.5 million to $20.8 million.

Similarly, when ETH’s price broke above the $2,800 ceiling last month, rising exchange reserves led to strong resistance, preventing bulls from pushing the price higher.

Consequently, the price retraced to the $2,390 support level.

However, since then, bulls have been eagerly awaiting a price correction. So, is the recent 3% surge the key to a rally?

No assurance for a bullish upsurge

Unsurprisingly, the chart above showed a notable spike in exchange reserves from $18.5 million to $18.7 million the day after ETH experienced a significant surge on the 2nd of September.

This confirmed the conventional day trading strategy of locking in profits as soon as the price showed a slight upward trend.

However, to counter this algorithmic behavior, new traders must enter the market while long-term holders avoid selling.

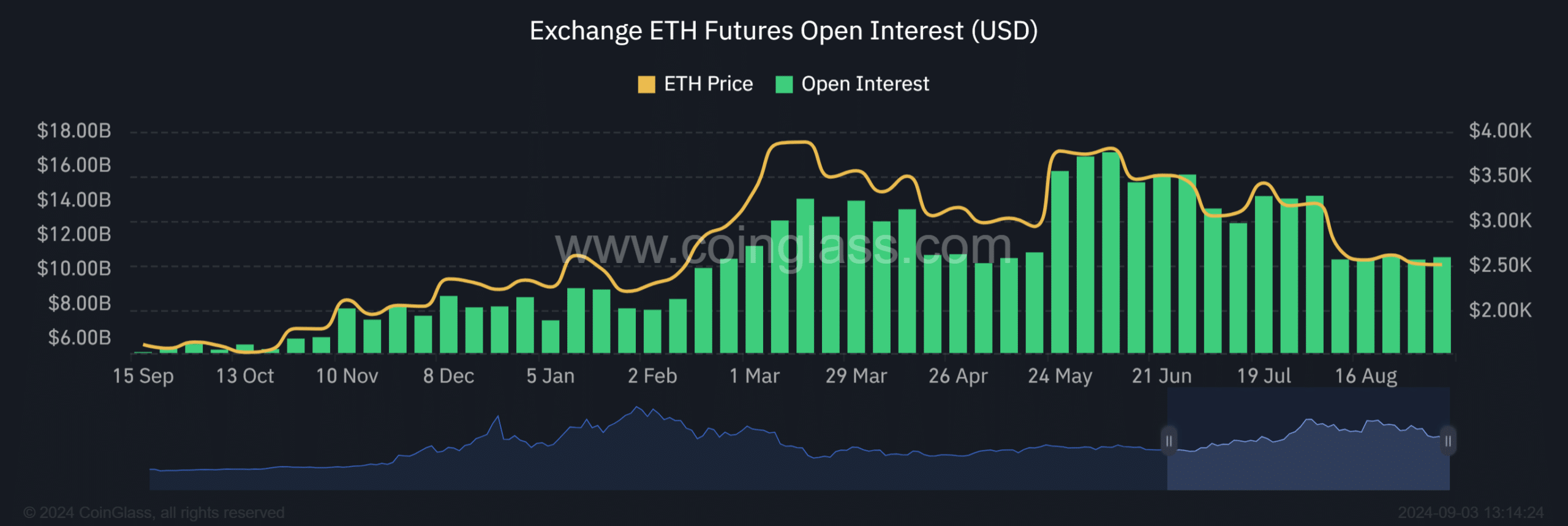

To the bulls’ relief, AMBCrypto noted an increase in Open Interest among Futures traders.

According to the chart above, the OI surged to $10.72 billion, marking a 0.37% increase from the previous day’s $10.68 billion.

Despite this uptick, a much stronger increase in Open Interest would be needed to guarantee a sustained bullish swing.

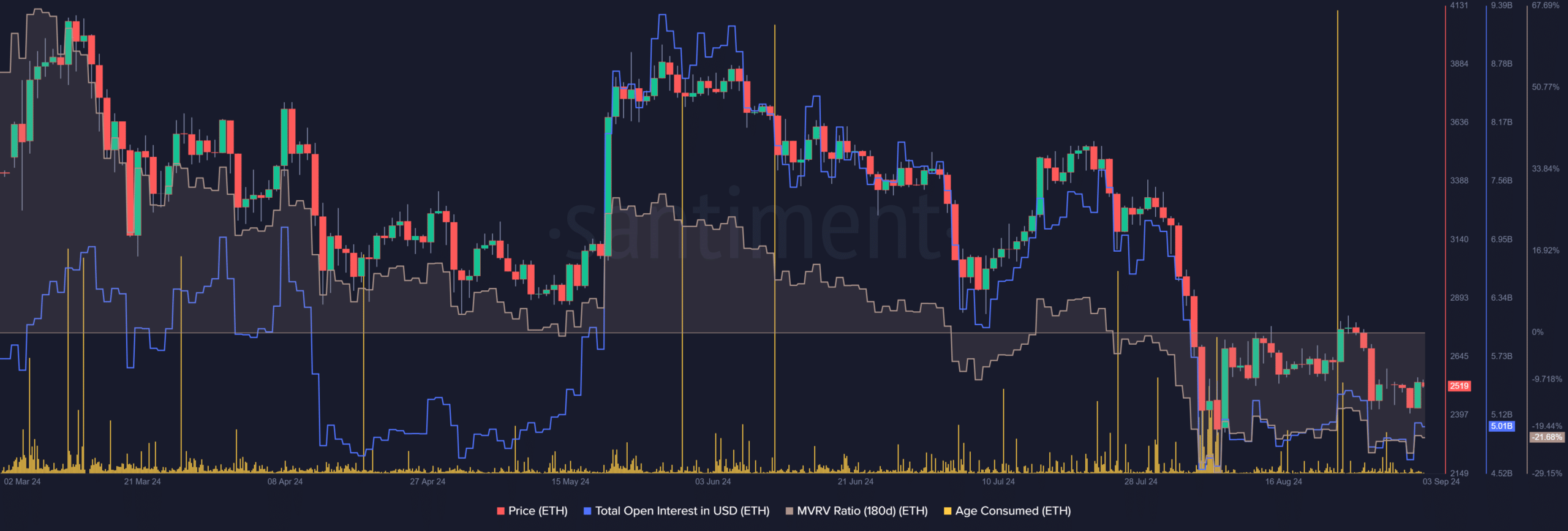

While Futures traders show limited optimism for a guaranteed ETH price surge, long-term holders have been routinely selling a portion of their aged coins, signaling a bearish trend.

On the 23rd of August, the age-consumed soared to an astounding $629 million, which subsequently led to a price plunge.

Additionally, a negative MVRV ratio indicated that the current market value of ETH is below its realized value, indicating that the asset may be undervalued. It can signal a potential buying opportunity.

However, the lack of a significant Open Interest surge could indicate that the true value of ETH has not yet been realized.

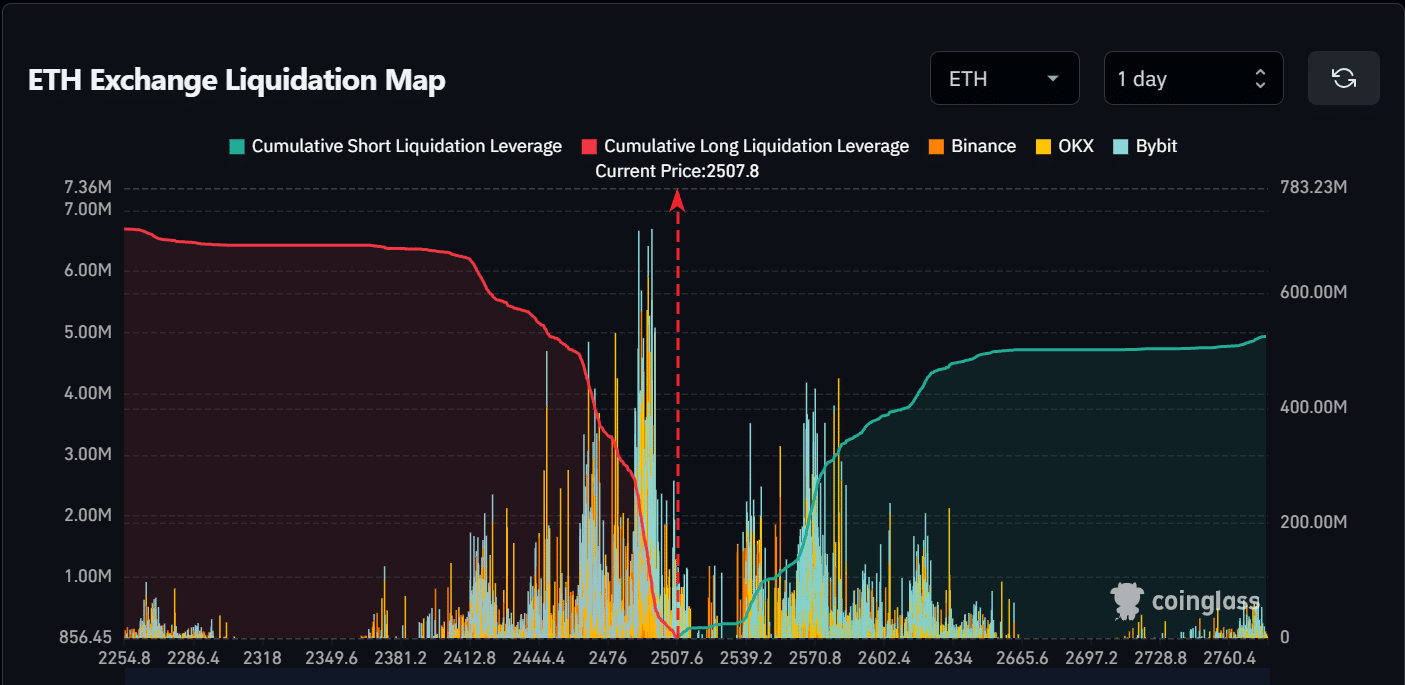

Moreover, AMBCrypto noted that the recent 3% surge might have been a bluff, leading to $34 million in short liquidations and pushing ETH to test the crucial $2,500 level.

Read Ethereum’s [ETH] Price Prediction 2024–2025

However, as analyzed by AMBCrypto, due to lack of strong buying activity, the chances of a breakout had diminished.

In short, if buying activity doesn’t increase, ETH could face around $40 million in long liquidations if it falls below the $2,500 support, retracing its price back to $2,300.